Vermont Business Tax Form 2020

What is the Vermont Business Tax Form

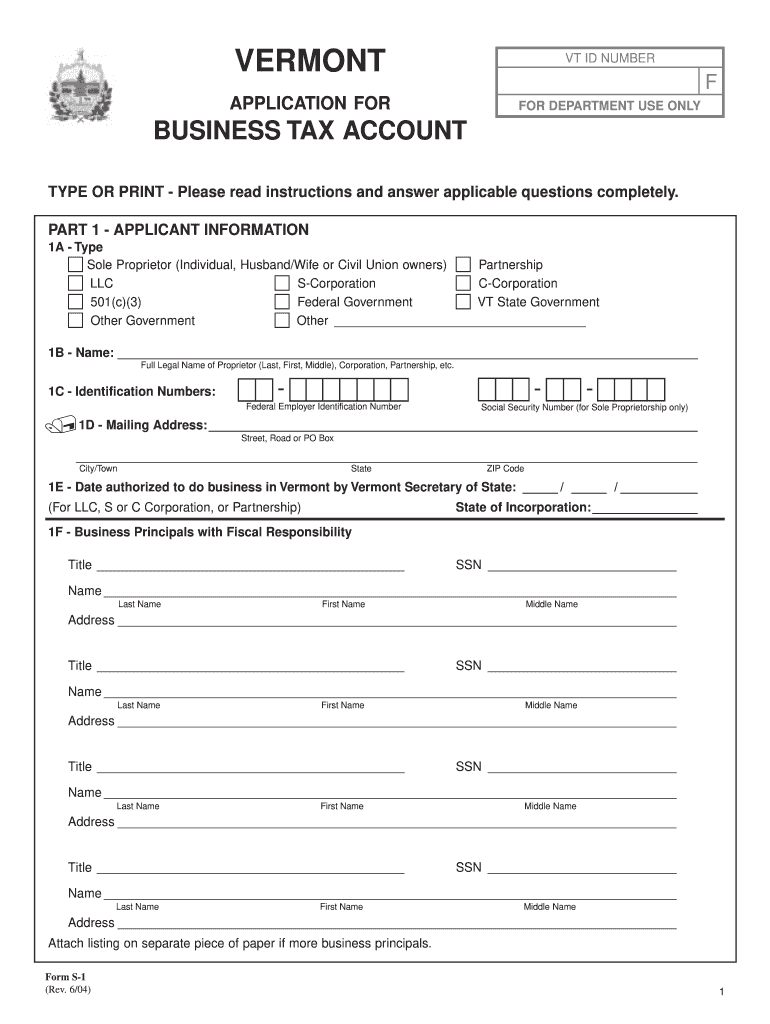

The Vermont Business Tax Form is a crucial document that businesses operating in Vermont must complete to report their income and calculate their tax obligations. This form is designed for various business entities, including corporations, partnerships, and limited liability companies (LLCs). It captures essential financial information that the Vermont Department of Taxes uses to assess the tax liability of each business. Understanding this form is vital for compliance and ensuring that businesses meet their tax responsibilities accurately.

How to use the Vermont Business Tax Form

Using the Vermont Business Tax Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form with precise details regarding your business's financial performance. It is important to follow the instructions provided with the form carefully, as this will guide you through each section. After completing the form, review it for accuracy before submitting it to avoid any potential penalties.

Steps to complete the Vermont Business Tax Form

Completing the Vermont Business Tax Form requires a systematic approach. Follow these steps:

- Gather all relevant financial documents, including income and expense records.

- Access the Vermont Business Tax Form from the Vermont Department of Taxes website or other authorized sources.

- Fill out the form, ensuring that all sections are completed accurately.

- Double-check your entries for any errors or omissions.

- Submit the form by the specified deadline, either electronically or by mail.

Legal use of the Vermont Business Tax Form

The Vermont Business Tax Form is legally binding when completed and submitted in accordance with state regulations. To ensure its legal validity, businesses must adhere to the guidelines set forth by the Vermont Department of Taxes. This includes providing accurate information and submitting the form by the required deadlines. Failure to comply with these regulations can result in penalties, including fines or additional taxes owed. Therefore, it is essential to understand the legal implications of this form.

Filing Deadlines / Important Dates

Filing deadlines for the Vermont Business Tax Form are critical for maintaining compliance. Typically, businesses must submit their forms by April fifteenth of each year for the previous tax year. However, specific deadlines may vary based on the type of business entity and any extensions granted. It is advisable for businesses to stay informed about these dates to avoid late penalties and ensure timely processing of their tax obligations.

Form Submission Methods (Online / Mail / In-Person)

The Vermont Business Tax Form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Many businesses opt to file electronically through the Vermont Department of Taxes' online portal, which can streamline the process.

- Mail: Businesses can also print the completed form and send it via traditional mail to the appropriate tax office.

- In-Person: For those who prefer face-to-face interaction, in-person submissions can be made at designated tax offices.

Quick guide on how to complete vermont business tax 2004 form

Effortlessly Prepare Vermont Business Tax Form on Any Device

Virtual document organization has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed papers, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Vermont Business Tax Form on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

Edit and eSign Vermont Business Tax Form with Ease

- Locate Vermont Business Tax Form and click Get Form to begin.

- Utilize the tools we provide to fill in your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools designed specifically for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form: via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Vermont Business Tax Form and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vermont business tax 2004 form

Create this form in 5 minutes!

How to create an eSignature for the vermont business tax 2004 form

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is the Vermont Business Tax Form?

The Vermont Business Tax Form is an essential document that businesses use to report their earnings and calculate their tax obligations in the state of Vermont. Understanding how to fill out this form accurately can help ensure compliance and avoid penalties. airSlate SignNow offers an easy-to-use solution for signing and sending these documents securely.

-

How can airSlate SignNow help with the Vermont Business Tax Form?

airSlate SignNow simplifies the process of completing and submitting the Vermont Business Tax Form. Our platform allows users to eSign and send documents electronically, making it quick and efficient. With customizable templates, you can ensure that your forms are filled out accurately and ready for submission.

-

Is airSlate SignNow a cost-effective solution for managing the Vermont Business Tax Form?

Yes, airSlate SignNow provides a cost-effective solution for businesses looking to manage their Vermont Business Tax Form. With various pricing plans tailored to different business sizes, you can find one that fits your budget. Our features streamline the eSigning process, saving you time and money.

-

What features does airSlate SignNow offer for the Vermont Business Tax Form?

airSlate SignNow includes a range of features designed to facilitate the completion of the Vermont Business Tax Form. These features include templates for easy form filling, secure storage for your documents, and real-time tracking of signed forms. This ensures you stay organized and compliant during tax season.

-

Can I integrate airSlate SignNow with other software for my Vermont Business Tax Form?

Absolutely! airSlate SignNow offers seamless integrations with numerous software applications, making it easier to manage your Vermont Business Tax Form. You can connect with accounting systems, customer relationship management tools, and more to streamline your workflow efficiently.

-

What are the benefits of using airSlate SignNow for the Vermont Business Tax Form?

Using airSlate SignNow for the Vermont Business Tax Form provides multiple benefits including reduced paperwork, faster processing times, and enhanced security for your sensitive information. Our platform ensures that your forms are lSignNowed in a timely manner, helping you meet all state deadlines with ease.

-

Is it easy to eSign the Vermont Business Tax Form using airSlate SignNow?

Yes, eSigning the Vermont Business Tax Form with airSlate SignNow is incredibly easy. Our user-friendly interface allows you to add your signature in just a few clicks. Plus, you can do this from anywhere, making document management more convenient for busy professionals.

Get more for Vermont Business Tax Form

Find out other Vermont Business Tax Form

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template