Loan Confirmation Letter Form

What is the loan confirmation letter?

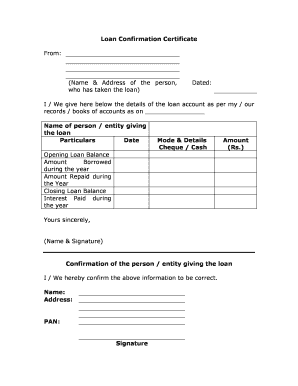

A loan confirmation letter is a formal document issued by a financial institution to verify the details of a loan agreement. This letter serves as proof of the loan's existence and outlines critical information such as the loan amount, interest rate, repayment terms, and the borrower's obligations. It is often required by individuals or businesses seeking to demonstrate their financial commitments to other parties, such as landlords, creditors, or during audits.

Key elements of the loan confirmation letter

When drafting a loan confirmation letter, several essential elements must be included to ensure clarity and compliance. These elements typically consist of:

- Borrower's name and contact information: Clearly state the full name and address of the borrower.

- Lender's name and contact information: Include the name and address of the financial institution or lender.

- Loan details: Specify the loan amount, interest rate, and repayment schedule.

- Loan purpose: Describe the intended use of the loan funds.

- Signatures: Ensure that the letter is signed by authorized representatives from both the lender and borrower.

Steps to complete the loan confirmation letter

Completing a loan confirmation letter involves several straightforward steps to ensure that all necessary information is accurately captured. Follow these steps:

- Gather all relevant loan information, including the loan amount, interest rate, and repayment terms.

- Draft the letter by including the key elements mentioned above.

- Review the document for accuracy and completeness.

- Obtain signatures from both the lender and borrower.

- Distribute copies of the signed letter to all relevant parties.

How to obtain the loan confirmation letter

To obtain a loan confirmation letter, borrowers typically need to contact their lender directly. This can often be done through the lender's customer service department or online banking platform. It is essential to provide any necessary identification and loan details to facilitate the request. Some lenders may have specific forms or procedures in place for issuing loan confirmation letters.

Legal use of the loan confirmation letter

The loan confirmation letter holds legal significance as it serves as an official record of the loan agreement. It can be used in various legal contexts, such as during audits, loan applications, or disputes regarding repayment. To ensure its legal standing, the letter must be accurately completed and signed by both parties. Compliance with relevant laws and regulations is crucial for the letter to be considered valid in legal proceedings.

Examples of using the loan confirmation letter

Loan confirmation letters can be utilized in various scenarios, including:

- Providing proof of a loan for a rental application.

- Demonstrating financial obligations during a business audit.

- Supporting loan applications for additional financing.

- Clarifying loan terms in case of disputes with creditors.

Quick guide on how to complete loan confirmation letter

Complete Loan Confirmation Letter effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Loan Confirmation Letter on any platform using airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to edit and eSign Loan Confirmation Letter with ease

- Obtain Loan Confirmation Letter and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form seeking, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Loan Confirmation Letter and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan confirmation letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loan confirmation letter?

A loan confirmation letter is a formal document that verifies the approval of a loan application. It typically includes details such as the loan amount, terms, and conditions. airSlate SignNow simplifies the process of generating and sending these letters electronically, ensuring you can provide them to clients quickly and efficiently.

-

How does airSlate SignNow help in creating a loan confirmation letter?

airSlate SignNow provides an easy-to-use platform for creating a professional loan confirmation letter. With our customizable templates, you can quickly fill in necessary details and have the letter ready for signing. This streamlines the process, allowing for rapid approval and delivery to your clients.

-

Can I integrate airSlate SignNow with my existing loan processing software?

Yes, airSlate SignNow offers seamless integrations with various loan processing software and CRMs. This allows you to import data directly into your loan confirmation letter, minimizing manual entry and reducing errors. Enhancing your workflow has never been easier with our versatile integration options.

-

What are the benefits of using airSlate SignNow for a loan confirmation letter?

Using airSlate SignNow for your loan confirmation letter offers several benefits, including increased efficiency, enhanced security, and professional image. Our solution allows for electronic signatures, which speeds up the process and ensures confidentiality. Additionally, our system saves you time and resources, enabling you to focus on growing your business.

-

Is there a cost associated with sending a loan confirmation letter using airSlate SignNow?

airSlate SignNow operates on a subscription-based pricing model, allowing access to all features, including sending loan confirmation letters. The cost-effective plans are designed to cater to businesses of all sizes, ensuring you get the best value for your investment. Contact us for specific pricing tailored to your needs.

-

How long does it take to send a loan confirmation letter using airSlate SignNow?

Sending a loan confirmation letter using airSlate SignNow is almost instantaneous. Once you've completed the letter and added the necessary signatures, it can be sent out within minutes. This quick turnaround helps provide your clients with the timely information they need.

-

Can multiple parties sign the loan confirmation letter using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple parties to eSign a loan confirmation letter, making it ideal for transactions requiring approvals from different stakeholders. Our platform tracks each signature's status, ensuring everyone has signed before finalizing the document.

Get more for Loan Confirmation Letter

- Naacp membership department action naacp form

- Love application form

- Merchandise order form

- Red robin giving fund form

- Nasm essentials of personal fitness training 6th edition pdf form

- States ccdf link americorps child care program1 form

- Sony music entertainmentchange request form

- Find the volume of each rectangular prism form

Find out other Loan Confirmation Letter

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe