PTAX 340 Senior Citizens Assessment Ze Homestead Exemption Application and Affidavit 2022

What is the PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application and Affidavit

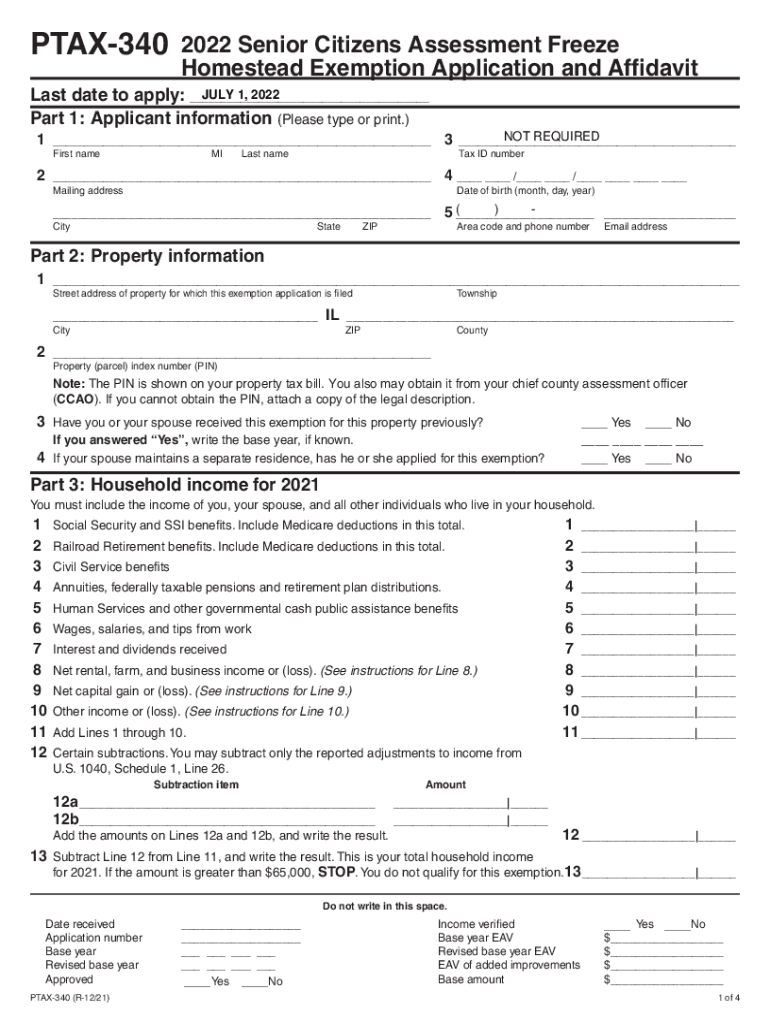

The PTAX 340 is an official form used in Illinois for the Senior Citizens Assessment Homestead Exemption. This exemption is designed to provide property tax relief to senior citizens who meet specific eligibility criteria. The application and affidavit serve as a declaration of the applicant's age, residency, and ownership of the property for which the exemption is being claimed. By completing this form, eligible seniors can reduce their property tax burden, making homeownership more affordable during retirement.

Steps to Complete the PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application and Affidavit

Completing the PTAX 340 form involves several straightforward steps:

- Gather necessary information, including proof of age, residency, and property ownership.

- Fill out the application form, ensuring all sections are completed accurately.

- Sign the affidavit, confirming the truthfulness of the information provided.

- Submit the completed form to your local assessor's office by the specified deadline.

It is important to review the form for accuracy before submission to avoid delays in processing.

Eligibility Criteria for the PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application and Affidavit

To qualify for the PTAX 340 exemption, applicants must meet certain criteria:

- Be at least sixty-five years old by the assessment date.

- Own and occupy the property as their principal residence.

- Meet income limits set by the state for the year of application.

These criteria ensure that the exemption is targeted towards seniors who may be facing financial challenges in maintaining their homes.

Required Documents for the PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application and Affidavit

When applying for the PTAX 340 exemption, several documents may be required to support your application:

- Proof of age, such as a driver's license or birth certificate.

- Documentation proving residency, like a utility bill or lease agreement.

- Income verification, which may include tax returns or Social Security statements.

Having these documents ready can streamline the application process and help ensure a successful claim.

Form Submission Methods for the PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application and Affidavit

The PTAX 340 form can be submitted through various methods to accommodate different preferences:

- Online submission via the local assessor's office website, if available.

- Mailing the completed form to the appropriate local office.

- In-person delivery to the local assessor's office during business hours.

Choosing the method that works best for you can help ensure timely processing of your application.

Legal Use of the PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application and Affidavit

The PTAX 340 form is legally binding and must be completed truthfully. Providing false information on the application can result in penalties, including the denial of the exemption or legal action. It is essential to understand that the affidavit serves as a sworn statement, reinforcing the importance of accuracy in the information provided. Compliance with state laws regarding property tax exemptions is crucial for maintaining eligibility.

Quick guide on how to complete ptax 340 2022 senior citizens assessment freeze homestead exemption application and affidavit

Effortlessly prepare PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to access the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and eSign your documents swiftly without interruptions. Manage PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to adjust and eSign PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit effortlessly

- Find PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight key sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Adjust and eSign PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ptax 340 2022 senior citizens assessment freeze homestead exemption application and affidavit

Create this form in 5 minutes!

How to create an eSignature for the ptax 340 2022 senior citizens assessment freeze homestead exemption application and affidavit

The way to generate an electronic signature for a PDF document online

The way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

The best way to make an e-signature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What is ptax 340 and how does it relate to airSlate SignNow?

Ptax 340 refers to a specific tax form that can be handled efficiently using airSlate SignNow. Our platform allows users to create, send, and eSign the ptax 340 document seamlessly, ensuring compliance and accuracy.

-

What features does airSlate SignNow offer for handling ptax 340?

airSlate SignNow provides various features including document templates, automatic reminders, and secure eSigning, which simplify managing ptax 340 forms. These features help ensure that your documents are completed promptly and securely.

-

Is airSlate SignNow cost-effective for businesses dealing with ptax 340?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, making it a cost-effective solution for handling ptax 340 forms. The ability to streamline document processes can save time and money in the long run.

-

Can I integrate airSlate SignNow with other tools for managing ptax 340?

Absolutely! airSlate SignNow integrates seamlessly with various tools, allowing for enhanced workflow when managing ptax 340 and other documents. Popular integrations include CRM systems, cloud storage services, and other business applications.

-

What are the benefits of using airSlate SignNow for ptax 340 documents?

Using airSlate SignNow for ptax 340 documents enhances efficiency, reduces paper usage, and ensures compliance. The platform's user-friendly interface allows for quick eSigning, signNowly speeding up document processing.

-

How secure is the eSigning process for ptax 340 with airSlate SignNow?

Security is a top priority for airSlate SignNow. The eSigning process for ptax 340 documents is protected by advanced encryption and authentication methods, ensuring that your sensitive information remains confidential and secure.

-

Can I customize the ptax 340 templates in airSlate SignNow?

Yes, airSlate SignNow allows users to create and customize templates for ptax 340 and other forms. This feature enables businesses to tailor the documents to their specific needs, enhancing efficiency during the signing process.

Get more for PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit

- Parent name change form

- Affidavit in support of order for publication and order in minor name change minnesota minnesota form

- Affidavit of personal service minnesota 497312779 form

- Mn name change form

- Order granting name change form

- Minnesota unsecured installment payment promissory note for fixed rate minnesota form

- Minnesota installments fixed rate promissory note secured by residential real estate minnesota form

- Minnesota installments fixed rate promissory note secured by personal property minnesota form

Find out other PTAX 340 Senior Citizens Assessment ze Homestead Exemption Application And Affidavit

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document