Tc 62s Form 2019-2026

What is the TC 62S Form

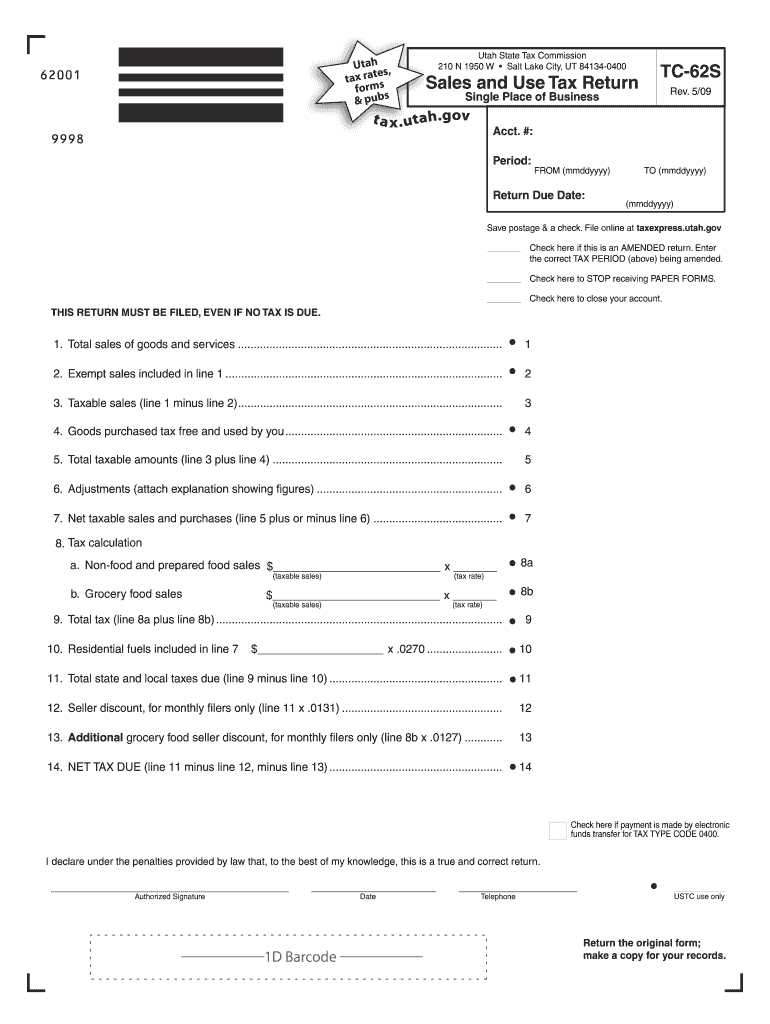

The 2009 Utah TC 62S form is a state-specific tax document used for reporting certain tax information to the Utah State Tax Commission. It is primarily utilized by individuals and businesses to declare income and calculate tax liabilities. Understanding the purpose of this form is essential for accurate tax reporting and compliance with state regulations.

How to Obtain the TC 62S Form

The TC 62S form can be obtained directly from the Utah State Tax Commission's official website. Users can download a PDF version of the form, which is available for free. Additionally, physical copies may be requested at local tax offices or through designated state agencies. Ensuring you have the correct version for the specific tax year is crucial for accurate filing.

Steps to Complete the TC 62S Form

Completing the 2009 TC 62S form involves several key steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Fill in personal information, such as your name, address, and Social Security number.

- Report your income and any applicable deductions or credits.

- Calculate your total tax liability and any payments made.

- Review the form for accuracy before submission.

Legal Use of the TC 62S Form

The TC 62S form is legally binding when completed and submitted in accordance with Utah tax laws. To ensure its validity, it must be signed and dated by the taxpayer. Additionally, compliance with all state regulations regarding tax reporting is necessary to avoid penalties or legal issues.

Filing Deadlines / Important Dates

For the 2009 tax year, the filing deadline for the TC 62S form typically aligns with the federal tax deadline. Taxpayers should be aware of any specific extensions or changes announced by the Utah State Tax Commission. Adhering to these deadlines is essential to avoid late fees and ensure timely processing of your tax return.

Form Submission Methods

The TC 62S form can be submitted through various methods:

- Online submission via the Utah State Tax Commission's e-filing system.

- Mailing a printed copy to the designated tax office address.

- In-person submission at local tax offices during business hours.

Penalties for Non-Compliance

Failure to file the TC 62S form on time or inaccurately reporting information can result in penalties imposed by the Utah State Tax Commission. These penalties may include fines, interest on unpaid taxes, and potential legal action. It is crucial to ensure compliance with all filing requirements to avoid these consequences.

Quick guide on how to complete tc 62s form 2009

Prepare Tc 62s Form effortlessly on any device

Online document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly option to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and efficiently. Manage Tc 62s Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to edit and eSign Tc 62s Form without hassle

- Find Tc 62s Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Tc 62s Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tc 62s form 2009

Create this form in 5 minutes!

How to create an eSignature for the tc 62s form 2009

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The way to create an eSignature for a PDF document on Android

People also ask

-

What is the 2009 Utah TC 62S and how does it function?

The 2009 Utah TC 62S is a specific model used for managing and processing vehicle title transactions in Utah. It provides a streamlined solution to navigate the complexities of title work, ensuring that all documentation is accurate and compliant with state regulations. By utilizing this model, users can efficiently handle title processing tasks.

-

Where can I purchase the 2009 Utah TC 62S?

You can purchase the 2009 Utah TC 62S from licensed automotive dealerships or authorized vendors of vehicle title processing equipment. It's important to ensure that you buy from reputable sources to guarantee authenticity and support. Prices may vary based on the vendor, so it's advisable to compare options.

-

What features does the 2009 Utah TC 62S offer?

The 2009 Utah TC 62S comes with features that include electronic document submission, status tracking for titles, and user-friendly software integration. It simplifies the document handling process and reduces the time taken to complete title transactions. This functionality is perfect for both businesses and individual users.

-

Is the 2009 Utah TC 62S cost-effective for businesses?

Yes, the 2009 Utah TC 62S is considered a cost-effective solution for businesses involved in title processing. By automating various tasks, it reduces manual labor and increases efficiency, ultimately saving you time and money. Investing in this model can lead to signNow operational savings in the long run.

-

Can the 2009 Utah TC 62S integrate with other software?

The 2009 Utah TC 62S has the capability to integrate with various document management and e-signature platforms, enhancing your business’s operational flow. This integration means that you can seamlessly connect your existing systems with title processing software, thus improving your document handling efficiency. Compatibility may depend on the specific software in use.

-

What are the benefits of using the 2009 Utah TC 62S?

Using the 2009 Utah TC 62S offers several benefits, such as increased accuracy in document processing and the ability to track title status in real-time. Additionally, it minimizes the risk of errors that can occur with manual documentation. Overall, it is designed to make title management faster and more reliable.

-

How does the 2009 Utah TC 62S address compliance issues?

The 2009 Utah TC 62S ensures that all title processing complies with Utah state regulations, reducing the risk of fines or legal complications. It automatically updates forms and processes based on current laws, ensuring users always operate within compliance guidelines. This built-in regulatory adherence makes title management more secure.

Get more for Tc 62s Form

- Ccl form pdf hindi download

- Pps sb form 1

- Chicken genetics gizmo answer key form

- Cash for keys letter form

- Army family care plan packet pdf form

- Holter monitor diary sample form

- Ending a marriagesuperior court of california form

- Post surgery parental permission form stony brook university medicine stonybrookmedicine

Find out other Tc 62s Form

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy