SSA 44 Medicare Income Related Monthly Adjustment Amount Form

What makes the ssa 44 medicare income related monthly adjustment amount form legally binding?

As the world ditches office working conditions, the execution of paperwork increasingly takes place electronically. The ssa 44 medicare income related monthly adjustment amount form isn’t an exception. Working with it using digital tools differs from doing so in the physical world.

An eDocument can be regarded as legally binding on condition that specific requirements are fulfilled. They are especially vital when it comes to signatures and stipulations related to them. Entering your initials or full name alone will not guarantee that the organization requesting the sample or a court would consider it executed. You need a reliable solution, like airSlate SignNow that provides a signer with a digital certificate. In addition to that, airSlate SignNow keeps compliance with ESIGN, UETA, and eIDAS - main legal frameworks for eSignatures.

How to protect your ssa 44 medicare income related monthly adjustment amount form when filling out it online?

Compliance with eSignature regulations is only a fraction of what airSlate SignNow can offer to make document execution legitimate and secure. It also gives a lot of possibilities for smooth completion security smart. Let's rapidly go through them so that you can be assured that your ssa 44 medicare income related monthly adjustment amount form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment details.

- FERPA, CCPA, HIPAA, and GDPR: leading privacy standards in the USA and Europe.

- Dual-factor authentication: provides an extra layer of protection and validates other parties identities through additional means, like an SMS or phone call.

- Audit Trail: serves to capture and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: transmits the information securely to the servers.

Completing the ssa 44 medicare income related monthly adjustment amount form with airSlate SignNow will give better confidence that the output form will be legally binding and safeguarded.

Quick guide on how to complete ssa 44 medicare income related monthly adjustment amount

Effortlessly Prepare SSA 44 Medicare Income Related Monthly Adjustment Amount on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the tools required to quickly create, modify, and electronically sign your documents without delays. Handle SSA 44 Medicare Income Related Monthly Adjustment Amount on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The Simplest Way to Modify and eSign SSA 44 Medicare Income Related Monthly Adjustment Amount with Ease

- Locate SSA 44 Medicare Income Related Monthly Adjustment Amount and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight key areas of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, an invitation link, or download it directly to your computer.

Put an end to misplaced documents, tedious form searches, or errors that require new copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign SSA 44 Medicare Income Related Monthly Adjustment Amount and ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ssa 44 medicare income related monthly adjustment amount

The way to generate an electronic signature for your PDF in the online mode

The way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the Magi for 2022?

If you file taxes as a single person, your Modified Adjusted Gross Income (MAGI) must be under $144,000 for tax year 2022 and $153,000 for tax year 2023 to contribute to a Roth IRA, and if you're married and filing jointly, your MAGI must be under $214,000 for tax year 2022 and $228,000 for tax year 2023.

-

What will the Irmaa brackets be for 2023?

What are the 2023 IRMAA Brackets 2023 IRMAA BRACKETS FOR MEDICARE PART B & PART D$97,000 or less$194,000 or less$164.90Above $97,000 – $123,000Above $194,000 – $246,000$230.80Above $123,000 – $153,000Above $246,000 – $306,000$329.70Above $153,000 – $183,000Above $306,000 – $366,000$428.604 more rows • Dec 21, 2022

-

Will IRMAA decrease in 2023?

IRMAA is going down in 2023. In 2023, the premium for Part B, medical insurance, is going down by $5.25, to $164.90. After last year's hefty increase, Medicare beneficiaries are relieved. With that drop, higher-income beneficiaries will be even more relieved.

-

How do I know if I have to pay Irmaa?

The Social Security Administration (SSA) determines who pays an IRMAA based on the income reported 2 years prior. So for 2023, the SSA looks at your 2021 tax returns to see if you must pay an IRMAA. IRMAA is calculated every year.

-

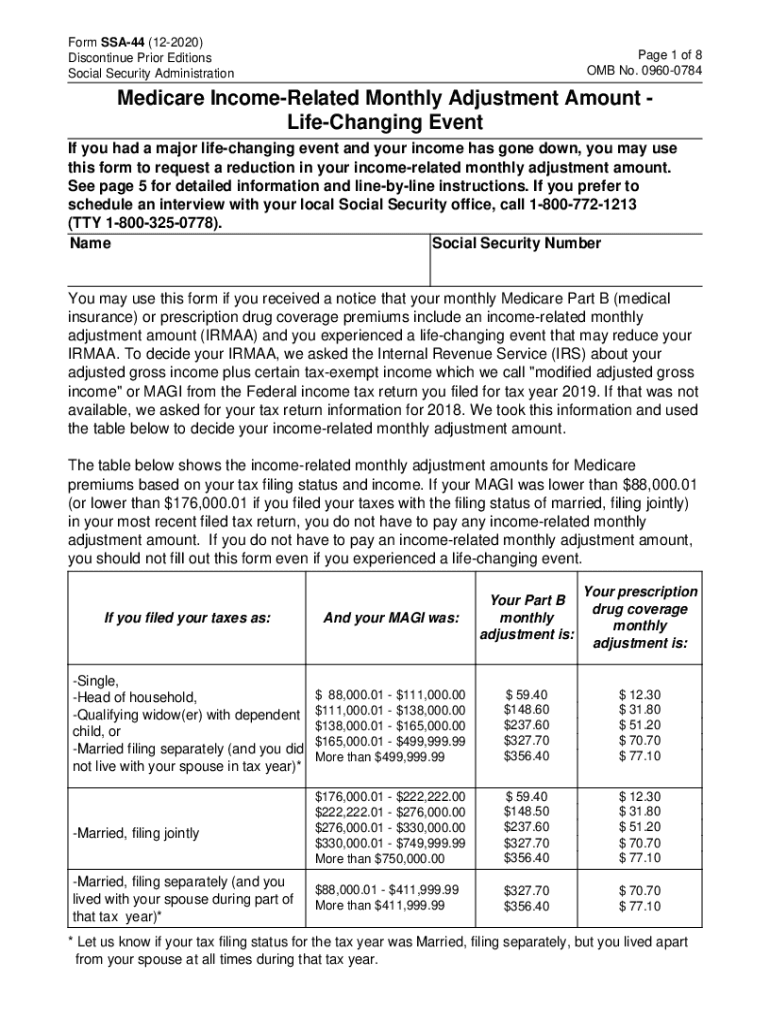

What is income related monthly adjustment amount Irmaa?

The income-related monthly adjustment amount (IRMAA) sliding scale is a set of statutory percentage-based tables used to adjust Medicare Part B and Part D prescription drug coverage premiums. The higher the beneficiary's range of modified adjusted gross income (MAGI), the higher the IRMAA.

-

Is Magi before or after standard deduction?

Does MAGI include the standard deduction? Both MAGI and AGI are calculated before a taxpayer claims the standard deduction or any itemized deductions.

-

How to calculate AGI?

The AGI calculation is relatively straightforward. It is equal to the total income you report that's subject to income tax—such as earnings from your job, self-employment, dividends and interest from a bank account—minus specific deductions, or “adjustments” that you're eligible to take.

-

What will be the Irmaa for 2023?

The income on your 2021 IRS tax return (filed in 2022) determines the IRMAA you pay in 2023. The standard Part B premium will be $164.90 in 2023. Higher-income Medicare beneficiaries also pay a surcharge for Part D.

-

What are the Irmaa limits for 2022?

The IRMAA surcharge was added to your 2022 premiums if your 2020 income was over $91,000 (or $182,000 if you're married). And for 2023, the IRMAA surcharge will be added to your premium if your 2021 income was over $97,000 (or $194,000 if you're married).

-

What is the modified adjusted gross income for 2022?

For the 2022 tax year, single tax filers can contribute the full $6,500 ($7,500 if you're age 50 or older) as long as your MAGI is less than $138,000 ($218,000 for joint filers). Taxpayers with MAGIs between $138,000 and $153,000 ($218,000-$228,000) can make partial contributions to a Roth IRA.

-

What is modified adjusted gross income for Medicare 2022?

MAGI is adjusted gross income (AGI) plus these, if any: untaxed foreign income, non-taxable Social Security benefits, and tax-exempt interest. For many people, MAGI is identical or very close to adjusted gross income. MAGI doesn't include Supplemental Security Income (SSI).

-

Does Irmaa go up every year?

This amount is recalculated annually. The IRMAA surcharge was added to your 2022 premiums if your 2020 income was over $91,000 (or $182,000 if you're married). And for 2023, the IRMAA surcharge will be added to your premium if your 2021 income was over $97,000 (or $194,000 if you're married).

-

Do I have to pay Irmaa if I have a Medicare Advantage plan?

You'll also have to pay this extra amount if you're in a Medicare Advantage Plan that includes drug coverage. If Social Security notifies you about paying a higher amount for your Part D coverage, you're required by law to pay the Part D-Income Related Monthly Adjustment Amount (Part D IRMAA).

-

What are Medicare income limits for 2023?

The government has updated the income limits for 2023, which — per Medicare Interactive — are now: up to $1,719 monthly income for individuals. up to $2,309 monthly income for married couples.

-

What is the Medicare Irmaa for 2022?

The threshold for IRMAA surcharges was quite a bit lower in 2022 (it started at $91,000), but it has grown for 2023, due to inflation.

-

Is modified adjusted gross income the same as taxable income?

AGI can reduce the amount of your taxable income by subtracting certain deductions from your gross income. MAGI is your AGI after factoring in tax deductions and tax-exempt interest. You can't find your MAGI on your tax return, although your AGI appears on line 11 of Form 1040.

-

What does income Related Monthly Adjustment Amount mean?

The Medicare Income-Related Monthly Adjustment Amount (IRMAA) is an amount you may pay in addition to your Part B or Part D premium if your income is above a certain level. The Social Security Administration (SSA) sets four income brackets that determine your (or you and your spouse's) IRMAA.

-

What income is used to determine Medicare premiums 2022?

Medicare beneficiaries with incomes above $97,000 for individuals and $194,000 for married couples are required to pay higher premiums. The amount you pay depends on your modified adjusted gross income from your most recent federal tax return.

-

What is the Irmaa adjustment for 2022?

The surcharge for Part B ranges this year from $68 to $408.20, depending on income. Based on this year's standard monthly premium of $170.10, that results in IRMAA-affected beneficiaries paying premiums ranging from $238.10 to $578.30. For Part D, the surcharges for 2022 range from $12.40 to $77.90.

-

What is the Medicare Irmaa for 2024?

thefinancebuff.com website estimates that the 2024 single lowest bracket for 2024 (2022 MAGI) with 0% additional inflation will be 102,000. With 5% additional inflation it could be 104,000.

Get more for SSA 44 Medicare Income Related Monthly Adjustment Amount

- Affidavit for efiling application form

- Empire life claim form pdf

- New zealand customs service form

- Authorization for direct deposit employee form mcalister

- Cornea and contact lens institute of minnesota form

- Life coaching consent form template

- For your protection and privacy press the clear t form

- Ocala family medical center form

Find out other SSA 44 Medicare Income Related Monthly Adjustment Amount

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document