Form 13844 Rev 2 Application for Reduced User Fee for Installment Agreements

What is the Form 13844 Application for Reduced User Fee for Installment Agreements

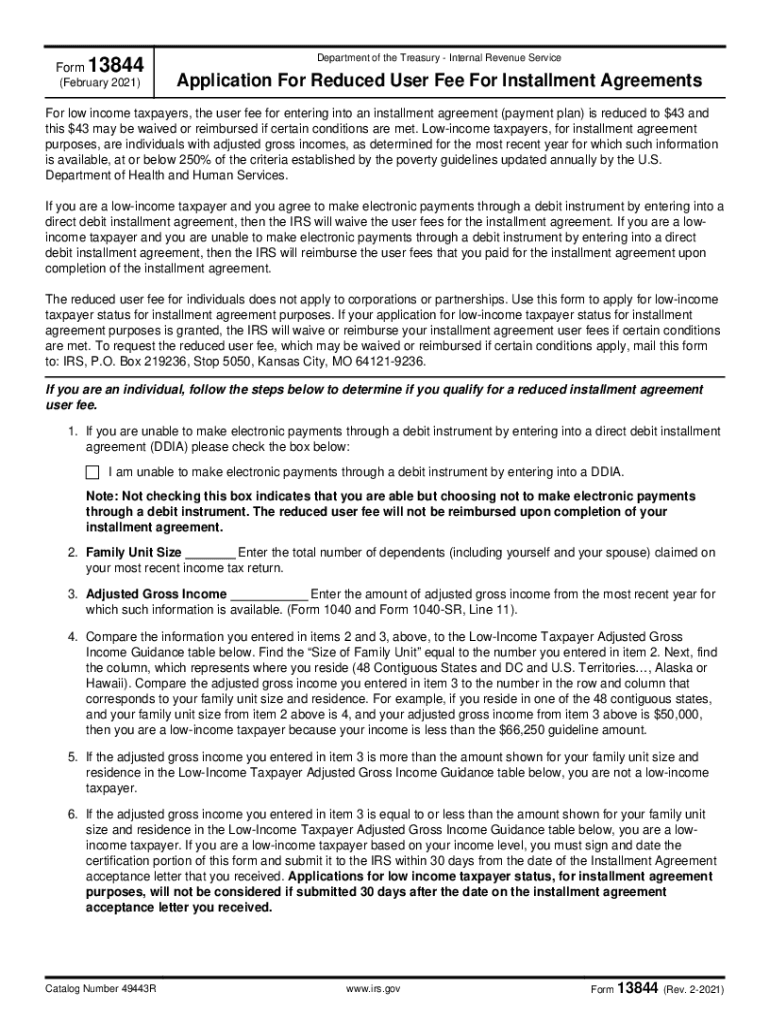

The Form 13844, officially known as the Application for Reduced User Fee for Installment Agreements, is a document provided by the IRS. It allows eligible taxpayers to request a reduction in the user fee associated with setting up an installment agreement for tax liabilities. This form is particularly beneficial for individuals who may be experiencing financial hardship and need assistance in managing their tax payments over time.

Eligibility Criteria for the Form 13844

To qualify for a reduced user fee when filing Form 13844, taxpayers must meet specific criteria set by the IRS. Generally, individuals with an adjusted gross income that falls below a certain threshold may be eligible. Additionally, the taxpayer must be applying for a standard installment agreement, not a streamlined or other specialized agreement. It is essential to review the latest IRS guidelines to ensure compliance with the eligibility requirements.

Steps to Complete the Form 13844

Completing the Form 13844 involves several straightforward steps:

- Gather necessary financial information, including income and expenses.

- Download the latest version of Form 13844 from the IRS website.

- Fill out the form accurately, providing all required personal and financial details.

- Review the form for completeness and accuracy before submission.

- Submit the completed form to the IRS, following the specified submission methods.

How to Obtain the Form 13844

The Form 13844 can be obtained directly from the IRS website. Taxpayers can download the form in PDF format, ensuring they have the most recent version. It is crucial to use the correct form to avoid delays in processing. Additionally, printed copies may be available at local IRS offices or through tax professionals who provide assistance with tax filings.

Legal Use of the Form 13844

The legal use of Form 13844 is governed by IRS regulations. When completed and submitted correctly, the form serves as a formal request for a reduced user fee, which can significantly lower the cost of setting up an installment agreement. It is important for taxpayers to ensure that all information provided is truthful and accurate, as any discrepancies could lead to penalties or denial of the request.

Form Submission Methods

Taxpayers have several options for submitting Form 13844. The form can be sent via mail to the appropriate IRS address, which is specified in the form instructions. Additionally, taxpayers may have the option to submit the form electronically through the IRS online portal, depending on the current IRS policies. It is advisable to check the latest submission guidelines to choose the most efficient method.

Quick guide on how to complete form 13844 rev 2 2021 application for reduced user fee for installment agreements

Complete Form 13844 Rev 2 Application For Reduced User Fee For Installment Agreements effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, enabling you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage Form 13844 Rev 2 Application For Reduced User Fee For Installment Agreements on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Form 13844 Rev 2 Application For Reduced User Fee For Installment Agreements with ease

- Find Form 13844 Rev 2 Application For Reduced User Fee For Installment Agreements and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with specialized tools that airSlate SignNow offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Form 13844 Rev 2 Application For Reduced User Fee For Installment Agreements to ensure clear communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 13844 rev 2 2021 application for reduced user fee for installment agreements

The best way to generate an electronic signature for a PDF document in the online mode

The best way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is an IRS application installment?

An IRS application installment is a payment plan that allows taxpayers to pay off their tax liabilities in manageable monthly installments. This option is beneficial for those who cannot pay the full amount owed to the IRS immediately. Utilizing an IRS application installment can help individuals avoid penalties and maintain financial stability.

-

How can airSlate SignNow assist with the IRS application installment process?

airSlate SignNow simplifies the documentation required for the IRS application installment process by allowing users to send and eSign necessary forms quickly and securely. With our platform, you can manage and track your documents, ensuring your IRS application installment is submitted accurately and on time. This efficiency helps reduce stress during tax season.

-

Are there any fees associated with setting up an IRS application installment?

While the IRS may charge fees for setting up an installment agreement, airSlate SignNow does not charge any additional fees for facilitating the eSigning of your IRS application installment documents. Our goal is to provide a cost-effective solution that streamlines the process while remaining affordable for your business or individual needs.

-

What documents do I need to prepare for the IRS application installment?

To apply for an IRS application installment, you typically need to provide your income details, tax returns, and any relevant financial information. airSlate SignNow ensures that all necessary documents are organized and securely signed, allowing you to focus on filling in the correct information. This guidance makes your installation application process much more efficient.

-

Can airSlate SignNow integrate with other tax preparation software for my IRS application installment?

Yes, airSlate SignNow offers seamless integrations with various tax preparation and accounting software, making the management of your IRS application installment easier. You can easily import documents and share information across platforms to streamline your tax filings. This integration helps ensure all data required for your application is efficiently handled.

-

What are the benefits of using airSlate SignNow for my IRS application installment?

Using airSlate SignNow for your IRS application installment offers numerous benefits, including ease of document management, secure eSigning, and expedited processing. Our user-friendly platform ensures your forms are completed accurately and stored securely. Additionally, the time saved can be redirected towards other crucial business activities.

-

How does airSlate SignNow ensure the security of my IRS application installment documents?

airSlate SignNow prioritizes the security of your IRS application installment documents by implementing robust encryption and compliance standards. We ensure that all data transmitted and stored is protected against unauthorized access. You can rest assured that your sensitive information is safe while you navigate your payment plan.

Get more for Form 13844 Rev 2 Application For Reduced User Fee For Installment Agreements

Find out other Form 13844 Rev 2 Application For Reduced User Fee For Installment Agreements

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors