Fin 405 Form

What is the Fin 405?

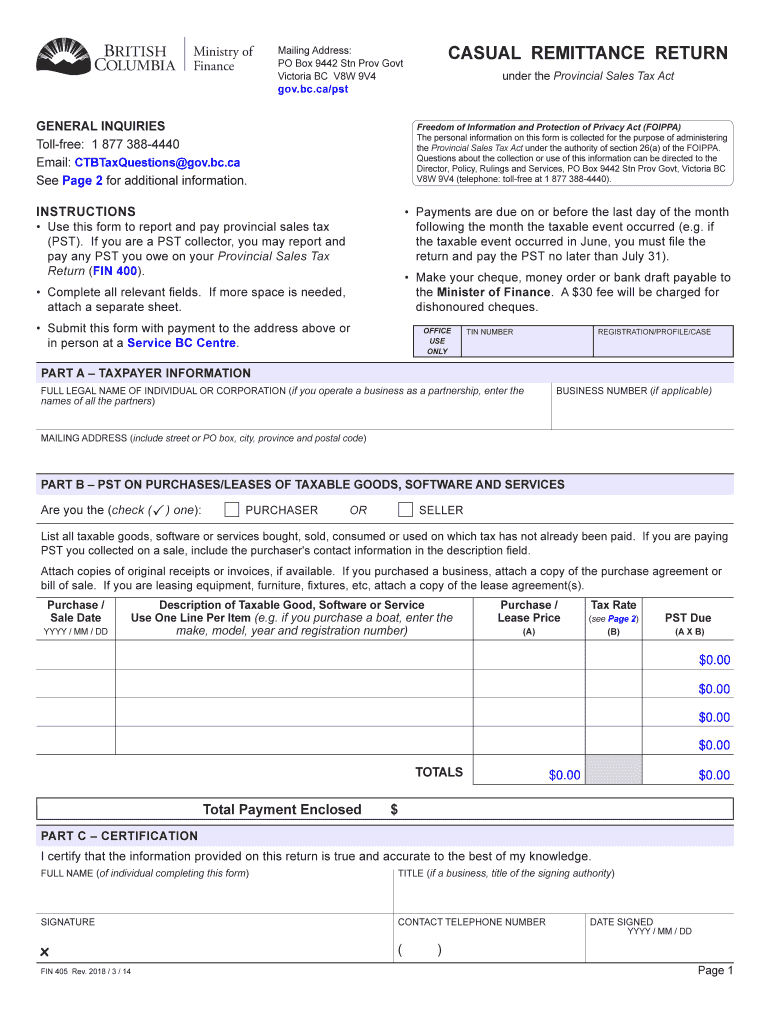

The Fin 405, also known as the casual remittance form, is a document used primarily in British Columbia for reporting and remitting provincial sales tax (PST) on casual sales. This form is essential for individuals and businesses that make occasional sales of taxable goods and services. By completing the Fin 405, sellers can ensure compliance with provincial tax regulations while accurately reporting their sales activities.

Steps to Complete the Fin 405

Completing the Fin 405 involves several key steps to ensure accuracy and compliance. Follow these guidelines:

- Gather necessary information: Collect details about your sales, including dates, amounts, and the nature of the goods or services sold.

- Fill out the form: Provide your personal or business information, including your name, address, and PST registration number, if applicable.

- Report sales: List the total sales amount and calculate the PST owed based on the applicable tax rate.

- Review and verify: Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

Legal Use of the Fin 405

The Fin 405 is legally binding when completed and submitted in accordance with the regulations set forth by the provincial government. To ensure its legal validity, it is crucial to follow the guidelines for eSignatures and maintain compliance with relevant laws, such as the Electronic Transactions Act. This ensures that the form is recognized by authorities and can be used in legal contexts if necessary.

Form Submission Methods

There are several methods for submitting the Fin 405, allowing flexibility based on user preference:

- Online submission: Many users prefer to complete and submit the form electronically, which can streamline the process and reduce processing time.

- Mail: For those who prefer traditional methods, the completed form can be printed and sent via postal service to the appropriate tax authority.

- In-person: Submitting the form in person at designated tax offices is also an option for individuals who need assistance or have questions.

Key Elements of the Fin 405

Understanding the key elements of the Fin 405 is essential for accurate completion:

- Personal or business information: This section requires the name and contact details of the seller.

- Sales details: Accurate reporting of sales amounts and dates is crucial for tax calculation.

- PST calculation: The form includes sections for calculating the total PST owed based on the sales reported.

- Signature: A signature or eSignature is required to validate the form, confirming the accuracy of the information provided.

Who Issues the Form?

The Fin 405 is issued by the provincial government of British Columbia. It is part of the regulatory framework for managing provincial sales tax compliance. Individuals and businesses engaged in casual sales are responsible for obtaining and completing this form to report their sales activities accurately.

Quick guide on how to complete fin 405

Effortlessly Prepare Fin 405 on Any Device

Managing documents online has gained traction among businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily find the right form and securely keep it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly without delays. Handle Fin 405 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Fin 405 with Ease

- Find Fin 405 and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize key sections of the documents or obscure sensitive details with the tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your revisions.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Fin 405 and ensure exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fin 405

The way to create an eSignature for your PDF in the online mode

The way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is a form casual remittance and how does it work?

A form casual remittance is a simplified method for individuals and businesses to send money or documents easily. Using airSlate SignNow, you can create and manage this form digitally, ensuring a quick and efficient remittance process.

-

What are the benefits of using airSlate SignNow for form casual remittance?

Using airSlate SignNow for form casual remittance streamlines your document workflow, saving you time and resources. It offers secure eSigning capabilities and easy document tracking, which enhances your overall remittance experience.

-

Is there a cost associated with using airSlate SignNow for form casual remittance?

airSlate SignNow offers flexible pricing plans that cater to different business needs. The costs associated with form casual remittance are competitive, ensuring that you get great value while enjoying efficient document management.

-

Can I integrate airSlate SignNow with other tools for form casual remittance?

Yes, airSlate SignNow can be easily integrated with various applications and platforms. This feature allows users to enhance their form casual remittance process, providing a comprehensive user experience tailored to their needs.

-

How secure is airSlate SignNow for processing form casual remittance?

Security is a top priority at airSlate SignNow, especially for form casual remittance. Our platform utilizes advanced encryption and secure protocols to ensure your data and documents remain confidential and protected throughout the process.

-

Can I customize my form casual remittance processes with airSlate SignNow?

Absolutely! airSlate SignNow allows for extensive customization of your form casual remittance documents. Users can tailor forms, branding, and workflows to match their specific requirements, enhancing both branding and user experience.

-

How do I get started with form casual remittance on airSlate SignNow?

Getting started with form casual remittance on airSlate SignNow is easy. Simply sign up for an account, and you can begin creating, sending, and eSigning your documents in no time, ensuring a seamless remittance process.

Get more for Fin 405

- Slope intercept form worksheet

- Uba transfer form

- Legal residence application county form

- Shading thermometer form

- Washington county homestead application pin asmt co washington mn form

- Aflac forms

- How do i get a permanent license plate in montana form

- Uniformed services university of the health scienc

Find out other Fin 405

- eSign Iowa Revocation of Power of Attorney Online

- How Do I eSign Maine Revocation of Power of Attorney

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy