D 40b Form

What is the D 40b?

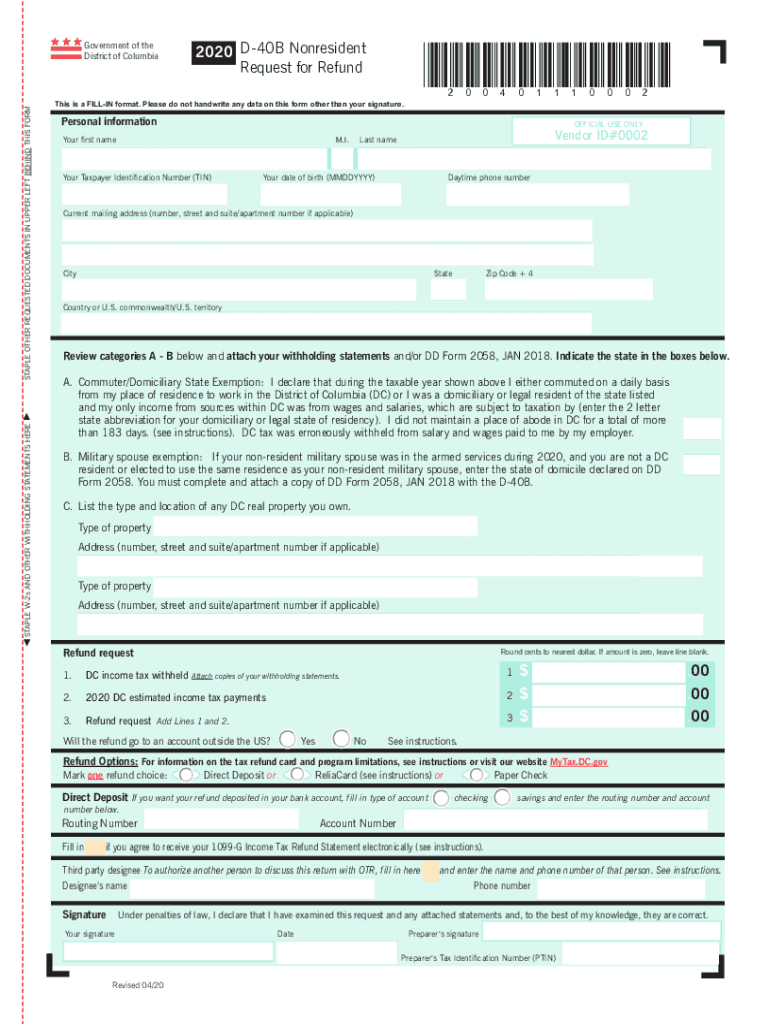

The D 40b form is a tax document used in the District of Columbia for individuals who are seeking a refund of overpaid taxes. This form is specifically designed for residents who have had excess withholding on their income taxes. By completing the D 40b, taxpayers can claim any refund they are entitled to based on their tax situation for the applicable year.

How to use the D 40b

To use the D 40b form effectively, individuals must first determine their eligibility for a refund. This involves reviewing their income, withholding amounts, and any applicable deductions or credits. Once eligibility is confirmed, the taxpayer can fill out the form accurately, ensuring all required information is provided. After completing the D 40b, the form must be submitted to the appropriate tax authority in the District of Columbia for processing.

Steps to complete the D 40b

Completing the D 40b form involves several key steps:

- Gather necessary documents, including W-2 forms and any other income statements.

- Review your total income and withholding amounts to confirm eligibility for a refund.

- Fill out the D 40b form, ensuring all personal and financial information is accurate.

- Double-check the form for any errors or omissions before submission.

- Submit the completed form to the District of Columbia Office of Tax and Revenue.

Legal use of the D 40b

The D 40b form is legally recognized for claiming tax refunds in the District of Columbia. It is essential that taxpayers use the form in compliance with local tax laws and regulations. Proper completion and submission of the D 40b ensure that individuals can receive their entitled refunds without legal complications. Additionally, the form must be filed within the specified deadlines to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the D 40b form are crucial for taxpayers to keep in mind. Typically, the form must be submitted within a specific timeframe following the end of the tax year. For instance, individuals often need to file their D 40b by the same deadline as their annual income tax return. Staying informed about these dates helps ensure timely processing of refunds.

Required Documents

To complete the D 40b form, taxpayers must gather several key documents, including:

- W-2 forms from employers detailing income and withholding.

- Any 1099 forms for additional income sources.

- Records of any tax credits or deductions claimed.

- Identification information, such as Social Security numbers.

Form Submission Methods (Online / Mail / In-Person)

The D 40b form can be submitted through various methods to accommodate taxpayer preferences. Options include:

- Online submission through the District of Columbia Office of Tax and Revenue website.

- Mailing the completed form to the designated tax office address.

- In-person submission at local tax offices during business hours.

Quick guide on how to complete d 40b

Complete D 40b effortlessly on any gadget

Managing documents online has become increasingly favored by both enterprises and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, enabling you to find the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents rapidly without holdups. Manage D 40b on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign D 40b without stress

- Find D 40b and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and electronically sign D 40b and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the d 40b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

How to create an eSignature for a PDF on Android

People also ask

-

What is a d 40b form and how does airSlate SignNow help with it?

The d 40b form is a critical tax document used by businesses for specific reporting requirements. airSlate SignNow simplifies the eSigning of the d 40b form, ensuring that your documents are securely signed and efficiently managed in one central location.

-

Is there a cost associated with using airSlate SignNow for the d 40b form?

Yes, airSlate SignNow offers competitive pricing plans to fit various business needs. By utilizing our platform for the d 40b form, you save on costs associated with traditional paperwork, making it a cost-effective solution.

-

What features does airSlate SignNow provide for handling the d 40b form?

airSlate SignNow provides features such as document templates, customizable workflows, and real-time tracking to enhance your experience with the d 40b form. These tools streamline the signing process and improve overall efficiency.

-

How secure is the signing process for the d 40b form with airSlate SignNow?

Security is a top priority at airSlate SignNow. The signing process for the d 40b form is protected with advanced encryption, ensuring that your sensitive information is safe and secure during transmission and storage.

-

Can I integrate airSlate SignNow with other applications for processing the d 40b form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enabling you to manage the d 40b form alongside your existing tools. This integration enhances workflow efficiency across platforms.

-

Are there any templates available for the d 40b form in airSlate SignNow?

Yes, airSlate SignNow provides ready-to-use templates for the d 40b form. This feature allows you to quickly create, customize, and send documents for eSignature, saving time and streamlining your processes.

-

How can airSlate SignNow benefit my business when handling the d 40b form?

Using airSlate SignNow for the d 40b form can signNowly increase your productivity by reducing the time spent on document management. With easy-to-use features and a quick turnaround for eSignatures, your business can operate more efficiently.

Get more for D 40b

Find out other D 40b

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation