PTAX 340 Senior Citizens Assessment Ze Homestead Exemption Application and Affidavit 2020

What is the PTAX 340 Senior Citizens Assessment Ze Homestead Exemption Application and Affidavit

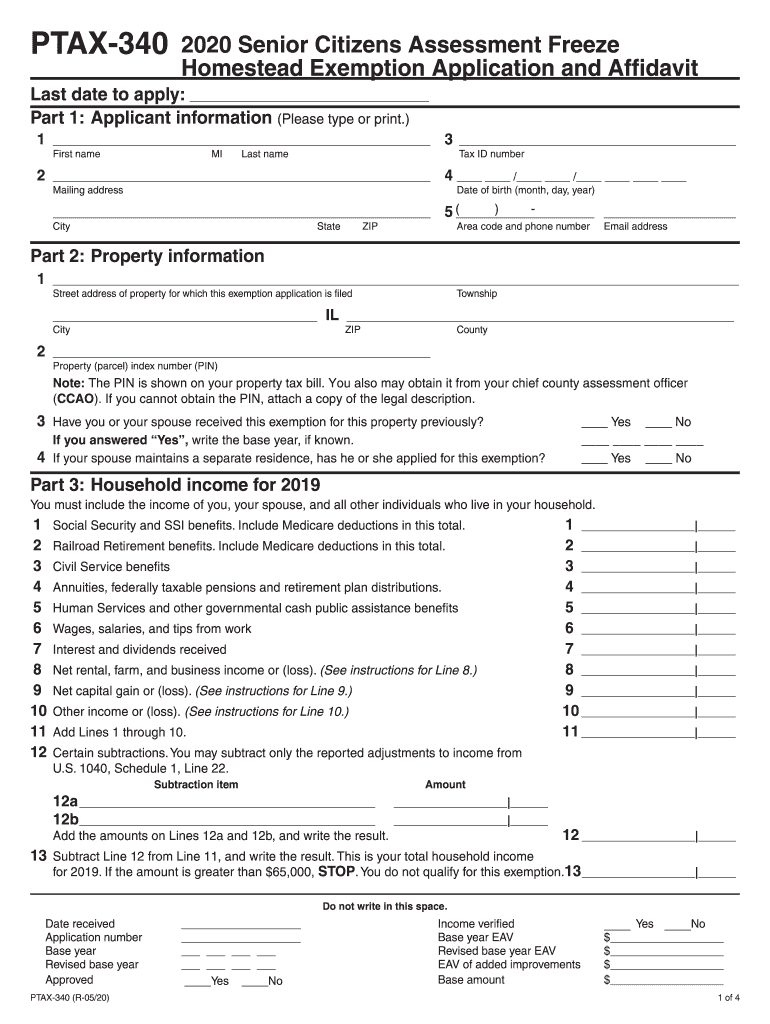

The PTAX 340 Senior Citizens Assessment Ze Homestead Exemption Application and Affidavit is a crucial document for eligible seniors in Illinois. This form allows qualifying individuals to apply for a property tax exemption that can significantly reduce their real estate tax burden. The exemption is designed to assist senior citizens by lowering the assessed value of their property, thereby decreasing the amount of property tax owed. Understanding the purpose and benefits of this application is essential for seniors seeking financial relief on their property taxes.

Steps to Complete the PTAX 340 Senior Citizens Assessment Ze Homestead Exemption Application and Affidavit

Completing the PTAX 340 application involves several important steps to ensure accuracy and compliance. First, gather necessary documentation, including proof of age, residency, and income. Next, fill out the application form, ensuring all sections are completed accurately. It is vital to review the form for any errors before submission. After completing the application, submit it to the appropriate local assessor's office by the designated deadline. Keeping a copy of the submitted form for your records is also advisable.

Eligibility Criteria for the PTAX 340 Senior Citizens Assessment Ze Homestead Exemption Application and Affidavit

To qualify for the PTAX 340 exemption, applicants must meet specific eligibility criteria. Generally, applicants must be at least sixty-five years old and must occupy the property as their principal residence. Additionally, the applicant's total household income must fall below a certain threshold set by the state. It is essential to review these criteria carefully to determine eligibility before completing the application.

Required Documents for the PTAX 340 Senior Citizens Assessment Ze Homestead Exemption Application and Affidavit

When applying for the PTAX 340 exemption, several documents are required to support the application. These typically include a government-issued photo ID to verify age, proof of residency such as a utility bill or lease agreement, and income documentation like tax returns or pay stubs. Gathering these documents in advance can streamline the application process and help ensure that all necessary information is provided.

Form Submission Methods for the PTAX 340 Senior Citizens Assessment Ze Homestead Exemption Application and Affidavit

The PTAX 340 application can be submitted through various methods to accommodate different preferences. Applicants may choose to submit the form by mail, ensuring it is sent to the correct local assessor's office. Alternatively, some counties may allow for in-person submissions at designated offices. It is important to verify the submission methods accepted in your specific county to ensure compliance with local regulations.

Key Elements of the PTAX 340 Senior Citizens Assessment Ze Homestead Exemption Application and Affidavit

The PTAX 340 application includes several key elements that applicants must be aware of. These elements typically consist of personal information, property details, and income verification sections. Additionally, the affidavit portion requires the applicant to affirm the truthfulness of the information provided. Understanding these components is vital for ensuring that the application is completed correctly and that all required information is included.

Quick guide on how to complete ptax 340 2020 senior citizens assessment freeze homestead exemption application and affidavit

Effortlessly complete PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit on any device

The management of online documents has gained popularity among businesses and individuals. It offers a fantastic eco-friendly substitute to conventional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to quickly create, modify, and eSign your documents without delays. Handle PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit on any platform with the airSlate SignNow applications for Android or iOS and enhance any document-centric operation today.

How to modify and eSign PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit with ease

- Obtain PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit and click Get Form to begin.

- Use the tools we provide to finalize your document.

- Emphasize relevant sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to secure your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Modify and eSign PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit and ensure superb communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ptax 340 2020 senior citizens assessment freeze homestead exemption application and affidavit

Create this form in 5 minutes!

How to create an eSignature for the ptax 340 2020 senior citizens assessment freeze homestead exemption application and affidavit

How to create an eSignature for your PDF in the online mode

How to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the homestead ze exemption in Woodford County, IL?

The homestead ze exemption in Woodford County, IL, is a property tax exemption designed to reduce the taxable value of residential properties. This exemption is available to homeowners who meet specific income requirements, making their property taxes more affordable. Understanding this exemption can help you save money on your property taxes each year.

-

How can I apply for the homestead ze exemption in Woodford County, IL?

To apply for the homestead ze exemption in Woodford County, IL, you need to complete an application form provided by the county assessor's office. Ensure you meet the eligibility requirements, including income limits, before submitting your application. It is crucial to file your application by the designated deadlines to maximize your savings.

-

What are the benefits of the homestead ze exemption in Woodford County, IL?

The primary benefit of the homestead ze exemption in Woodford County, IL, is the reduction in your property's assessed value, which in turn lowers your property tax bill. This exemption can result in signNow savings over time, allowing you to allocate funds to other essential areas. Additionally, it supports affordable housing in the community.

-

Are there any income limits for the homestead ze exemption in Woodford County, IL?

Yes, the homestead ze exemption in Woodford County, IL, has specific income limits that applicants must adhere to. These limits are set to ensure that assistance is provided to those who need it most. Homeowners are encouraged to check the latest guidelines from the county assessor to verify the income requirements.

-

Can I receive the homestead ze exemption in Woodford County, IL, if I own multiple properties?

In general, the homestead ze exemption in Woodford County, IL, applies to your primary residence. If you own multiple properties, you will only be eligible for the exemption on your primary home. Be sure to report your property ownership status accurately to the county assessor to avoid complications.

-

How does the homestead ze exemption affect my property tax payments in Woodford County, IL?

The homestead ze exemption directly impacts your property tax payments in Woodford County, IL, by lowering the taxable value of your primary residence. As a result, you will pay a reduced property tax amount, which can provide signNow financial relief. Homeowners should review their tax bills to see the difference the exemption makes each year.

-

Is there a renewal process for the homestead ze exemption in Woodford County, IL?

Yes, the homestead ze exemption in Woodford County, IL, may require renewal every year, depending on your circumstances. It's essential to stay informed about any changes in the eligibility criteria or application process. Homeowners should check with the county assessor's office to ensure they remain compliant and continue to receive their exemption.

Get more for PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit

- Declaration mailing file form

- Guardian washington form

- Order approving guardian washington form

- Wa initial form

- Approving plan form

- Periodic personal care form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497430024 form

- Washington annual 497430025 form

Find out other PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement