Tax Colorado Form 2019

What is the Tax Colorado Form

The Tax Colorado Form is an official document used by residents of Colorado to report their income and calculate their state tax obligations. This form is essential for individuals and businesses alike, as it ensures compliance with state tax laws. The form may vary depending on the taxpayer's situation, such as whether they are filing as an individual, a business entity, or under specific circumstances like self-employment or retirement. Understanding the purpose and requirements of the Tax Colorado Form is crucial for accurate tax reporting and avoiding potential penalties.

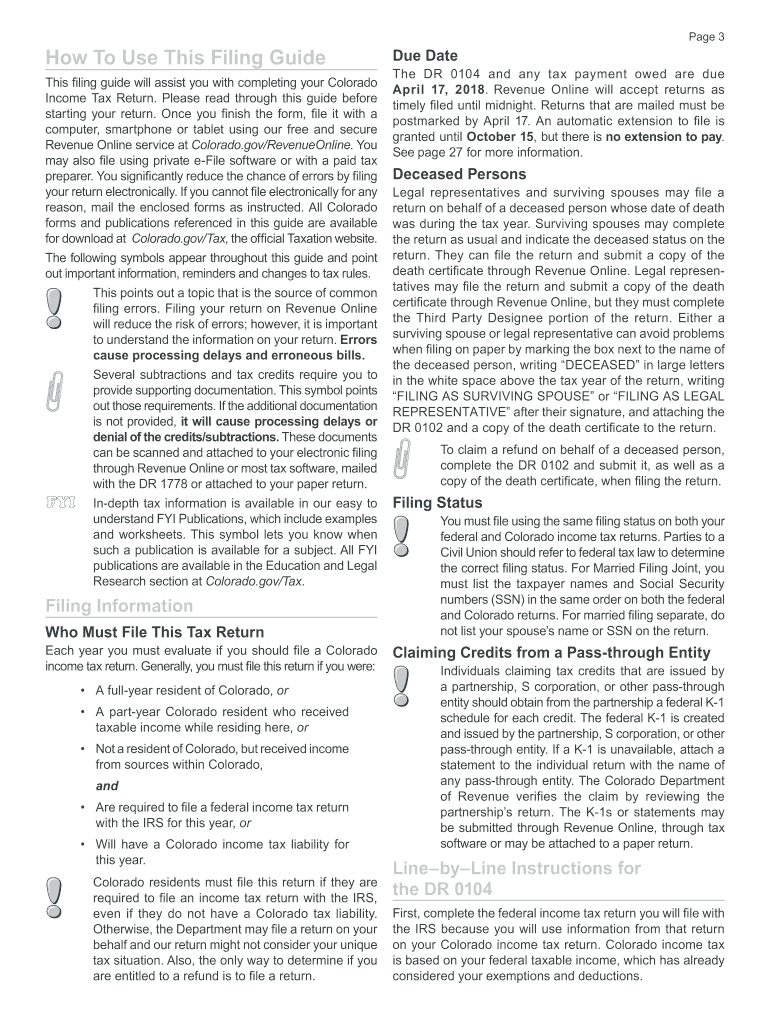

How to use the Tax Colorado Form

Using the Tax Colorado Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, carefully read the instructions provided with the form to understand the specific requirements for your filing status. Complete the form by entering your income, deductions, and credits as applicable. Finally, review the information for accuracy before submitting the form either electronically or by mail, depending on your preference and the options available.

Steps to complete the Tax Colorado Form

Completing the Tax Colorado Form requires a systematic approach to ensure all information is correctly reported. Follow these steps:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Choose the appropriate version of the Tax Colorado Form based on your filing status.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and any other earnings.

- Claim applicable deductions and credits to reduce your taxable income.

- Calculate your total tax liability and any refund or balance due.

- Sign and date the form before submitting it according to the provided instructions.

Legal use of the Tax Colorado Form

The Tax Colorado Form is legally binding when completed and submitted according to state regulations. It is important to ensure that all information provided is accurate and truthful, as discrepancies can lead to audits or penalties. The form must be signed by the taxpayer, affirming that the information is correct to the best of their knowledge. Compliance with state tax laws is essential for maintaining good standing with the Colorado Department of Revenue and avoiding legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Colorado Form are crucial for taxpayers to adhere to in order to avoid penalties. Typically, the deadline for individual filers is April 15 of each year, aligning with federal tax deadlines. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any specific deadlines related to extensions or special circumstances that may apply to your situation.

Form Submission Methods (Online / Mail / In-Person)

The Tax Colorado Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers choose to file electronically through approved e-filing services, which can expedite processing times and reduce errors.

- Mail Submission: Completed forms can be mailed to the Colorado Department of Revenue at the designated address. Ensure that you use the correct postage and send it well before the deadline.

- In-Person Submission: Taxpayers may also visit local tax offices to submit their forms directly, which can be beneficial for those needing assistance or clarification.

Quick guide on how to complete 2015 tax colorado form

Prepare Tax Colorado Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents promptly without any holdups. Manage Tax Colorado Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to adjust and eSign Tax Colorado Form with ease

- Obtain Tax Colorado Form and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Mark important sections of the documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or mislaid files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Amend and eSign Tax Colorado Form while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 tax colorado form

Create this form in 5 minutes!

How to create an eSignature for the 2015 tax colorado form

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is a Tax Colorado Form and why is it important?

A Tax Colorado Form is a document that residents and businesses in Colorado must use to report their income and calculate tax liabilities. Filling out the correct Tax Colorado Form is essential to ensure compliance with state tax laws and to avoid penalties. Understanding its importance helps you to manage your finances better and prepare for tax season effectively.

-

How can airSlate SignNow assist with the Tax Colorado Form?

airSlate SignNow enables you to easily eSign and send your Tax Colorado Form online, streamlining your tax filing process. With its user-friendly interface, you can complete and sign your forms securely from anywhere. This ensures that your documents are submitted on time and reduces the risk of errors.

-

Is airSlate SignNow cost-effective for managing Tax Colorado Forms?

Yes, airSlate SignNow offers a cost-effective solution for managing your Tax Colorado Forms. With different pricing plans available, you can choose one that fits your budget while maintaining high-quality service. This allows businesses and individuals alike to efficiently handle their tax documents without breaking the bank.

-

What features does airSlate SignNow include for Tax Colorado Form processing?

airSlate SignNow includes various features that enhance the eSigning experience for Tax Colorado Forms, such as document templates, reminders, and real-time tracking. These features ensure that you can easily manage deadlines and maintain an organized workflow. Additionally, the platform offers secure storage and encryption for your sensitive information.

-

Can I integrate airSlate SignNow with other tools for Tax Colorado Form submissions?

Absolutely! airSlate SignNow offers integrations with various applications and services, making it easier to manage your Tax Colorado Form submissions alongside your existing systems. Whether you use accounting software or CRM solutions, integrating airSlate SignNow helps streamline your processes and keep everything organized.

-

What are the benefits of using airSlate SignNow for Tax Colorado Forms?

Using airSlate SignNow for your Tax Colorado Forms provides numerous benefits, including faster processing times, improved accuracy, and enhanced security. By eSigning your forms online, you eliminate the hassles of handwritten signatures and physical paperwork. This not only saves time but also helps you stay compliant with state regulations.

-

Are there any specific compliance features for Tax Colorado Forms in airSlate SignNow?

Yes, airSlate SignNow is designed with compliance in mind, ensuring that your Tax Colorado Forms meet all necessary regulatory standards. The platform records every transaction with timestamps, making it easy to track changes and maintain a transparent audit trail. This level of compliance helps protect you in case of reviews or audits.

Get more for Tax Colorado Form

Find out other Tax Colorado Form

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure