Formato Impuesto Cedular Chihuahua 2005

What is the Formato Impuesto Cedular Chihuahua

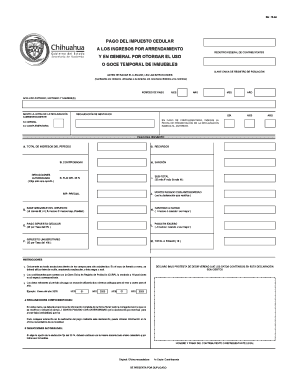

The Formato Impuesto Cedular Chihuahua is a tax form used in the state of Chihuahua, Mexico, specifically designed for individuals and businesses to report income and calculate taxes owed. This form is essential for ensuring compliance with local tax regulations and is part of the broader tax system governing income taxation in the region. The form captures various income types, including salaries, business profits, and other earnings, allowing taxpayers to accurately declare their financial activities.

How to use the Formato Impuesto Cedular Chihuahua

Using the Formato Impuesto Cedular Chihuahua involves several steps. First, gather all necessary financial documents, such as income statements and previous tax returns. Next, fill out the form by entering your income details and any applicable deductions. It is crucial to ensure that all information is accurate and complete to avoid penalties. After completing the form, you can submit it through the designated channels, whether online or in person, depending on your preference and local regulations.

Steps to complete the Formato Impuesto Cedular Chihuahua

Completing the Formato Impuesto Cedular Chihuahua requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including income statements and receipts for deductions.

- Download the latest version of the form from the official tax authority's website.

- Fill in your personal information, including your name, address, and tax identification number.

- Report your income by entering amounts in the designated sections for different income types.

- Calculate any deductions you may qualify for and subtract them from your total income.

- Review the completed form for accuracy before submission.

Legal use of the Formato Impuesto Cedular Chihuahua

The Formato Impuesto Cedular Chihuahua is legally binding when completed and submitted according to local tax laws. To ensure its legal standing, the form must be filled out accurately and submitted by the appropriate deadlines. Compliance with tax regulations is vital, as inaccuracies or late submissions can lead to penalties. Utilizing a reliable digital tool for completing this form can enhance its legitimacy and security, ensuring that all signatures and data are properly authenticated.

Key elements of the Formato Impuesto Cedular Chihuahua

Several key elements are essential for the Formato Impuesto Cedular Chihuahua to be valid:

- Personal Information: Accurate details about the taxpayer, including name, address, and tax identification number.

- Income Reporting: Sections for different types of income, such as wages, business income, and other earnings.

- Deductions: Areas to claim eligible deductions that can reduce taxable income.

- Signature: A space for the taxpayer's signature, which is necessary for the form to be legally binding.

Filing Deadlines / Important Dates

Filing deadlines for the Formato Impuesto Cedular Chihuahua are crucial for compliance. Typically, the deadline falls within specific periods set by the local tax authority, often coinciding with the end of the fiscal year. Taxpayers should be aware of these dates to avoid late fees and penalties. It is advisable to check the official tax authority's announcements for any updates or changes to the deadlines.

Quick guide on how to complete formato impuesto cedular chihuahua

Effortlessly Prepare Formato Impuesto Cedular Chihuahua on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any holdups. Manage Formato Impuesto Cedular Chihuahua on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Alter and eSign Formato Impuesto Cedular Chihuahua with Ease

- Locate Formato Impuesto Cedular Chihuahua and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Decide how you want to distribute your form—via email, SMS, invitation link, or download it to your computer.

Stop worrying about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Formato Impuesto Cedular Chihuahua to ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct formato impuesto cedular chihuahua

Create this form in 5 minutes!

How to create an eSignature for the formato impuesto cedular chihuahua

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the formato impuesto cedular chihuahua and why is it important?

The formato impuesto cedular chihuahua is a specific tax form required for individuals in Chihuahua, Mexico, to report income and pay taxes. Understanding and using the correct formato is crucial for compliance with local tax regulations, helping individuals avoid penalties and ensure accurate tax filing.

-

How can airSlate SignNow help me with the formato impuesto cedular chihuahua?

airSlate SignNow provides a user-friendly platform for easily preparing, signing, and sending the formato impuesto cedular chihuahua. With customizable templates and secure eSigning features, you can streamline the submission process, making it more efficient and error-free.

-

Is there a cost associated with using airSlate SignNow for formato impuesto cedular chihuahua?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Depending on the features you require for managing the formato impuesto cedular chihuahua, you can choose a plan that fits your budget and workflow requirements, ensuring you get the best value.

-

Can I integrate airSlate SignNow with other platforms for managing the formato impuesto cedular chihuahua?

Absolutely! airSlate SignNow supports integration with a variety of business applications, allowing you to efficiently manage and send the formato impuesto cedular chihuahua alongside your other business workflows. This integration helps streamline operations and enhances productivity.

-

What features does airSlate SignNow offer for handling the formato impuesto cedular chihuahua?

airSlate SignNow includes essential features like document templates, eSigning, cloud storage, and real-time collaboration, all designed to facilitate the handling of the formato impuesto cedular chihuahua. These tools enhance user experience, ensuring a seamless process from document creation to final submission.

-

How secure is airSlate SignNow for sending the formato impuesto cedular chihuahua?

Security is a top priority at airSlate SignNow. The platform utilizes advanced encryption and compliance protocols to ensure that your documents, including the formato impuesto cedular chihuahua, are securely transmitted and stored, protecting sensitive information from unauthorized access.

-

What benefits can I expect when using airSlate SignNow for the formato impuesto cedular chihuahua?

Using airSlate SignNow for the formato impuesto cedular chihuahua offers numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. The digital process makes it easier to manage forms and ensures that you meet all necessary deadlines without the hassles of traditional paperwork.

Get more for Formato Impuesto Cedular Chihuahua

- Information amp instructions for business wv state tax information amp instructions for businessinformation amp instructions

- Free west virginia articles of incorporation templateswv form

- 1 the name of the limited liability company as registered in its home form

- Llc 1 certificate of formation of a nh limited liability company

- Form a new hampshire llc certificate of formation step by

- Fllc 1 application for registration as a foreign nh sos form

- Llc 1 certificate of formation of a nh limited nh sos

- Item 1 enter the complete company name which must include a limited liability company ending required by n form

Find out other Formato Impuesto Cedular Chihuahua

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document