Form 720 Rev March Quarterly Federal Excise Tax Return

What is the Form 720 Rev March Quarterly Federal Excise Tax Return

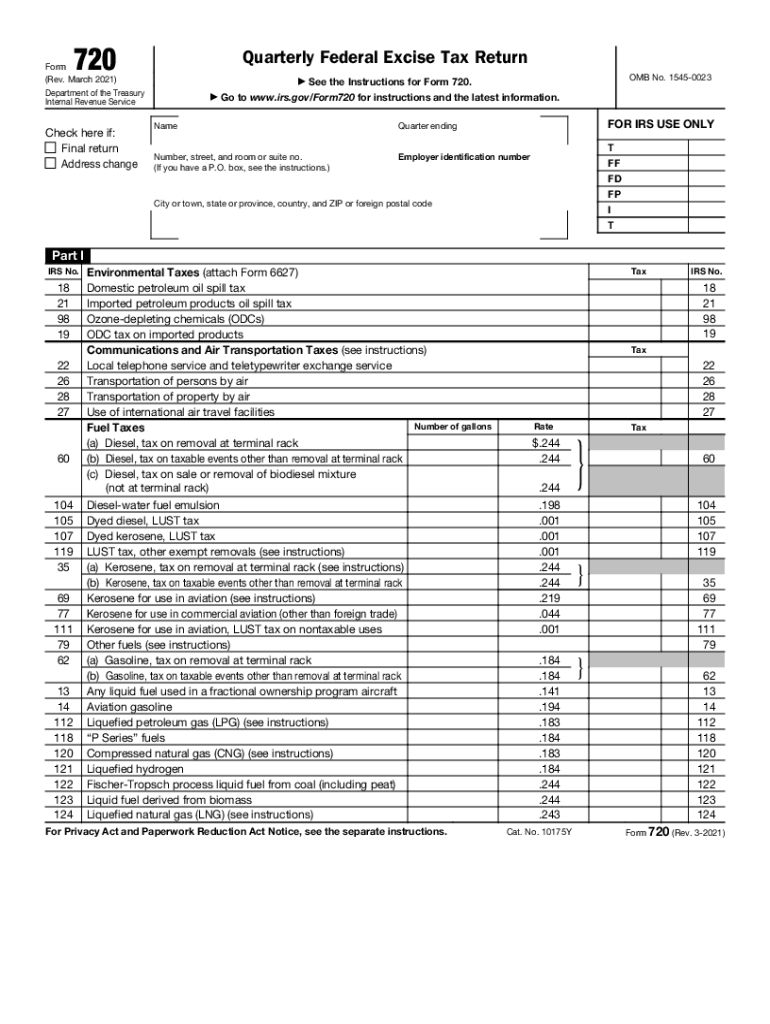

The Form 720 Rev March is a federal tax form used by businesses to report and pay federal excise taxes on specific goods and services. This form is essential for entities engaged in activities such as manufacturing, selling, or importing products subject to excise tax. The form must be filed quarterly, reflecting the tax liabilities incurred during each quarter of the year. Understanding the purpose and requirements of this form is crucial for compliance with IRS regulations.

Steps to complete the Form 720 Rev March Quarterly Federal Excise Tax Return

Completing the Form 720 for 2021 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records related to the excise taxes owed. This includes sales records, purchase invoices, and any relevant documentation that supports your tax calculations. Next, fill out the form by providing your business information, including the name, address, and Employer Identification Number (EIN).

Then, calculate the total excise tax due based on the applicable rates for the goods or services your business provides. This may involve multiple tax categories, so careful attention to detail is required. After completing the calculations, review the form for accuracy, ensuring that all figures and information are correct. Finally, submit the form by the designated filing deadline, either electronically or via mail.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 720 for 2021. It is important to refer to the IRS instructions accompanying the form, which detail the requirements for each line item, including the types of excise taxes applicable. The guidelines also outline the filing frequency, payment methods, and penalties for late submission or underpayment. Adhering to these guidelines helps ensure that your submission is compliant with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 720 Rev March are crucial for maintaining compliance with IRS regulations. Generally, the form is due on the last day of the month following the end of each quarter. For instance, the first quarter's form is due by April 30, the second quarter by July 31, the third quarter by October 31, and the fourth quarter by January 31 of the following year. It is essential to mark these dates on your calendar to avoid penalties and interest on late payments.

Penalties for Non-Compliance

Failure to file the Form 720 for 2021 on time or underreporting excise taxes can result in significant penalties. The IRS may impose a failure-to-file penalty, which is typically calculated as a percentage of the unpaid tax amount for each month the return is late. Additionally, interest accrues on any unpaid taxes from the due date until payment is made. Understanding these penalties emphasizes the importance of timely and accurate filing to avoid unnecessary financial burdens.

Digital vs. Paper Version

When completing the Form 720 for 2021, businesses have the option to file digitally or submit a paper version. The digital version allows for quicker processing and may reduce the risk of errors. Electronic filing also provides immediate confirmation of receipt, which can be beneficial for record-keeping. Conversely, some businesses may prefer the traditional paper method for various reasons, including familiarity or specific accounting practices. Regardless of the method chosen, ensuring that the form is filled out correctly is essential for compliance.

Quick guide on how to complete form 720 rev march 2021 quarterly federal excise tax return

Effortlessly prepare Form 720 Rev March Quarterly Federal Excise Tax Return on any device

Managing documents online has become increasingly favored by both organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to easily access the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, edit, and electronically sign your documents quickly and without delays. Handle Form 720 Rev March Quarterly Federal Excise Tax Return on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign Form 720 Rev March Quarterly Federal Excise Tax Return effortlessly

- Locate Form 720 Rev March Quarterly Federal Excise Tax Return and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 720 Rev March Quarterly Federal Excise Tax Return to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 720 rev march 2021 quarterly federal excise tax return

How to make an eSignature for a PDF in the online mode

How to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

How to create an eSignature for a PDF document on Android OS

People also ask

-

What is form 7202 for 2021 and why is it important?

Form 7202 for 2021 is used to calculate the Employee Retention Credit for certain employers affected by COVID-19. By understanding this form, businesses can take advantage of credits available to them, ultimately reducing their tax liability and improving financial stability.

-

How can airSlate SignNow help in signing form 7202 for 2021?

With airSlate SignNow, you can easily upload, send, and eSign form 7202 for 2021 securely. Our platform ensures that your documents are signed quickly and efficiently, allowing you to focus on what matters most—running your business.

-

Is there a cost associated with using airSlate SignNow to manage form 7202 for 2021?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs. We provide a cost-effective solution for electronically signing documents, including form 7202 for 2021, helping you save time and resources.

-

What features does airSlate SignNow offer for managing form 7202 for 2021?

Our platform includes essential features such as customizable templates, audit trails, and automatic reminders to ensure that form 7202 for 2021 is completed and signed on time. These features streamline the signing process and enhance document management efficiency.

-

Can I integrate airSlate SignNow with other software for processing form 7202 for 2021?

Yes, airSlate SignNow offers various integrations with popular software like CRM systems, cloud storage, and accounting tools. These integrations enhance workflow efficiency, making it easier to manage form 7202 for 2021 alongside your existing applications.

-

What benefits does airSlate SignNow provide for businesses filing form 7202 for 2021?

Using airSlate SignNow for filing form 7202 for 2021 allows businesses to expedite the signing process, reduce paperwork, and ensure compliance. Our solution enhances collaboration, increases accuracy in document handling, and minimizes delays in receiving necessary credits.

-

Is airSlate SignNow secure for signing form 7202 for 2021?

Absolutely! airSlate SignNow employs industry-standard security measures to protect your documents, including form 7202 for 2021. Our platform uses encryption and secure access protocols to ensure that your information remains safe and confidential.

Get more for Form 720 Rev March Quarterly Federal Excise Tax Return

- Oklahoma child support forms

- Phq 9 form pdf printable for teens

- Subcontractor verification form hillsborugh county

- Minnesota voluntary recognition of parentage spouse non parentage statement form

- Statutory declaration wa 487292512 form

- General scholarship application fill online printable form

- Penn state digital photography learning site form

- Spring fling bracelet order form victory elementary school

Find out other Form 720 Rev March Quarterly Federal Excise Tax Return

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free