Arizona Quarterly Withholding Tax Return Fillable Az A1 Form

What is the Arizona Quarterly Withholding Tax Return Fillable AZ A1

The Arizona Quarterly Withholding Tax Return Fillable AZ A1 is a crucial document for employers in Arizona. This form is used to report and remit state income tax withheld from employees' wages. It is essential for ensuring compliance with state tax laws and for maintaining accurate records of tax obligations. Employers are required to submit this form quarterly, detailing the amount withheld during the reporting period. Understanding the purpose and requirements of the AZ A1 form is vital for all businesses operating in Arizona.

Steps to complete the Arizona Quarterly Withholding Tax Return Fillable AZ A1

Completing the Arizona Quarterly Withholding Tax Return Fillable AZ A1 involves several key steps:

- Gather necessary information, including your Employer Identification Number (EIN) and total wages paid during the quarter.

- Calculate the total amount of state income tax withheld from employees' wages for the reporting period.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the specified deadline, either electronically or via mail.

Following these steps carefully will help ensure that your submission is accurate and timely, reducing the risk of penalties.

Legal use of the Arizona Quarterly Withholding Tax Return Fillable AZ A1

The legal use of the Arizona Quarterly Withholding Tax Return Fillable AZ A1 is governed by state tax regulations. This form must be completed and submitted by employers to comply with Arizona tax laws. Failure to file the AZ A1 form can result in penalties, including fines and interest on unpaid taxes. It is important for employers to understand their obligations and ensure that the form is submitted accurately and on time to avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Quarterly Withholding Tax Return Fillable AZ A1 are critical for compliance. Employers must submit the form by the last day of the month following the end of each quarter. The specific deadlines are:

- First Quarter (January - March): Due by April 30

- Second Quarter (April - June): Due by July 31

- Third Quarter (July - September): Due by October 31

- Fourth Quarter (October - December): Due by January 31 of the following year

Staying aware of these deadlines helps prevent late submissions and associated penalties.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the Arizona Quarterly Withholding Tax Return Fillable AZ A1. The available submission methods include:

- Online Submission: Employers can file the form electronically through the Arizona Department of Revenue's online portal, which is often the fastest and most efficient method.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Arizona Department of Revenue.

- In-Person: Employers may also deliver the form in person to a local Arizona Department of Revenue office.

Choosing the right submission method can help ensure timely processing and compliance with state regulations.

Penalties for Non-Compliance

Non-compliance with the Arizona Quarterly Withholding Tax Return Fillable AZ A1 can lead to significant penalties for employers. Common penalties include:

- Late Filing Penalties: Employers who fail to submit the form by the deadline may incur fines based on the amount of tax owed.

- Failure to Pay Penalties: If taxes withheld are not paid on time, additional interest and penalties may apply.

- Legal Consequences: Continued non-compliance can result in legal action from the state, including liens on business assets.

Understanding these penalties highlights the importance of timely and accurate filing of the AZ A1 form.

Quick guide on how to complete arizona quarterly withholding tax return fillable az a1

Complete Arizona Quarterly Withholding Tax Return Fillable Az A1 effortlessly on any device

Online document management has gained increased popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to acquire the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly without any holdups. Handle Arizona Quarterly Withholding Tax Return Fillable Az A1 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Arizona Quarterly Withholding Tax Return Fillable Az A1 with ease

- Find Arizona Quarterly Withholding Tax Return Fillable Az A1 and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Arizona Quarterly Withholding Tax Return Fillable Az A1 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona quarterly withholding tax return fillable az a1

The best way to generate an eSignature for your PDF document online

The best way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

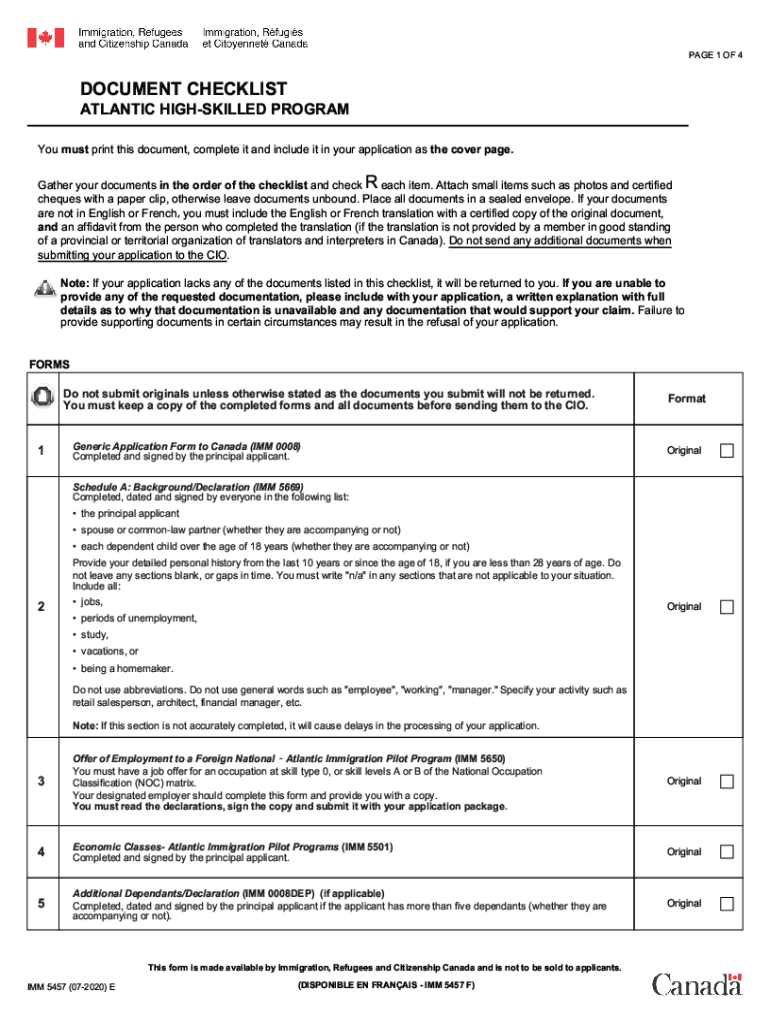

What is the imm 5457 form and how can airSlate SignNow help?

The imm 5457 form is a signNow document for Canadian immigration processes. AirSlate SignNow simplifies the signing and sending of the imm 5457, ensuring that your application is processed without unnecessary delays.

-

How much does it cost to use airSlate SignNow for completing the imm 5457?

AirSlate SignNow offers various pricing plans that cater to different needs. You can choose the plan that best suits your requirements for processing the imm 5457, which can save both time and money.

-

What are the key features of airSlate SignNow when dealing with the imm 5457?

Key features include eSignature capabilities, document templates, and cloud storage options. These features streamline the process of completing and submitting the imm 5457, making it easier to manage your documents efficiently.

-

Are there any benefits to using airSlate SignNow for the imm 5457?

Yes, using airSlate SignNow for the imm 5457 provides faster turnaround times, improved document security, and enhanced collaboration. This ensures a smoother experience when submitting important immigration paperwork.

-

How secure is airSlate SignNow for handling the imm 5457?

AirSlate SignNow prioritizes document security and compliance. When managing sensitive forms like imm 5457, our platform uses encryption and secure storage to keep your information safe.

-

Can airSlate SignNow integrate with other tools for the imm 5457 process?

Absolutely! AirSlate SignNow integrates with several popular applications and tools, making it easy to streamline your workflow for the imm 5457. These integrations help you connect with your existing systems seamlessly.

-

Is there customer support available for airSlate SignNow users completing the imm 5457?

Yes, airSlate SignNow provides robust customer support for users working on the imm 5457. Our team is available to assist you with any questions or issues during the document signing process.

Get more for Arizona Quarterly Withholding Tax Return Fillable Az A1

- Renters insurance quote sheet form

- Sample subpoena for cell phone records form

- Nm public regulation commisiondomestic nonprofit corporation file electronic report form

- Zip codes within the city of los angeles lahd lahd lacity form

- Petition for divorce georgia form

- 63 madani inamat in urdu pdf download form

- Letterhead template for cumru cumru township form

- Tax revenue forecasting documentation form

Find out other Arizona Quarterly Withholding Tax Return Fillable Az A1

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple