Colorado W 2 Wage Withholding Tax Return Colorado Gov Colorado 2020

What is the Colorado W-2 Wage Withholding Tax Return?

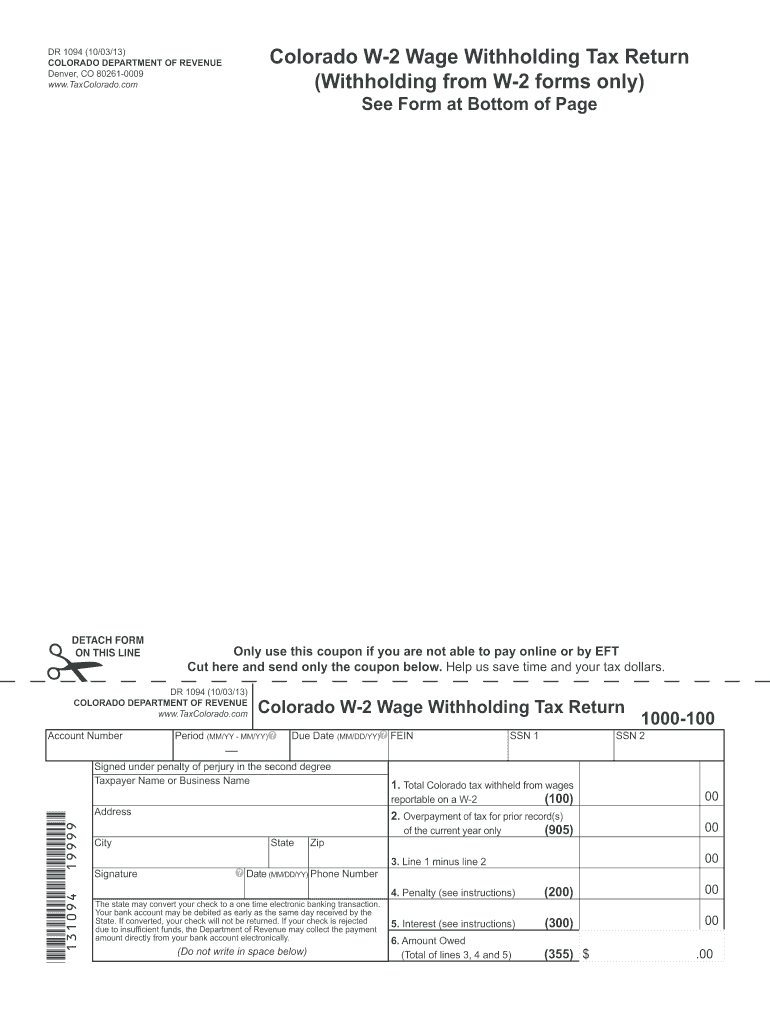

The Colorado W-2 Wage Withholding Tax Return is a crucial document for employers in Colorado, used to report the state income tax withheld from employees' wages. This form provides the Colorado Department of Revenue with essential information regarding the amount of tax collected from employees throughout the year. Employers must ensure accurate reporting to maintain compliance with state tax regulations.

Steps to Complete the Colorado W-2 Wage Withholding Tax Return

Completing the Colorado W-2 Wage Withholding Tax Return involves several key steps:

- Gather all relevant employee wage data, including total wages paid and the amount of state tax withheld.

- Fill out the form accurately, ensuring all fields are completed, including employer information and employee details.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Colorado Department of Revenue by the designated deadline.

How to Obtain the Colorado W-2 Wage Withholding Tax Return

Employers can obtain the Colorado W-2 Wage Withholding Tax Return from the Colorado Department of Revenue's official website. The form is available for download in a printable format. It is advisable for employers to check for the most recent version of the form to ensure compliance with current tax laws.

Key Elements of the Colorado W-2 Wage Withholding Tax Return

Several key elements are essential when filling out the Colorado W-2 Wage Withholding Tax Return:

- Employer Information: This includes the employer's name, address, and identification number.

- Employee Information: Details such as the employee's name, Social Security number, and total wages.

- Tax Withheld: The total amount of state income tax withheld from the employee's wages.

- Signature: The form must be signed by an authorized representative of the employer.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Colorado W-2 Wage Withholding Tax Return. Typically, the form is due by the end of January for the previous tax year. It is crucial to stay updated on any changes to filing dates to avoid penalties.

Penalties for Non-Compliance

Failure to submit the Colorado W-2 Wage Withholding Tax Return on time or inaccuracies in reporting can result in penalties. Employers may face fines based on the amount of tax due or the length of the delay. Ensuring timely and accurate filing is essential to avoid these consequences.

Quick guide on how to complete colorado w 2 wage withholding tax return coloradogov colorado

Complete Colorado W 2 Wage Withholding Tax Return Colorado gov Colorado effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Colorado W 2 Wage Withholding Tax Return Colorado gov Colorado on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign Colorado W 2 Wage Withholding Tax Return Colorado gov Colorado with ease

- Locate Colorado W 2 Wage Withholding Tax Return Colorado gov Colorado and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Colorado W 2 Wage Withholding Tax Return Colorado gov Colorado and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct colorado w 2 wage withholding tax return coloradogov colorado

Create this form in 5 minutes!

How to create an eSignature for the colorado w 2 wage withholding tax return coloradogov colorado

The best way to generate an electronic signature for a PDF online

The best way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

How to make an eSignature for a PDF document on Android

People also ask

-

What is the Colorado W 2 Wage Withholding Tax Return process?

The Colorado W 2 Wage Withholding Tax Return process involves filing your W-2 forms to report wages paid and taxes withheld for employees. By utilizing the Colorado gov Colorado resources, businesses can ensure they meet all state requirements. airSlate SignNow provides a streamlined method for completing this process efficiently and effectively.

-

How can airSlate SignNow help with filing Colorado W 2 Wage Withholding Tax Return?

airSlate SignNow simplifies the process of filing the Colorado W 2 Wage Withholding Tax Return by enabling businesses to eSign documents and securely send them. This easy-to-use platform ensures that your W-2 filings comply with Colorado gov Colorado regulations. Our solution is both cost-effective and time-saving.

-

Are there any costs associated with using airSlate SignNow for Colorado W 2 Wage Withholding Tax Return?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses managing their Colorado W 2 Wage Withholding Tax Return. These plans ensure you have access to necessary features while remaining budget-friendly. Check our pricing page for specific details.

-

What features does airSlate SignNow offer for managing W-2 forms?

airSlate SignNow offers an array of features for managing W-2 forms, including easy document eSigning, templates for W-2 forms, and secure document storage. These features facilitate the Colorado W 2 Wage Withholding Tax Return process and ensure compliance with state regulations provided by Colorado gov Colorado.

-

Can I integrate airSlate SignNow with other software for handling payroll?

Absolutely! airSlate SignNow can seamlessly integrate with various payroll software solutions. This integration allows for an efficient workflow in handling the Colorado W 2 Wage Withholding Tax Return without the hassle of switching between different platforms.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow allows your business to streamline document management, reduce turnaround time, and ensure compliance with legal requirements such as the Colorado W 2 Wage Withholding Tax Return. The easy-to-use platform enhances productivity while offering a secure method to send and eSign important documents.

-

Is airSlate SignNow compliant with Colorado government regulations?

Yes, airSlate SignNow is designed to comply with Colorado government regulations regarding the Colorado W 2 Wage Withholding Tax Return. Our platform includes features that adhere to Colorado gov Colorado standards, ensuring your tax return filing is accurate and compliant.

Get more for Colorado W 2 Wage Withholding Tax Return Colorado gov Colorado

Find out other Colorado W 2 Wage Withholding Tax Return Colorado gov Colorado

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free