Tc 941r Form 2015

What is the Tc 941r Form

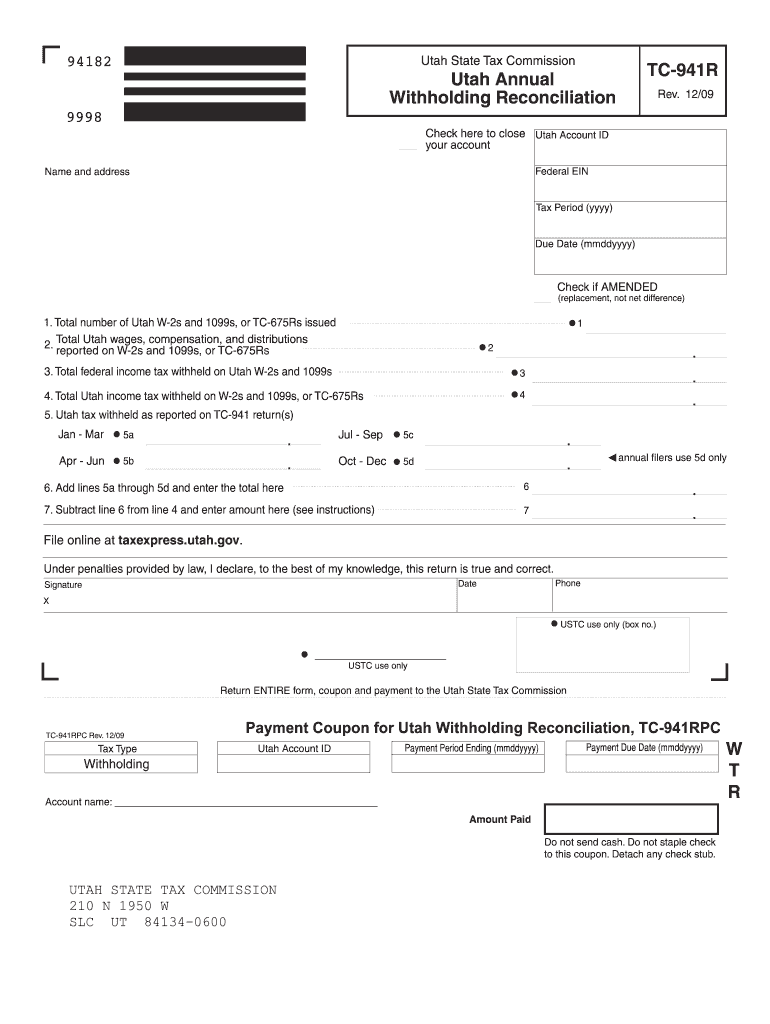

The Tc 941r Form is a specific tax document used primarily by businesses in the United States. It is essential for reporting and remitting certain tax obligations to the Internal Revenue Service (IRS). This form is particularly relevant for employers who need to report withholding taxes from employee wages. Understanding the purpose of the Tc 941r Form is crucial for maintaining compliance with federal tax regulations.

How to use the Tc 941r Form

Using the Tc 941r Form involves several steps to ensure accurate reporting of tax withholdings. First, gather all necessary financial records, including payroll information for the reporting period. Next, complete the form by entering the required details, such as total wages paid and the amount withheld for federal income tax. Finally, review the form for accuracy before submission. Proper use of the Tc 941r Form helps avoid potential penalties associated with incorrect filings.

Steps to complete the Tc 941r Form

Completing the Tc 941r Form requires careful attention to detail. Follow these steps:

- Gather payroll records for the reporting period.

- Fill in your business information, including name, address, and Employer Identification Number (EIN).

- Report total wages paid to employees during the period.

- Calculate and enter the total federal income tax withheld.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the Tc 941r Form

The Tc 941r Form serves a legal purpose in tax reporting. It must be completed accurately to comply with IRS regulations. Failure to use the form correctly can result in penalties, including fines or additional scrutiny from tax authorities. It is essential to understand the legal implications of submitting the form and to ensure that all information is truthful and complete.

Filing Deadlines / Important Dates

Timely filing of the Tc 941r Form is crucial to avoid penalties. Generally, the form is due quarterly, with specific deadlines for each quarter. For example, the deadlines for filing the form are typically the last day of the month following the end of each quarter. It is important to stay updated on these deadlines to ensure compliance and avoid potential late fees.

Form Submission Methods

The Tc 941r Form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission through the IRS e-file system.

- Mailing a paper copy to the appropriate IRS address.

- In-person submission at designated IRS offices.

Choosing the right submission method can streamline the filing process and ensure that the form is received on time.

Quick guide on how to complete tc 941r 2009 form

Complete Tc 941r Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents quickly without delays. Handle Tc 941r Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to edit and eSign Tc 941r Form with ease

- Find Tc 941r Form and click on Get Form to begin.

- Make use of the tools available to complete your document.

- Highlight necessary sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Edit and eSign Tc 941r Form and ensure clear communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tc 941r 2009 form

Create this form in 5 minutes!

How to create an eSignature for the tc 941r 2009 form

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

The way to create an eSignature for a PDF on Android devices

People also ask

-

What is the Tc 941r Form and why is it important?

The Tc 941r Form is a crucial document used for reporting and reconciling the tax withheld from employee wages. Understanding its significance helps businesses maintain compliance with tax regulations, ensuring accurate filing and avoiding penalties.

-

How can airSlate SignNow help with the Tc 941r Form?

airSlate SignNow simplifies the process of preparing and electronically signing the Tc 941r Form. With our platform, users can quickly fill out, send, and manage their tax documents securely, making tax season much more manageable.

-

What features does airSlate SignNow offer for the Tc 941r Form?

airSlate SignNow offers a range of features for the Tc 941r Form, including customizable templates, electronic signatures, and secure document storage. These features facilitate a seamless workflow for businesses, allowing for efficient tax reporting.

-

Is airSlate SignNow cost-effective for handling the Tc 941r Form?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to handle the Tc 941r Form. Our flexible pricing plans cater to various business sizes, allowing companies to choose a package that suits their budget while ensuring compliance.

-

Can I integrate airSlate SignNow with my existing software for the Tc 941r Form?

airSlate SignNow supports various integrations, making it easy to connect with existing payroll or accounting software for managing the Tc 941r Form. This capability streamlines document workflows and enhances overall productivity.

-

Is airSlate SignNow user-friendly for preparing the Tc 941r Form?

Absolutely! airSlate SignNow is designed to be user-friendly, allowing individuals with minimal technical knowledge to prepare the Tc 941r Form effortlessly. Clear navigation and intuitive interfaces make document management a breeze.

-

What support options are available for users of airSlate SignNow regarding the Tc 941r Form?

airSlate SignNow offers comprehensive support options for users needing assistance with the Tc 941r Form. Our customer service team is available via email, chat, and phone to guide users through any questions or issues they may encounter.

Get more for Tc 941r Form

Find out other Tc 941r Form

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure