Informe Auditoria De Certificacin Bureau Veritas Monedas De Las Amricas Monedas De Amrica Del Norte 30 2018

Understanding Texas Franchise Tax Forms

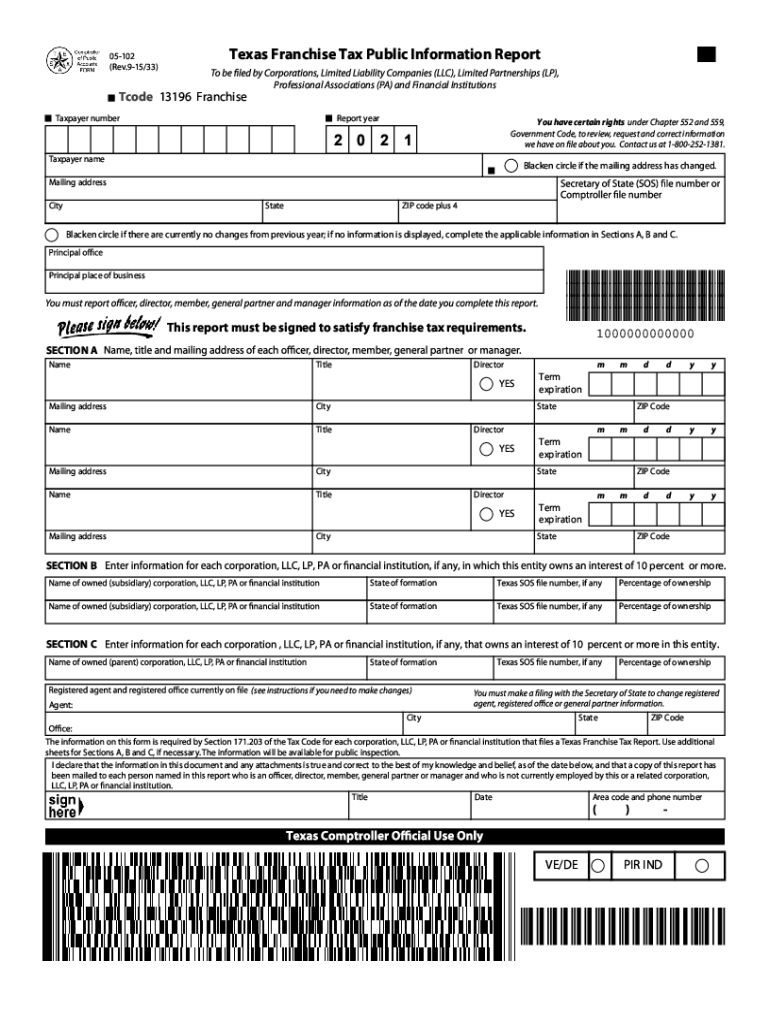

The Texas franchise tax forms are essential for businesses operating in Texas to report their revenue and calculate their tax obligations. The primary form used is the Texas Franchise Tax Public Information Report, often referred to as Form 05-102. This form is required for various business entities, including corporations and limited liability companies (LLCs). It provides critical information about the business, such as its revenue, ownership structure, and contact details.

Filing these forms accurately is crucial to ensure compliance with Texas tax regulations. Businesses must understand the specific requirements and deadlines associated with these forms to avoid penalties.

Steps to Complete the Texas Franchise Tax Public Information Report

Completing the Texas franchise tax forms involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Determine your business entity type, as this affects the form requirements.

- Access the Texas Franchise Tax Public Information Report form, which can be found on the Texas Comptroller's website.

- Fill out the form with accurate information regarding your business's revenue and ownership.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail by the specified deadline.

Following these steps helps ensure that your submission is complete and compliant with state regulations.

Filing Deadlines for Texas Franchise Tax Forms

Timely filing of the Texas franchise tax forms is critical to avoid penalties. The general deadline for most businesses is May 15 of each year. However, if this date falls on a weekend or holiday, the deadline is extended to the next business day. It is essential for businesses to mark their calendars and prepare their documents in advance to meet these deadlines.

Additionally, some entities may have different deadlines based on their fiscal year or specific circumstances, so it is advisable to check with the Texas Comptroller's office for any updates or changes to the filing schedule.

Required Documents for Filing

When preparing to file the Texas franchise tax forms, businesses should gather the following documents:

- Financial statements, including profit and loss statements.

- Balance sheets detailing assets and liabilities.

- Ownership information, including details of partners or shareholders.

- Prior year tax returns, if applicable.

Having these documents ready will facilitate a smoother filing process and help ensure that all necessary information is accurately reported.

Penalties for Non-Compliance

Failure to file the Texas franchise tax forms on time can result in significant penalties. Businesses may face fines and interest charges on unpaid taxes. Additionally, non-compliance can lead to the suspension of business operations in Texas. It is crucial for businesses to understand these consequences and prioritize timely and accurate filing to maintain good standing with the state.

Digital vs. Paper Version of Texas Franchise Tax Forms

Businesses have the option to file their Texas franchise tax forms either digitally or through paper submission. Filing electronically is often more efficient, as it allows for quicker processing and confirmation of receipt. The electronic filing system also reduces the likelihood of errors that can occur with paper forms. However, some businesses may prefer paper filing for record-keeping purposes or due to specific operational preferences.

Regardless of the method chosen, it is essential to ensure that the forms are completed accurately and submitted by the deadline to avoid penalties.

Quick guide on how to complete informe auditoria de certificacin bureau veritas monedas de las amricas monedas de amrica del norte free 30

Effortlessly Complete Informe Auditoria De Certificacin Bureau Veritas Monedas De Las Amricas Monedas De Amrica Del Norte 30 on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, enabling you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without complications. Manage Informe Auditoria De Certificacin Bureau Veritas Monedas De Las Amricas Monedas De Amrica Del Norte 30 on any device using the airSlate SignNow applications for Android or iOS, and streamline any document-centric procedure today.

How to Alter and Electronically Sign Informe Auditoria De Certificacin Bureau Veritas Monedas De Las Amricas Monedas De Amrica Del Norte 30 with Ease

- Obtain Informe Auditoria De Certificacin Bureau Veritas Monedas De Las Amricas Monedas De Amrica Del Norte 30 and then click Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign Informe Auditoria De Certificacin Bureau Veritas Monedas De Las Amricas Monedas De Amrica Del Norte 30 to ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct informe auditoria de certificacin bureau veritas monedas de las amricas monedas de amrica del norte free 30

Create this form in 5 minutes!

How to create an eSignature for the informe auditoria de certificacin bureau veritas monedas de las amricas monedas de amrica del norte free 30

The best way to generate an eSignature for your PDF in the online mode

The best way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What are Texas franchise tax forms?

Texas franchise tax forms are official documents that businesses must complete to report their franchise taxes to the state of Texas. These forms vary based on the type of business entity and revenue, and it's crucial to use the correct Texas franchise tax forms to ensure compliance and avoid penalties.

-

How can airSlate SignNow help with Texas franchise tax forms?

airSlate SignNow simplifies the process of completing and signing Texas franchise tax forms by providing an easy-to-use platform. With our eSignature functionality, users can quickly sign documents electronically, facilitating faster submissions and ensuring that all relevant forms are completed correctly.

-

Are there any costs associated with using airSlate SignNow for Texas franchise tax forms?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Our cost-effective solution enables you to manage your Texas franchise tax forms without breaking the bank, providing an excellent return on investment.

-

Can I integrate airSlate SignNow with other software for Texas franchise tax forms?

Absolutely! airSlate SignNow integrates seamlessly with a variety of accounting and tax software, allowing for efficient management of your Texas franchise tax forms. This integration ensures that your data flows smoothly between systems, making tax preparation simpler.

-

What features does airSlate SignNow offer for handling Texas franchise tax forms?

airSlate SignNow offers features such as eSignature, document templates, and tracking capabilities to manage your Texas franchise tax forms effectively. These tools enhance productivity and ensure that your filings are organized and submitted on time.

-

How can I ensure my Texas franchise tax forms are filed on time using airSlate SignNow?

To ensure timely filing of your Texas franchise tax forms using airSlate SignNow, utilize our reminder features and document tracking. You can set up notifications to stay on top of deadlines, ensuring you never miss an important submission date.

-

Is customer support available for issues related to Texas franchise tax forms?

Yes, airSlate SignNow provides robust customer support to assist users with any issues related to Texas franchise tax forms. Our knowledgeable team is available to answer questions and guide you through any challenges you may encounter.

Get more for Informe Auditoria De Certificacin Bureau Veritas Monedas De Las Amricas Monedas De Amrica Del Norte 30

- This invoice must be completed in english esta factura se debe llenar en ingles form

- Social security administration employment history report ab 1346 form

- Srs 22 patient questionnaire arch health partners archhealth form

- Gsa 1142 form

- Po box 19196 form

- Temperature conversion worksheet form

- Instructions for opm y adjustment form

- Az form 290 fillable

Find out other Informe Auditoria De Certificacin Bureau Veritas Monedas De Las Amricas Monedas De Amrica Del Norte 30

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation