Taxpayer Information Provide Information for Only One Taxpayer Per Form 2021-2026

Understanding the Utah POA Tax Form

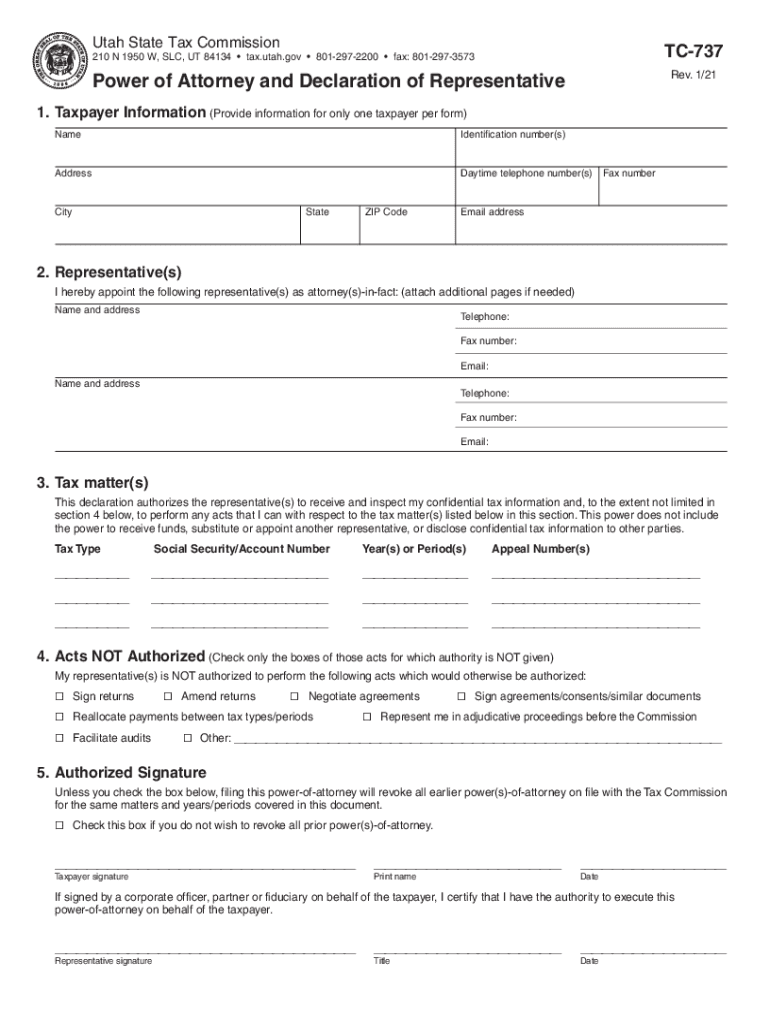

The Utah POA tax form, also known as the TC-737, is a crucial document for taxpayers who wish to authorize someone to represent them in dealings with the Utah State Tax Commission. This form allows a designated individual, often referred to as an agent, to manage tax-related matters on behalf of the taxpayer. It is essential to ensure that the information provided is accurate and complete, as it directly impacts the authority granted to the agent.

Steps to Complete the Utah POA Tax Form

Filling out the Utah POA tax form involves several key steps:

- Begin by entering the taxpayer's name, address, and Social Security number or Employer Identification Number (EIN).

- Provide the name and contact information of the agent who will be authorized to act on behalf of the taxpayer.

- Specify the tax matters for which the agent is authorized, such as income tax, sales tax, or property tax.

- Indicate the effective date of the authorization and any expiration date, if applicable.

- Sign and date the form to validate the authorization.

Required Documents for Submission

When submitting the Utah POA tax form, it is important to include any necessary supporting documentation. This may include:

- A copy of the taxpayer's identification, such as a driver's license or Social Security card.

- Any previous correspondence with the Utah State Tax Commission that may be relevant to the authorization.

Ensuring that all required documents are included can help prevent delays in processing the form.

Form Submission Methods

The Utah POA tax form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Utah State Tax Commission's website, if applicable.

- Mailing the completed form to the appropriate address designated by the tax commission.

- In-person submission at a local tax commission office for those who prefer face-to-face interaction.

Legal Use of the Utah POA Tax Form

The Utah POA tax form is legally binding when completed correctly. It grants the designated agent the authority to act on behalf of the taxpayer in specific tax matters. To ensure legal validity, the form must be signed by the taxpayer and comply with all state regulations regarding power of attorney documents. It is advisable to keep a copy of the completed form for personal records and future reference.

Filing Deadlines and Important Dates

When dealing with tax matters, it is crucial to be aware of filing deadlines associated with the Utah POA tax form. Generally, the form should be submitted before the tax matters it pertains to are due. Specific deadlines may vary based on the type of tax and the taxpayer's circumstances, so consulting the Utah State Tax Commission's website or a tax professional for the most accurate information is recommended.

Quick guide on how to complete taxpayer information provide information for only one taxpayer per form

Handle Taxpayer Information Provide Information For Only One Taxpayer Per Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, adjust, and eSign your documents swiftly and without delays. Manage Taxpayer Information Provide Information For Only One Taxpayer Per Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Taxpayer Information Provide Information For Only One Taxpayer Per Form effortlessly

- Locate Taxpayer Information Provide Information For Only One Taxpayer Per Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Taxpayer Information Provide Information For Only One Taxpayer Per Form and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxpayer information provide information for only one taxpayer per form

Create this form in 5 minutes!

How to create an eSignature for the taxpayer information provide information for only one taxpayer per form

The best way to create an eSignature for a PDF document in the online mode

The best way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the Utah POA tax form?

The Utah POA tax form is a legal document that grants authority to an individual or entity to act on your behalf in tax matters. This form is essential for ensuring that your tax filings align with the state regulations. Using airSlate SignNow to eSign this form makes the entire process efficient and secure.

-

How can I fill out the Utah POA tax form using airSlate SignNow?

Filling out the Utah POA tax form with airSlate SignNow is straightforward. You can easily upload the document, fill in the required information, and add electronic signatures. This streamlined process saves you time and helps ensure accuracy in your submissions.

-

Is airSlate SignNow cost-effective for managing the Utah POA tax form?

Yes, airSlate SignNow offers a cost-effective solution for managing the Utah POA tax form. With transparent pricing plans, you can choose the option that best fits your business needs while benefiting from unlimited eSigning capabilities and document management features.

-

Can I store my completed Utah POA tax forms on airSlate SignNow?

Absolutely! airSlate SignNow provides secure storage for all your completed documents, including the Utah POA tax forms. This feature allows you to access and manage your documents anytime, ensuring that your important forms are safely kept.

-

What integrations does airSlate SignNow offer for the Utah POA tax form?

airSlate SignNow seamlessly integrates with various popular applications and software, enhancing your workflow when managing the Utah POA tax form. Whether you’re using CRM tools, cloud storage, or email services, these integrations help streamline the entire signing process.

-

What benefits does eSigning the Utah POA tax form offer?

eSigning the Utah POA tax form through airSlate SignNow offers numerous benefits, including time savings and improved accuracy. With the ability to sign documents remotely, you eliminate the hassle of in-person meetings and can expedite your tax processes.

-

How secure is my information when using airSlate SignNow for the Utah POA tax form?

Your information is highly secure when using airSlate SignNow for the Utah POA tax form. The platform employs advanced encryption and compliance measures to protect your data, ensuring that your sensitive information remains confidential and safe.

Get more for Taxpayer Information Provide Information For Only One Taxpayer Per Form

Find out other Taxpayer Information Provide Information For Only One Taxpayer Per Form

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online