Irs Form 13844

What is the IRS Form 13844

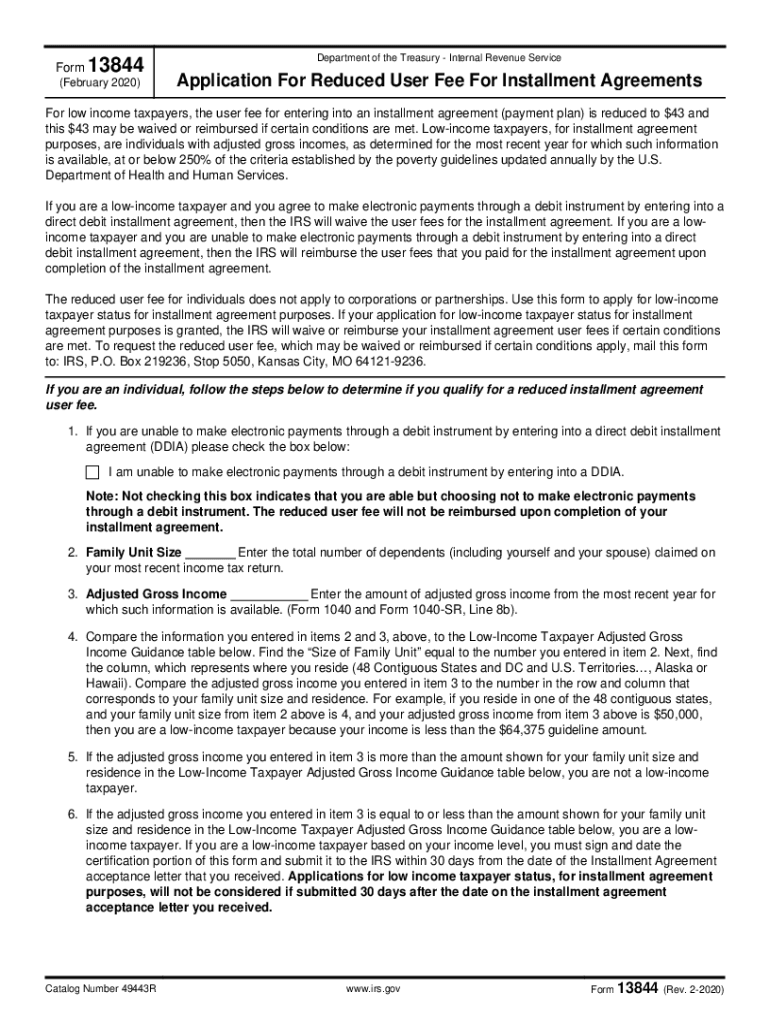

The IRS Form 13844, also known as the Application for Reduced User Fee for Installment Agreements, is a document used by taxpayers to request a reduction in the user fee associated with setting up an installment agreement with the IRS. This form is particularly relevant for individuals who may face financial hardship and are seeking to pay their tax liabilities over time without incurring excessive fees. Understanding this form is essential for taxpayers who wish to manage their tax obligations more effectively.

How to use the IRS Form 13844

Using the IRS Form 13844 involves several key steps. First, taxpayers must determine their eligibility for a reduced user fee based on their financial situation. Once eligibility is confirmed, the form needs to be filled out accurately, providing necessary personal and financial information. After completing the form, it should be submitted alongside the application for an installment agreement. This process ensures that the IRS can review the request for a fee reduction in conjunction with the installment agreement application.

Steps to complete the IRS Form 13844

Completing the IRS Form 13844 requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial documents, including income statements and expense reports.

- Fill out the form with accurate personal information, including your name, address, and Social Security number.

- Provide details regarding your financial situation, including monthly income and expenses.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS along with your installment agreement application.

Eligibility Criteria

To qualify for a reduced user fee when filing the IRS Form 13844, taxpayers must demonstrate financial hardship. This typically means that the taxpayer's income is below a certain threshold or that they are facing significant financial challenges. The IRS provides guidelines to help determine eligibility, and it is important for applicants to review these criteria carefully before submitting the form.

Form Submission Methods

The IRS Form 13844 can be submitted through various methods, depending on the taxpayer's preference and situation. Taxpayers can choose to file the form electronically if they are applying for an installment agreement online. Alternatively, the form can be printed, completed, and mailed to the IRS. It is essential to follow the specific submission instructions provided by the IRS to ensure timely processing of the request.

Required Documents

When submitting the IRS Form 13844, certain documents may be required to support the application. These documents typically include proof of income, such as pay stubs or tax returns, as well as documentation of monthly expenses. Providing comprehensive and accurate documentation helps the IRS assess the request for a reduced user fee more effectively.

Quick guide on how to complete irs form 13844

Effortlessly Prepare Irs Form 13844 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Irs Form 13844 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

Easily Edit and eSign Irs Form 13844

- Locate Irs Form 13844 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Irs Form 13844 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 13844

The best way to make an eSignature for a PDF file online

The best way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

How to generate an eSignature for a PDF document on Android devices

People also ask

-

What is form 13844 and how can airSlate SignNow help?

Form 13844 is a crucial document required for specific tax purposes. With airSlate SignNow, you can easily prepare, send, and eSign form 13844, ensuring a streamlined process that saves you time and reduces errors.

-

Is there a cost associated with using airSlate SignNow for form 13844?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including options for handling form 13844. Depending on the features you require, you can select a plan that fits your budget while ensuring efficient document management.

-

Can I customize form 13844 using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize form 13844 by adding your branding, fields, and other elements necessary to meet your business needs. This feature enhances both compliance and recognition for your documents.

-

What are the benefits of using airSlate SignNow for form 13844?

Using airSlate SignNow for form 13844 offers numerous benefits such as enhanced security, a user-friendly interface, and reduced processing time. Additionally, it simplifies tracking your documents and obtaining necessary signatures, ensuring compliance and efficiency.

-

Does airSlate SignNow integrate with other tools for processing form 13844?

Yes, airSlate SignNow seamlessly integrates with various CRM and productivity tools, making the handling of form 13844 even more efficient. This connectivity allows you to automate workflows and keep all relevant information in sync.

-

How secure is the eSigning process for form 13844 on airSlate SignNow?

The eSigning process for form 13844 on airSlate SignNow is highly secure, utilizing advanced encryption and authentication methods. This ensures that your sensitive information is protected, giving you peace of mind while handling important documents.

-

Can multiple users collaborate on form 13844 using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on form 13844 efficiently. This feature enables teams to work together in real-time, making it easier to gather input and finalize documents without delays.

Get more for Irs Form 13844

Find out other Irs Form 13844

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document