Form 3372 Michigan Sales and Use Tax Certificate of 2021-2026

What is the Michigan Sales and Use Tax Certificate of Exemption Form 3372?

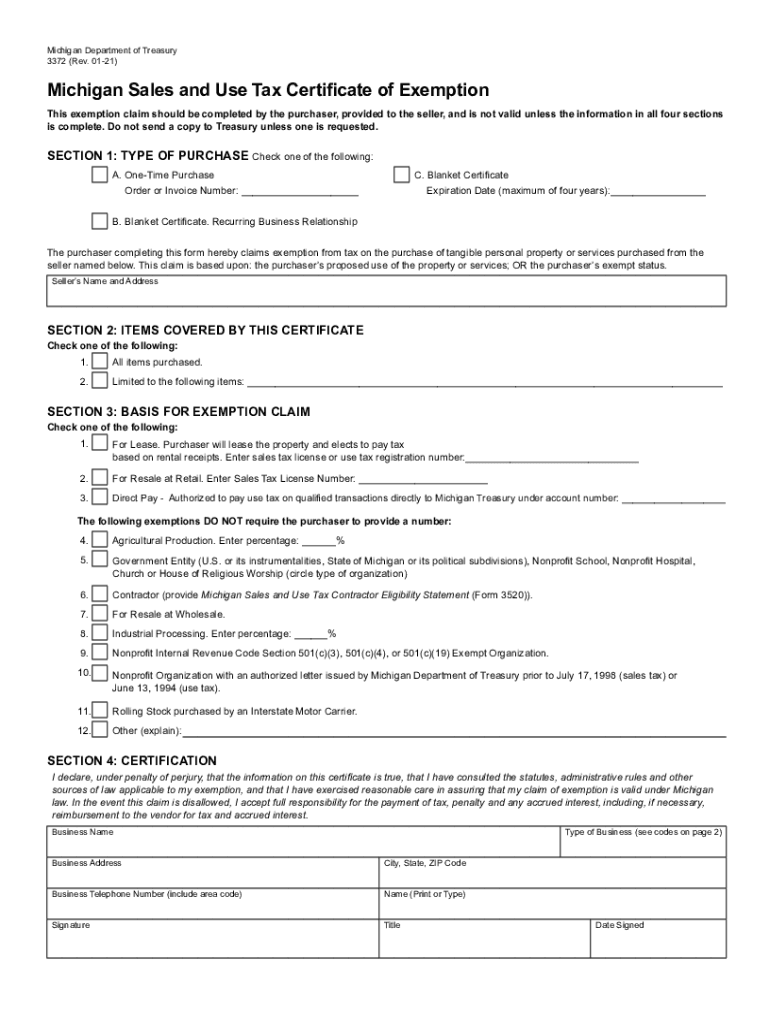

The Michigan Sales and Use Tax Certificate of Exemption Form 3372 is a crucial document for businesses in Michigan that allows them to make tax-exempt purchases. This form is primarily used by organizations that qualify for sales tax exemptions under specific categories defined by the Michigan Department of Treasury. The certificate serves as proof that the purchaser is exempt from paying sales tax on certain transactions, which can include items for resale or goods purchased for specific exempt purposes.

How to Use the Michigan Sales and Use Tax Certificate of Exemption Form 3372

Using the Michigan tax exempt form 3372 involves several straightforward steps. First, ensure that you qualify for tax exemption based on your organization’s status. Once confirmed, complete the form by providing accurate information about your business, including your name, address, and tax identification number. Present the completed form to the seller at the time of purchase to avoid being charged sales tax. It is essential to keep a copy of the submitted form for your records, as it may be required for future reference or audits.

Steps to Complete the Michigan Sales and Use Tax Certificate of Exemption Form 3372

Completing the Michigan tax exempt form 3372 requires careful attention to detail. Follow these steps for accurate completion:

- Gather necessary information, including your business name, address, and tax identification number.

- Indicate the type of exemption you are claiming, such as resale or specific exempt purposes.

- Sign and date the form to validate it.

- Provide the completed form to the seller when making a tax-exempt purchase.

Legal Use of the Michigan Sales and Use Tax Certificate of Exemption Form 3372

The legal use of the Michigan tax exempt form 3372 is governed by state tax laws. This form must be used only for legitimate tax-exempt purchases. Misuse of the form, such as using it for personal purchases or for items not qualifying for exemption, can lead to penalties and fines. It is essential to understand the specific categories of exemption and ensure that your purchases align with these regulations to maintain compliance with Michigan tax laws.

Eligibility Criteria for Using the Michigan Sales and Use Tax Certificate of Exemption Form 3372

To be eligible to use the Michigan tax exempt form 3372, your organization must meet specific criteria set by the Michigan Department of Treasury. Generally, eligible entities include non-profit organizations, government agencies, and businesses purchasing items for resale. It is important to verify your organization’s status and ensure that you have the necessary documentation to support your exemption claim when completing the form.

Form Submission Methods for the Michigan Sales and Use Tax Certificate of Exemption Form 3372

The Michigan tax exempt form 3372 can be submitted in various ways depending on the seller's policies. Typically, the form is presented directly to the seller at the time of purchase. Some businesses may allow electronic submissions, while others may require a physical copy. Always check with the seller regarding their preferred method of receiving the exemption certificate to ensure compliance and avoid any issues during the transaction.

Quick guide on how to complete form 3372 michigan sales and use tax certificate of

Prepare Form 3372 Michigan Sales And Use Tax Certificate Of easily on any gadget

Electronic document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without interruptions. Manage Form 3372 Michigan Sales And Use Tax Certificate Of on any gadget using airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Form 3372 Michigan Sales And Use Tax Certificate Of with minimal effort

- Locate Form 3372 Michigan Sales And Use Tax Certificate Of and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of your documents or redact sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 3372 Michigan Sales And Use Tax Certificate Of and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3372 michigan sales and use tax certificate of

Create this form in 5 minutes!

How to create an eSignature for the form 3372 michigan sales and use tax certificate of

The way to make an electronic signature for a PDF document in the online mode

The way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the Michigan tax exempt form 3372?

The Michigan tax exempt form 3372 is a document used by eligible organizations to claim exemption from sales and use tax in the state of Michigan. By filling out this form accurately, businesses can facilitate tax-exempt purchases, helping to manage their finances effectively.

-

How can airSlate SignNow assist in completing the Michigan tax exempt form 3372?

airSlate SignNow provides an easy-to-use platform to fill out and eSign the Michigan tax exempt form 3372 digitally. This streamlines the process and ensures that all necessary fields are completed accurately, reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Michigan tax exempt form 3372?

airSlate SignNow offers cost-effective pricing plans that cater to different business needs. Users can efficiently handle the Michigan tax exempt form 3372 alongside numerous other documents without incurring heavy costs.

-

What features does airSlate SignNow offer to enhance the filing of Michigan tax exempt form 3372?

airSlate SignNow offers features like customizable templates, automated alerts, and secure cloud storage. These tools enhance the experience of preparing the Michigan tax exempt form 3372, providing users with efficiency and reliability.

-

Can airSlate SignNow integrate with accounting software for tax purposes, including the Michigan tax exempt form 3372?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions. This integration simplifies the submission process for the Michigan tax exempt form 3372 and ensures that all relevant data is synchronized and up to date.

-

What are the benefits of using airSlate SignNow for the Michigan tax exempt form 3372?

Using airSlate SignNow for the Michigan tax exempt form 3372 provides benefits such as increased efficiency, reduced paperwork, and enhanced security. It allows users to manage their tax-exempt transactions effortlessly and stay compliant with state regulations.

-

How long does it take to complete the Michigan tax exempt form 3372 using airSlate SignNow?

With airSlate SignNow, completing the Michigan tax exempt form 3372 can be done in just a few minutes. The intuitive interface and easy access to eSigning features speed up the process signNowly.

Get more for Form 3372 Michigan Sales And Use Tax Certificate Of

Find out other Form 3372 Michigan Sales And Use Tax Certificate Of

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free