Ca Tax Form 3519

What is the California Tax Form 3519?

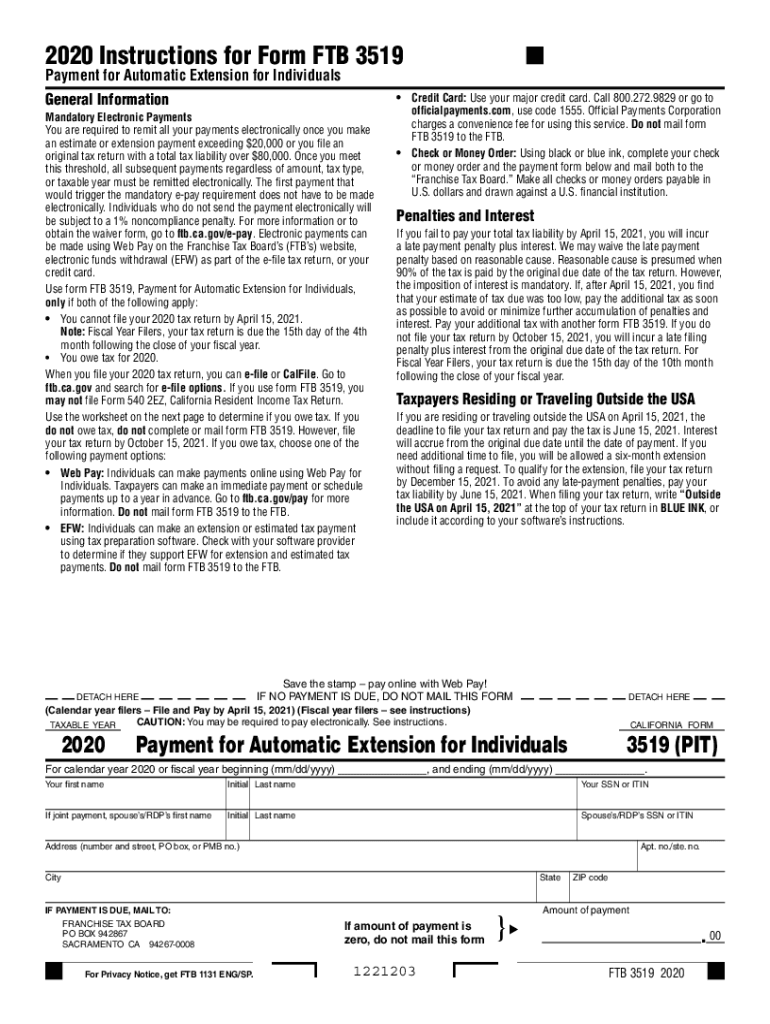

The California Tax Form 3519, also known as the 3519 extension form, is a document used by taxpayers in California to request an extension for filing their state income tax returns. This form is particularly relevant for individuals who may need additional time to prepare their tax documents, ensuring they can comply with state tax regulations without incurring penalties. The form allows taxpayers to extend their filing deadline, providing them with a more manageable timeframe to gather necessary information and complete their returns accurately.

How to Use the California Tax Form 3519

To use the California Tax Form 3519 effectively, taxpayers should first ensure they meet the eligibility criteria for an extension. After confirming eligibility, individuals can download the form from the California Franchise Tax Board (FTB) website or obtain a physical copy from local tax offices. Once the form is in hand, fill it out by providing the required personal information, including your name, address, and Social Security number. It's essential to indicate the tax year for which the extension is being requested. After completing the form, submit it to the FTB by the original filing deadline to ensure the extension is granted.

Steps to Complete the California Tax Form 3519

Completing the California Tax Form 3519 involves several straightforward steps:

- Obtain the form from the California FTB website or a local tax office.

- Fill in your personal details, including your full name, address, and Social Security number.

- Specify the tax year for which you are requesting the extension.

- Sign and date the form to validate your request.

- Submit the completed form to the FTB by the original tax filing deadline.

Following these steps ensures that your request for an extension is processed correctly and on time.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the California Tax Form 3519 is crucial for taxpayers. The form must be submitted by the original due date of the tax return, which is typically April 15 for most individuals. If this date falls on a weekend or holiday, the deadline may be adjusted accordingly. It is important to keep track of these dates to avoid any penalties or interest charges on unpaid taxes.

Legal Use of the California Tax Form 3519

The California Tax Form 3519 is legally recognized as a valid request for an extension to file state income taxes. When properly completed and submitted on time, it provides taxpayers with the necessary legal protection against late filing penalties. However, it is important to note that while the form extends the filing deadline, it does not extend the deadline for paying any taxes owed. Taxpayers are still required to estimate and pay any due taxes by the original deadline to avoid interest and penalties.

Who Issues the Form

The California Tax Form 3519 is issued by the California Franchise Tax Board (FTB), the state agency responsible for administering California's income tax laws. The FTB provides resources and guidance for taxpayers on how to complete and submit the form, ensuring compliance with state tax regulations. Taxpayers can access additional information and assistance directly from the FTB to address any questions or concerns regarding the form and the extension process.

Quick guide on how to complete ca tax form 3519

Complete Ca Tax Form 3519 effortlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents swiftly without delays. Handle Ca Tax Form 3519 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Ca Tax Form 3519 with ease

- Find Ca Tax Form 3519 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the information and then select the Done button to save your modifications.

- Decide how you want to share your form, whether by email, text message (SMS), invite link, or by downloading it to your computer.

Eliminate the worry of lost or missing files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow covers all your document management needs in just a few clicks from any device you prefer. Edit and eSign Ca Tax Form 3519 and guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca tax form 3519

The way to create an eSignature for a PDF file in the online mode

The way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is the 2021 California tax extension process?

The 2021 California tax extension allows taxpayers to request additional time to file their income tax returns. By submitting Form 3519 by the due date, you can extend your filing until October 15, 2022. It’s important to note that this extension does not delay the payment of any taxes owed.

-

How can airSlate SignNow assist with the 2021 California tax extension?

airSlate SignNow streamlines the process of signing and submitting your 2021 California tax extension forms electronically. With our user-friendly platform, you can quickly eSign documents from anywhere, ensuring you don’t miss crucial deadlines. Our solution also reduces paper waste, making it environmentally friendly.

-

Are there any costs associated with using airSlate SignNow for the 2021 California tax extension?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs. Depending on the features you choose, the cost can vary. Using our platform for your 2021 California tax extension documents can be a cost-effective solution compared to traditional printing and mailing.

-

What features does airSlate SignNow provide for handling tax extension forms?

airSlate SignNow provides features such as customizable templates, secure storage, and real-time tracking of your 2021 California tax extension documents. You can easily manage your paperwork with our intuitive interface, ensuring that you stay organized throughout the filing process. Plus, our electronic signatures are legally binding.

-

Can I integrate airSlate SignNow with other software for tax management?

Yes, airSlate SignNow easily integrates with popular accounting software and tax management tools. This allows for a seamless workflow when managing your 2021 California tax extension forms and other tax documents. By integrating our solution, you can streamline your processes and improve efficiency.

-

What benefits does airSlate SignNow offer for small businesses regarding the 2021 California tax extension?

For small businesses, airSlate SignNow simplifies the 2021 California tax extension process by reducing the time spent on paperwork and improving collaboration. Our solution enables teams to work together remotely, securely sign documents, and keep all tax-related forms in one place. This can signNowly enhance productivity during peak tax season.

-

Is airSlate SignNow secure for eSigning the 2021 California tax extension?

Absolutely! airSlate SignNow employs top-notch encryption and security protocols to keep your documents safe. When eSigning your 2021 California tax extension forms, you can trust that your information is protected against unauthorized access and data bsignNowes.

Get more for Ca Tax Form 3519

Find out other Ca Tax Form 3519

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation