Tca 34 6 101 Form

What is the TCA 34 6 101?

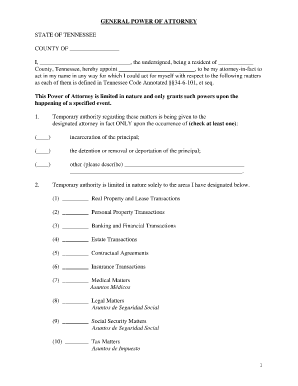

The TCA 34 6 101 form is a specific document used in the state of Tennessee, primarily for tax purposes. It serves as a declaration for certain tax-related activities, ensuring compliance with state regulations. This form is essential for individuals and businesses to report their financial information accurately to the Tennessee Department of Revenue. Understanding the purpose of the TCA 34 6 101 is crucial for anyone engaging in activities that require tax reporting within the state.

Steps to Complete the TCA 34 6 101

Completing the TCA 34 6 101 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documentation, including income statements and expense records. Next, fill out the form with precise information, ensuring that all fields are completed accurately. It is important to double-check your entries for any errors before submission. Finally, submit the form through the appropriate channels, whether electronically or via mail, depending on the guidelines provided by the Tennessee Department of Revenue.

How to Obtain the TCA 34 6 101

The TCA 34 6 101 form can be obtained directly from the Tennessee Department of Revenue's official website. It is available for download in a printable format, making it accessible for individuals and businesses alike. Additionally, local tax offices may provide physical copies of the form. Ensure that you have the most current version to avoid any compliance issues.

Legal Use of the TCA 34 6 101

The legal use of the TCA 34 6 101 form is governed by state tax laws. Proper completion and submission of this form are essential for maintaining compliance with Tennessee tax regulations. Failure to use the form correctly can result in penalties or legal repercussions. It is advisable to consult with a tax professional if there are any uncertainties regarding the form's legal implications.

Required Documents for the TCA 34 6 101

When preparing to complete the TCA 34 6 101 form, certain documents are required to provide accurate information. These may include:

- Income statements, such as W-2s or 1099s

- Expense reports and receipts

- Previous year’s tax returns for reference

- Any relevant financial statements

Having these documents on hand will facilitate a smoother completion process and help ensure that all reported information is accurate.

Form Submission Methods

The TCA 34 6 101 form can be submitted through various methods, depending on the preferences of the filer. Options typically include:

- Online submission via the Tennessee Department of Revenue's electronic filing system

- Mailing a physical copy of the completed form to the designated address

- In-person submission at local tax offices

Each method has its own guidelines and deadlines, so it is important to choose the one that best fits your needs while ensuring timely compliance.

Quick guide on how to complete tca 34 6 101

Prepare Tca 34 6 101 easily on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-conscious alternative to conventional printed and signed documents, as you can obtain the right form and securely preserve it online. airSlate SignNow provides all the resources you require to create, alter, and eSign your documents promptly without delays. Handle Tca 34 6 101 on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Tca 34 6 101 effortlessly

- Find Tca 34 6 101 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or mislaid documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Tca 34 6 101 and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tca 34 6 101

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tn code annotated 34 6 108 c 9?

The tn code annotated 34 6 108 c 9 refers to specific sections of Tennessee statutes relevant to electronic signatures. Understanding this code is critical for businesses leveraging electronic signing solutions like airSlate SignNow to ensure compliance with local regulations.

-

How does airSlate SignNow comply with the tn code annotated 34 6 108 c 9?

airSlate SignNow ensures compliance with the tn code annotated 34 6 108 c 9 by incorporating secure procedures for the electronic signing and management of documents. This feature upholds the legality and enforceability of electronic signatures according to Tennessee law.

-

What features does airSlate SignNow offer to support the tn code annotated 34 6 108 c 9?

airSlate SignNow provides features such as secure document storage, advanced authentication methods, and an audit trail that aligns with the requirements outlined in the tn code annotated 34 6 108 c 9. These features ensure that all electronic signatures are recognized and compliant with Tennessee regulations.

-

Is airSlate SignNow a cost-effective solution for businesses needing tn code annotated 34 6 108 c 9 compliance?

Yes, airSlate SignNow is a cost-effective solution for businesses seeking compliance with the tn code annotated 34 6 108 c 9. By offering affordable pricing plans, businesses can easily implement compliant electronic signing practices without overspending.

-

What integrations does airSlate SignNow offer that relate to tn code annotated 34 6 108 c 9?

airSlate SignNow integrates with a variety of platforms, including CRM systems and document management tools, which can enhance compliance with the tn code annotated 34 6 108 c 9. These integrations streamline workflows, making it easier to manage eSigning processes while adhering to local laws.

-

How can airSlate SignNow benefit my business in relation to the tn code annotated 34 6 108 c 9?

Using airSlate SignNow can benefit your business by simplifying the eSigning process and ensuring compliance with the tn code annotated 34 6 108 c 9. This not only improves efficiency but also provides peace of mind regarding legal requirements associated with electronic documents.

-

What types of documents can be signed using airSlate SignNow under tn code annotated 34 6 108 c 9?

With airSlate SignNow, a wide range of documents can be signed electronically, including contracts, agreements, and forms, all compliant with the tn code annotated 34 6 108 c 9. This versatility allows businesses to utilize electronic signatures for various operational needs.

Get more for Tca 34 6 101

- 69com 2010 form

- Utah claim for refund of fees or sales tax for motor vehicles tc 55a form

- Utah tc 65 2016 form

- Virginia tax form 760 year 2010

- Form 720 vi virgin islands bureau of internal revenue

- Form 501 vi 2003

- Tax help line 1 k 1vt 2010 form

- Schedule in 113 income adjustment vermont department of taxes form

Find out other Tca 34 6 101

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online