Sd 101 Short Form 2015-2026

What is the SD 101 Short Form

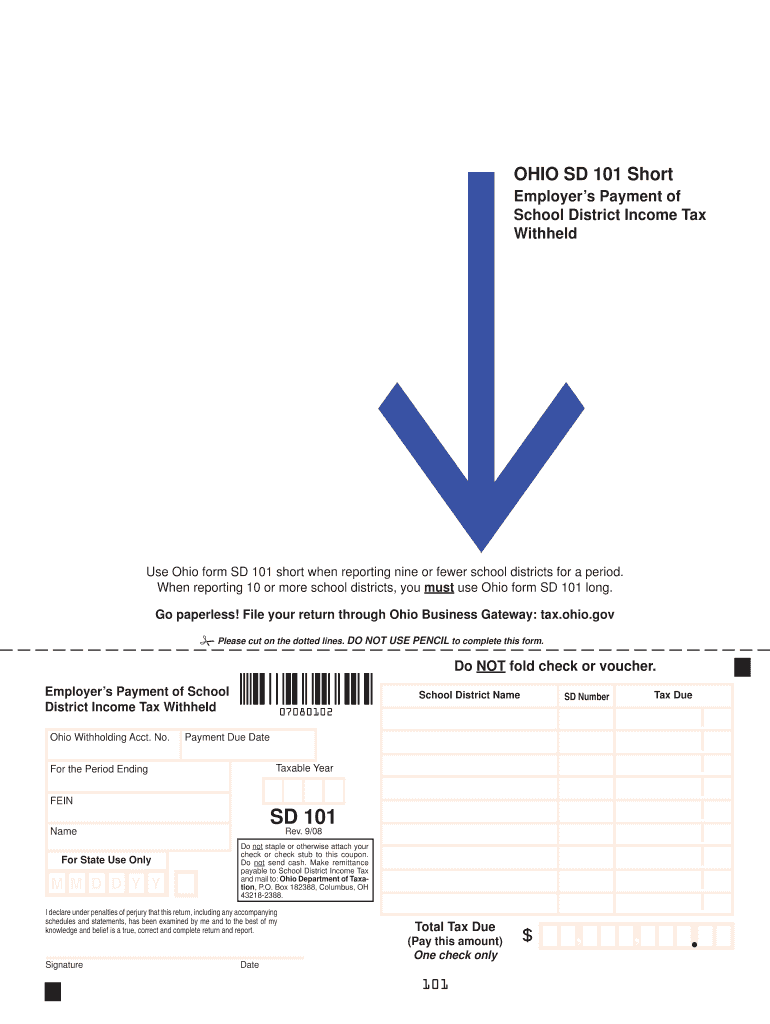

The SD 101 form, also known as the Ohio short form, is a document used primarily for tax purposes in the state of Ohio. This form is essential for individuals and businesses to report specific financial information to the state government. It simplifies the process of filing taxes by providing a concise format for taxpayers. Understanding the purpose and function of the SD 101 form is crucial for ensuring compliance with state tax regulations.

How to Use the SD 101 Short Form

Using the SD 101 form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and any relevant tax documents. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. Once the form is filled out, review it for any errors before submission. It is important to follow the specific instructions provided with the form to avoid any issues during the filing process.

Steps to Complete the SD 101 Short Form

Completing the SD 101 form requires attention to detail. Follow these steps:

- Obtain the latest version of the SD 101 form from a reliable source.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately, including wages, interest, and other sources.

- Deduct any eligible expenses as outlined in the form instructions.

- Calculate your total tax liability based on the information provided.

- Sign and date the form to certify its accuracy.

Legal Use of the SD 101 Short Form

The SD 101 form is legally recognized by the state of Ohio for tax reporting purposes. To ensure its legal validity, it must be completed accurately and submitted by the designated deadlines. Compliance with state tax laws is essential to avoid penalties. Additionally, eSignature solutions can enhance the legality of the form by providing a secure method for signing and submitting documents electronically.

Required Documents

To complete the SD 101 form, certain documents are necessary. These may include:

- W-2 forms from employers

- 1099 forms for additional income sources

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents ready will streamline the process of filling out the form and ensure accuracy in reporting.

Form Submission Methods

The SD 101 form can be submitted through various methods. Taxpayers can choose to file online using approved e-filing platforms, which often provide a more efficient and faster processing time. Alternatively, the form can be mailed to the appropriate state tax office or submitted in person at designated locations. Each submission method has its own set of guidelines, so it is important to follow the instructions provided with the form.

Quick guide on how to complete sd 101 short form

Prepare Sd 101 Short Form effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle Sd 101 Short Form on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to update and eSign Sd 101 Short Form with ease

- Locate Sd 101 Short Form and then click Get Form to begin.

- Utilize the available tools to complete your form.

- Emphasize relevant parts of the documents or obscure sensitive data with tools specifically provided by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method for submitting your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Sd 101 Short Form and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sd 101 short form

Create this form in 5 minutes!

How to create an eSignature for the sd 101 short form

How to make an electronic signature for your PDF online

How to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

How to create an eSignature for a PDF on Android

People also ask

-

What is the SD 101 form and why do I need it?

The SD 101 form is a critical document used for various business processes, including tax compliance and regulatory filings. It ensures that your business remains compliant with state regulations. Using the SD 101 form through airSlate SignNow simplifies the signing process, making it hassle-free and efficient.

-

How can airSlate SignNow help me with the SD 101 form?

airSlate SignNow provides an easy-to-use platform that allows you to fill out and eSign the SD 101 form swiftly. Our intuitive interface ensures that anyone can complete the document without extensive training. Additionally, seamless eSigning speeds up your administrative tasks and improves workflow efficiency.

-

Is there a cost associated with using airSlate SignNow for the SD 101 form?

Yes, there is a pricing structure for using airSlate SignNow, but it is designed to be cost-effective, enabling businesses of all sizes to access our services. We offer various plans that cater to different needs, allowing you to choose the best option for managing the SD 101 form. Be sure to check our website for the latest pricing details.

-

Can I integrate airSlate SignNow with other tools for handling the SD 101 form?

Absolutely! airSlate SignNow offers several integrations with popular applications, allowing you to streamline the process of managing the SD 101 form. Whether using CRM systems or cloud storage solutions, our integrations ensure that you can work efficiently across platforms.

-

What are the benefits of using airSlate SignNow for the SD 101 form?

Using airSlate SignNow for the SD 101 form offers numerous benefits, including enhanced security, reduced processing time, and improved accuracy. Our digital solutions enable you to track document status and receive notifications once the form is signed. This ensures that you're always updated on your essential documents.

-

How secure is the process of signing the SD 101 form with airSlate SignNow?

Security is a top priority at airSlate SignNow, especially when dealing with important documents like the SD 101 form. We use encryption and secure cloud storage to protect your information, ensuring that your data remains confidential and safe. Our platform also complies with industry standards and regulations.

-

Can I modify the SD 101 form once it is uploaded to airSlate SignNow?

Yes, you can modify the SD 101 form even after it has been uploaded to airSlate SignNow. Our platform allows users to make necessary changes easily, ensuring that the document meets all requirements before signing. This feature helps prevent errors and streamline the signing process.

Get more for Sd 101 Short Form

Find out other Sd 101 Short Form

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple