Ca Form 100

What is the CA Form 100

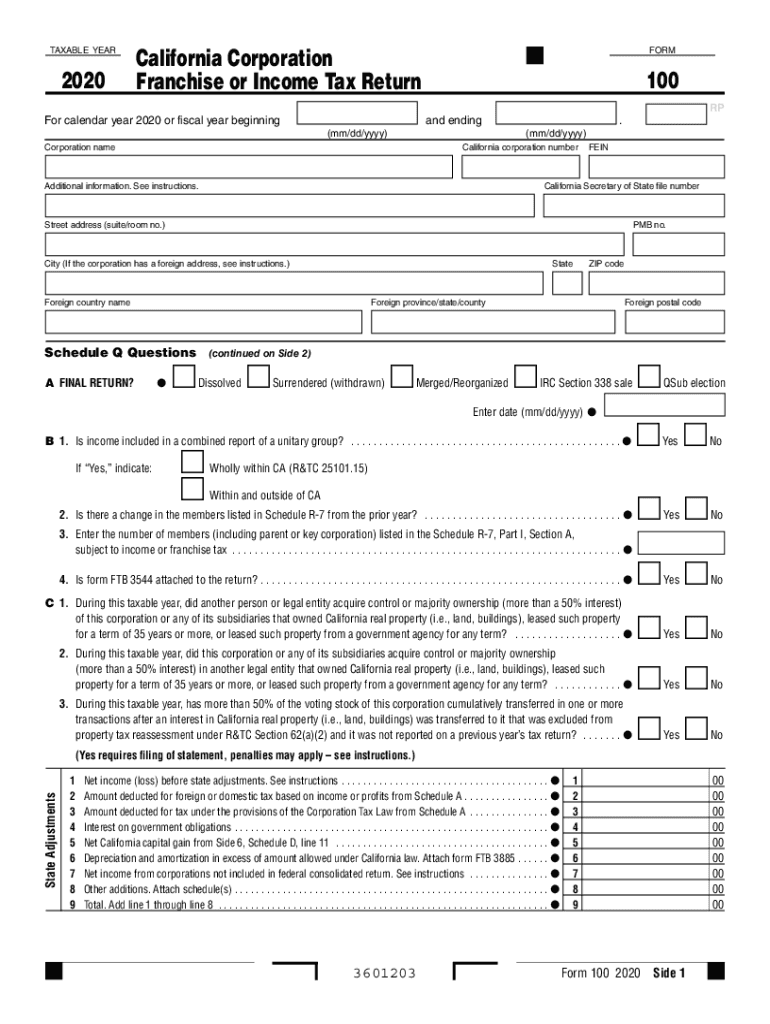

The CA Form 100, also known as the California Corporation Franchise or Income Tax Return, is a tax form used by corporations operating in California to report their income, calculate their tax liability, and disclose other pertinent financial information. This form is essential for both C corporations and S corporations, as it provides the California Franchise Tax Board (FTB) with necessary details regarding the corporation's financial activities within the state. The form must be completed annually, and it plays a crucial role in ensuring compliance with California tax laws.

How to Obtain the CA Form 100

The CA Form 100 can be easily obtained through the California Franchise Tax Board's official website. It is available for download in a printable format, allowing businesses to fill it out manually or electronically. Additionally, many tax preparation software programs also include the CA Form 100, enabling users to complete their tax filings digitally. It is important to ensure that you are using the most current version of the form, as tax laws and requirements may change from year to year.

Steps to Complete the CA Form 100

Completing the CA Form 100 involves several key steps to ensure accuracy and compliance. Here are the essential steps:

- Gather Financial Records: Collect all necessary financial documents, including income statements, balance sheets, and expense reports.

- Fill Out Basic Information: Enter the corporation's name, address, and federal employer identification number (EIN) at the top of the form.

- Report Income: Detail all sources of income, including sales revenue, interest, and dividends, in the appropriate sections of the form.

- Calculate Deductions: Identify and list allowable deductions to reduce taxable income, such as business expenses and depreciation.

- Determine Tax Liability: Use the provided tax tables to calculate the corporation's tax liability based on the reported income.

- Sign and Date: Ensure that the form is signed by an authorized officer of the corporation and dated appropriately.

Legal Use of the CA Form 100

The CA Form 100 must be completed and submitted in accordance with California state tax laws. It serves as a legally binding document that reports the corporation's financial activities to the state. To ensure its legal validity, the form must be signed by an authorized representative of the corporation. Furthermore, electronic submissions of the form are permissible, provided they meet the requirements set forth by the California Franchise Tax Board, including compliance with eSignature laws.

Filing Deadlines / Important Dates

Corporations are required to file the CA Form 100 by the fifteenth day of the fourth month following the close of their fiscal year. For corporations operating on a calendar year basis, this deadline typically falls on April 15. It is essential for businesses to be aware of these deadlines to avoid penalties and interest charges. If the deadline falls on a weekend or holiday, the filing date may be extended to the next business day.

Penalties for Non-Compliance

Failure to file the CA Form 100 by the designated deadline can result in significant penalties for corporations. The California Franchise Tax Board imposes a penalty of five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent. Additionally, interest accrues on any unpaid tax from the original due date until the tax is paid in full. It is crucial for corporations to adhere to filing requirements to avoid these financial repercussions.

Quick guide on how to complete ca form 100

Complete Ca Form 100 seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly and without hassle. Manage Ca Form 100 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to alter and eSign Ca Form 100 effortlessly

- Obtain Ca Form 100 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant portions of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Ca Form 100 and ensure superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca form 100

The best way to create an electronic signature for your PDF document online

The best way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the CA Form 100 and who needs it?

The CA Form 100, also known as the California Corporation Franchise or Income Tax Return, is required for corporations doing business in California. This form is essential for reporting your business income and calculating taxes owed to the state. If you're a corporation, timely filing this form is crucial to avoid penalties and maintain good standing.

-

How can airSlate SignNow assist with completing the CA Form 100?

AirSlate SignNow simplifies the process of completing the CA Form 100 by allowing you to fill out, eSign, and send the document securely online. Our platform ensures that the form is accurately completed and submitted on time. By using our solution, businesses can avoid common pitfalls associated with manual filing.

-

What are the pricing options for using airSlate SignNow for CA Form 100?

AirSlate SignNow offers various pricing tiers to suit the needs of different businesses. Our cost-effective solutions allow you to manage and eSign documents, including the CA Form 100, without breaking your budget. You can choose a plan that best fits your company's size and requirements.

-

Are there features specifically designed for handling the CA Form 100?

Yes, airSlate SignNow includes features tailored for document management, including templates for CA Form 100. These templates help streamline the form-filling process, ensuring all necessary fields are completed. Additionally, our electronic signature feature enables quick approval and processing of your form.

-

What benefits does airSlate SignNow provide for businesses filing the CA Form 100?

Using airSlate SignNow for filing the CA Form 100 helps businesses save time and reduce the risk of errors. Our user-friendly interface allows for quick document preparation and submission. Plus, secure online storage of your forms ensures easy access and compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for CA Form 100 management?

Absolutely! AirSlate SignNow easily integrates with various accounting and document management software. This capability allows businesses to seamlessly manage their CA Form 100 along with other financial documents, enhancing productivity and ensuring all information is consistent and up-to-date.

-

How does airSlate SignNow ensure the security of my CA Form 100?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols to protect your CA Form 100 and any other documents you handle through our platform. Our compliance with industry standards also ensures that your sensitive information remains confidential and secure.

Get more for Ca Form 100

Find out other Ca Form 100

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later