Fillable Ptax 766 Form Application and Affidavit for Irc 2021

Understanding the Fillable Ptax 766 Form Application and Affidavit for IRC

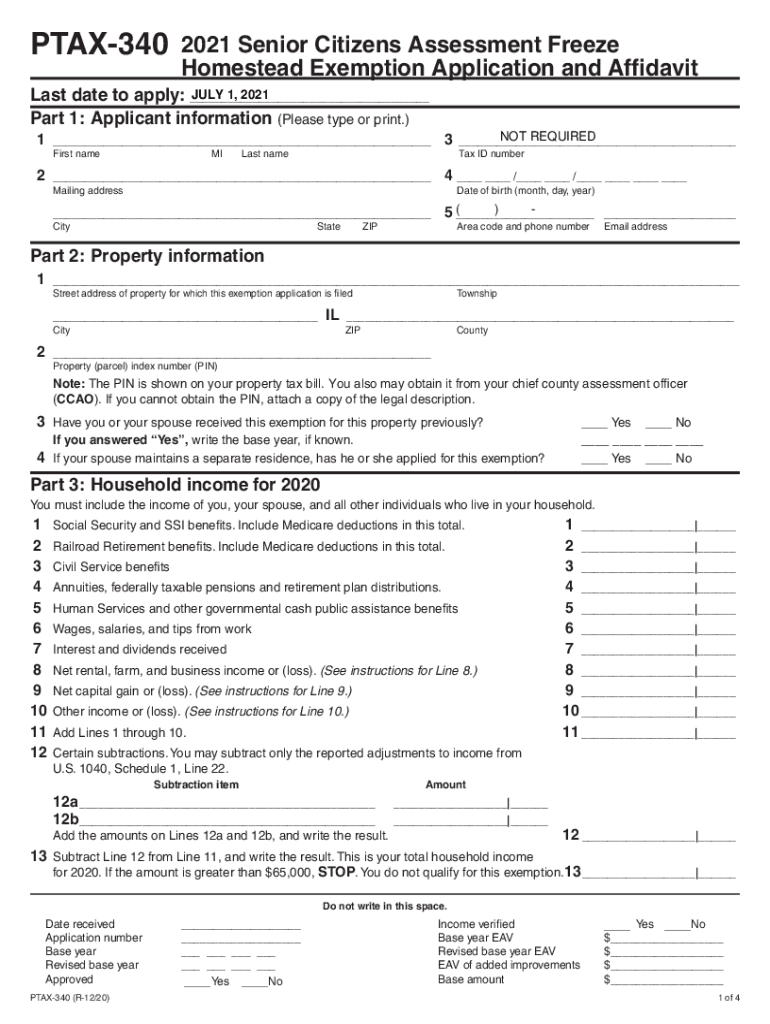

The Fillable Ptax 766 Form serves as an application and affidavit for the Illinois Property Tax Code. This form is essential for individuals seeking to claim specific property tax exemptions. It is designed to ensure that applicants provide accurate information regarding their property and eligibility for exemptions under the Illinois law. Understanding this form is crucial for homeowners in Illinois, particularly those in Woodford County, who wish to benefit from available tax relief programs.

Steps to Complete the Fillable Ptax 766 Form Application and Affidavit for IRC

Completing the Ptax 766 Form involves several key steps to ensure accuracy and compliance with state regulations. Here’s a structured approach:

- Gather necessary documentation, including proof of ownership and any supporting financial information.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form electronically, ensuring all fields are completed accurately.

- Review your entries for any errors or omissions before submission.

- Submit the completed form through the appropriate channels, either online or via mail.

Eligibility Criteria for the Fillable Ptax 766 Form Application and Affidavit for IRC

To qualify for the exemptions outlined in the Ptax 766 Form, applicants must meet specific eligibility criteria. Generally, these criteria include:

- Ownership of the property for which the exemption is being claimed.

- Residency in Illinois, with the property serving as the primary residence.

- Meeting income limits as specified by the Illinois Property Tax Code.

It is important for applicants to verify their eligibility before proceeding with the application to avoid delays or denials.

Required Documents for the Fillable Ptax 766 Form Application and Affidavit for IRC

When completing the Ptax 766 Form, applicants must provide several documents to substantiate their claims. Required documents typically include:

- Proof of property ownership, such as a deed or title.

- Identification documents, including a driver's license or state ID.

- Financial statements or tax returns to demonstrate income eligibility.

Having these documents ready can streamline the application process and enhance the likelihood of approval.

Form Submission Methods for the Fillable Ptax 766 Form Application and Affidavit for IRC

Applicants have several options for submitting the Ptax 766 Form. The methods include:

- Online submission through the designated state portal, which allows for immediate processing.

- Mailing the completed form to the appropriate local assessor's office.

- In-person submission at local government offices, which may provide additional assistance.

Choosing the right submission method can depend on personal preferences and the urgency of the application.

Legal Use of the Fillable Ptax 766 Form Application and Affidavit for IRC

The Ptax 766 Form is legally binding once completed and submitted according to the guidelines set forth by the Illinois Property Tax Code. It is crucial for applicants to understand that providing false information can lead to penalties, including fines or denial of the exemption. Therefore, ensuring accuracy and honesty in the application is essential for compliance with state laws.

Quick guide on how to complete fillable ptax 766 form application and affidavit for irc

Effortlessly Prepare Fillable Ptax 766 Form Application And Affidavit For Irc on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Fillable Ptax 766 Form Application And Affidavit For Irc on any platform using airSlate SignNow’s applications for Android or iOS and simplify any document-related tasks today.

How to Modify and eSign Fillable Ptax 766 Form Application And Affidavit For Irc with Ease

- Locate Fillable Ptax 766 Form Application And Affidavit For Irc and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Fillable Ptax 766 Form Application And Affidavit For Irc and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable ptax 766 form application and affidavit for irc

Create this form in 5 minutes!

How to create an eSignature for the fillable ptax 766 form application and affidavit for irc

The way to generate an eSignature for a PDF document in the online mode

The way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the homestead ze exemption in Woodford County, IL?

The homestead ze exemption in Woodford County, IL, is a property tax exemption designed to reduce the tax burden for eligible homeowners. This exemption specifically applies to primary residences, allowing residents to save money on their property taxes. Understanding the specifics of this exemption is essential for homeowners looking to optimize their tax benefits.

-

How can I apply for the homestead ze exemption in Woodford County, IL?

To apply for the homestead ze exemption in Woodford County, IL, homeowners must complete the necessary application forms and submit them to the local assessor's office. It is important to provide adequate documentation to prove eligibility, such as proof of residency. Following the specific guidelines helps ensure a smooth application process.

-

Are there income limits for the homestead ze exemption in Woodford County, IL?

Yes, there are income limits associated with the homestead ze exemption in Woodford County, IL. Homeowners must meet certain income criteria to qualify for the exemption, which helps to provide tax relief to low to moderate-income families. Checking your eligibility based on the latest guidelines ensures you do not miss out on potential savings.

-

What are the benefits of the homestead ze exemption in Woodford County, IL?

The primary benefit of the homestead ze exemption in Woodford County, IL, is the reduction in property taxes for qualifying homeowners. This exemption can lead to signNow savings, making homeownership more affordable. Additionally, it promotes local community development by encouraging residents to invest in their homes.

-

How does the homestead ze exemption affect my property taxes in Woodford County, IL?

The homestead ze exemption directly lowers the assessed value of your property, which leads to reduced property taxes in Woodford County, IL. By applying for this exemption, homeowners can enjoy lower tax bills and improve their financial situations. It's a smart way to enhance home affordability.

-

Can the homestead ze exemption be combined with other tax exemptions in Woodford County, IL?

Yes, the homestead ze exemption can often be combined with other tax exemptions available in Woodford County, IL. Homeowners should consult local tax guidelines to understand which exemptions apply to their situation. Combining exemptions can lead to even greater tax savings.

-

How often do I need to apply for the homestead ze exemption in Woodford County, IL?

Typically, once you are granted the homestead ze exemption in Woodford County, IL, you do not need to reapply every year. However, it's essential to notify the assessor's office of any changes in residency or ownership status. Periodic reviews may occur to ensure continued eligibility.

Get more for Fillable Ptax 766 Form Application And Affidavit For Irc

Find out other Fillable Ptax 766 Form Application And Affidavit For Irc

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now

- How Can I Sign Colorado Rental lease agreement forms

- Can I Sign Connecticut Rental lease agreement forms

- Sign Florida Rental lease agreement template Free

- Help Me With Sign Idaho Rental lease agreement template

- Sign Indiana Rental lease agreement forms Fast

- Help Me With Sign Kansas Rental lease agreement forms

- Can I Sign Oregon Rental lease agreement template

- Can I Sign Michigan Rental lease agreement forms

- Sign Alaska Rental property lease agreement Simple

- Help Me With Sign North Carolina Rental lease agreement forms