Form 540nr

What is the Form 540nr

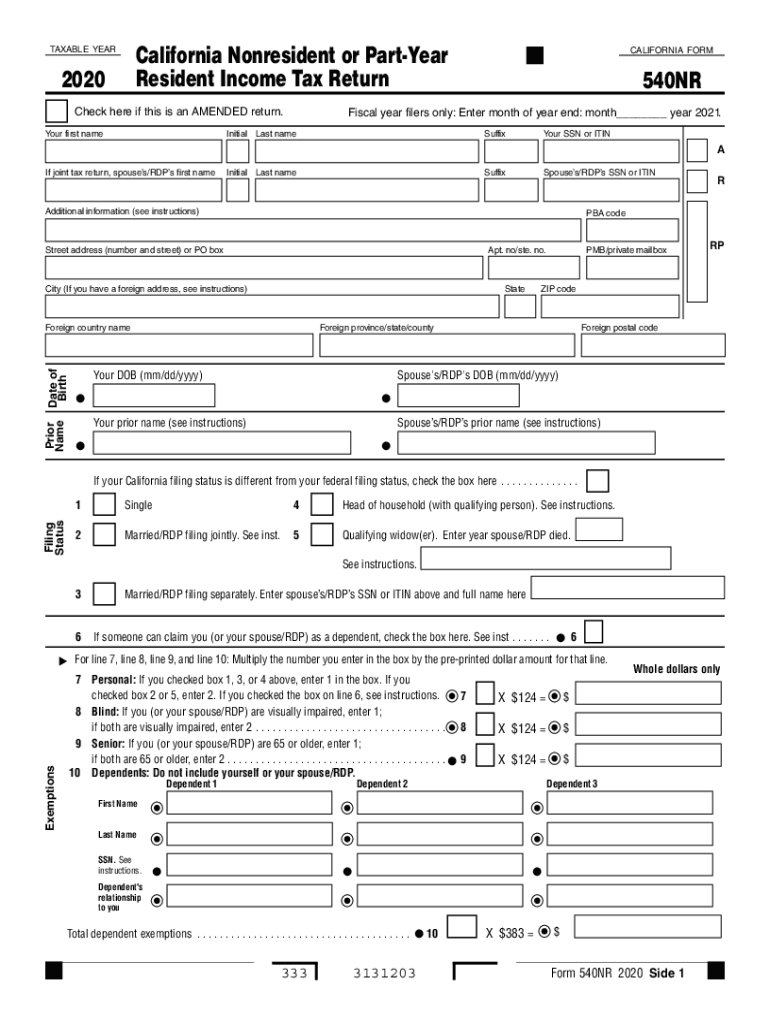

The Form 540nr is a California state income tax return designed for non-residents and part-year residents. It is used to report income earned within California and to calculate the tax owed to the state. This form is essential for individuals who do not meet the residency requirements but have income sourced from California, such as wages, rental income, or business revenue. Completing the Form 540nr accurately ensures compliance with state tax laws and helps avoid potential penalties.

Steps to complete the Form 540nr

Completing the Form 540nr involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status based on your situation, such as single, married filing jointly, or head of household.

- Report your California-source income on the form, ensuring to include all relevant amounts.

- Claim applicable deductions and credits to reduce your taxable income.

- Calculate your total tax liability using the appropriate tax rates.

- Review the completed form for accuracy before submission.

How to obtain the Form 540nr

The Form 540nr can be obtained from the California Franchise Tax Board's website, where it is available for download in PDF format. Additionally, paper copies may be requested by contacting the tax board directly. It is advisable to ensure you are using the correct version of the form corresponding to the tax year for which you are filing.

Legal use of the Form 540nr

The Form 540nr is legally binding when completed and submitted according to California tax laws. To ensure its validity, it must be signed and dated by the taxpayer. Electronic signatures are accepted if they comply with the legal standards set by the state. Using a reliable digital platform for e-signatures can enhance the security and legality of the submission process.

Filing Deadlines / Important Dates

For the tax year 2020, the deadline to file the Form 540nr was typically April 15, 2021. However, extensions may be available under specific circumstances. It is crucial to stay informed about any changes to deadlines, especially in light of varying state regulations or extensions granted due to extraordinary events.

Form Submission Methods (Online / Mail / In-Person)

The Form 540nr can be submitted in several ways:

- Electronically via e-filing through approved tax software, which is often the fastest method.

- By mail, sending the completed form to the address specified by the California Franchise Tax Board.

- In-person at designated tax offices, although this method is less common and may require an appointment.

Quick guide on how to complete form 540nr

Complete Form 540nr effortlessly on any gadget

Digital document management has gained increased traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed records, allowing you to pinpoint the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents rapidly without delays. Handle Form 540nr on any system with airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

How to modify and electronically sign Form 540nr with ease

- Find Form 540nr and then click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced records, monotonous form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Form 540nr while ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 540nr

The way to create an eSignature for a PDF document in the online mode

The way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What are the key features of the airSlate SignNow platform related to 2020 CA 540NR instructions?

The airSlate SignNow platform offers seamless document signing and sharing capabilities, making it easy to handle your 2020 CA 540NR instructions. You can upload, send, and store your documents securely, streamlining your eSignature needs while ensuring compliance with state guidelines.

-

How can airSlate SignNow help me complete my 2020 CA 540NR instructions efficiently?

With airSlate SignNow, you can quickly fill out your 2020 CA 540NR instructions using an intuitive interface. The platform allows you to collaborate with team members in real-time, ensuring that everyone has access to the latest version of your documents for fast and accurate completion.

-

Is there a cost associated with using airSlate SignNow for 2020 CA 540NR instructions?

AirSlate SignNow offers a cost-effective solution for document management, including handling your 2020 CA 540NR instructions. Pricing plans are flexible and tailored to meet the needs of businesses of all sizes, ensuring you get great value for your investment.

-

What integrations does airSlate SignNow offer for managing 2020 CA 540NR instructions?

AirSlate SignNow integrates with numerous applications, enhancing your workflow for 2020 CA 540NR instructions. You can connect with tools like Google Drive, Dropbox, and more, allowing for easy access and sharing of your documents across various platforms.

-

Can I track the status of my 2020 CA 540NR instructions using airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your documents, allowing you to monitor the status of your 2020 CA 540NR instructions. You’ll receive notifications when documents are viewed, signed, or completed, giving you peace of mind throughout the process.

-

What is the benefit of using airSlate SignNow for signing my 2020 CA 540NR instructions?

Using airSlate SignNow for signing your 2020 CA 540NR instructions offers flexibility and convenience. You can sign documents electronically from any device, eliminating the need for printing, scanning, and physically mailing, which saves you time and resources.

-

Is airSlate SignNow compliant with legal standards for 2020 CA 540NR instructions?

Absolutely, airSlate SignNow complies with all legal standards necessary for eSigning, ensuring your 2020 CA 540NR instructions are valid and enforceable. This means you can rely on the platform to meet legal requirements while handling sensitive documents securely.

Get more for Form 540nr

Find out other Form 540nr

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive