540nr Form

What is the 540nr

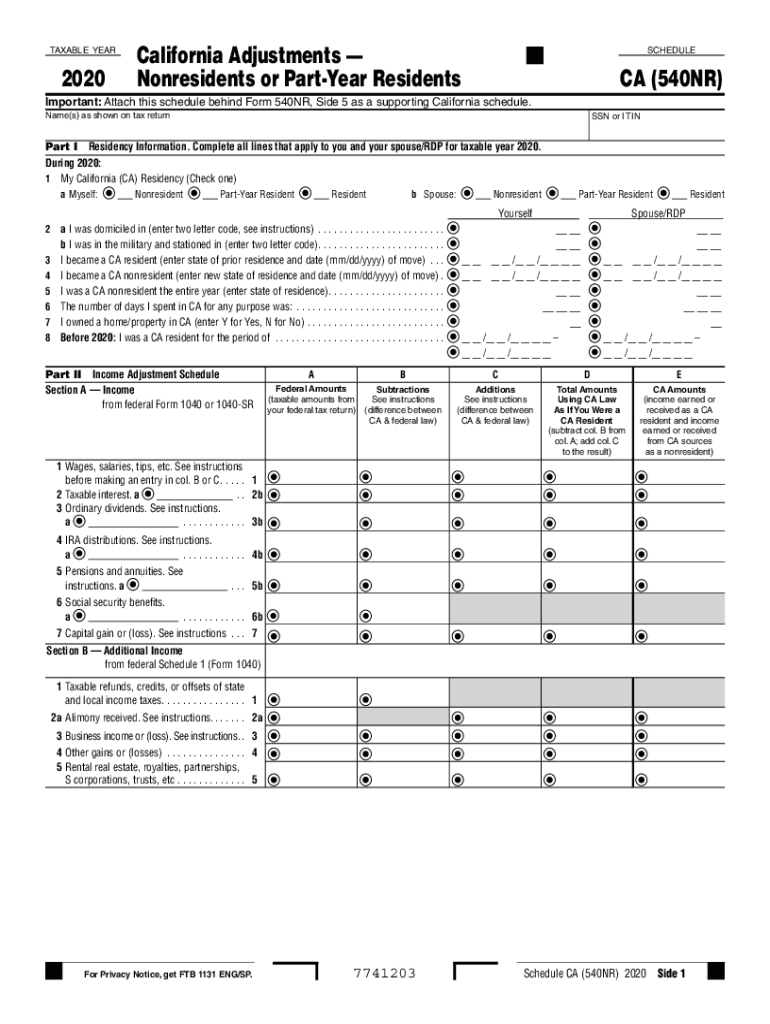

The 540nr is a California tax form designed for non-residents who earn income in the state. This form allows individuals to report their California-source income and calculate their tax liability. The 540nr is essential for ensuring compliance with California tax laws, especially for those who may not reside in the state but have financial ties to it. Understanding the purpose and requirements of the 540nr is crucial for accurate tax reporting.

How to use the 540nr

Using the 540nr involves several steps to ensure accurate completion. First, gather all necessary income documents, such as W-2s and 1099s, which detail your earnings from California sources. Next, download the 2020 540nr California PDF from the appropriate tax authority website. Carefully fill out the form, ensuring that all income is reported accurately. After completing the form, review it for any errors before submission. You can eSign the document for a secure and efficient filing process.

Steps to complete the 540nr

Completing the 540nr requires a systematic approach:

- Gather all relevant income documentation, including forms that report California-source income.

- Download the 2020 540nr PDF and open it using a compatible PDF editor.

- Fill in your personal information, including name, address, and Social Security number.

- Report your income accurately, detailing all sources of income earned in California.

- Calculate your tax liability based on the provided instructions and applicable tax rates.

- Review the form for accuracy and completeness.

- Submit the completed form electronically or by mail, ensuring you keep a copy for your records.

Legal use of the 540nr

The 540nr is legally binding when filled out correctly and submitted in accordance with California tax laws. It is crucial to comply with the requirements set forth by the California Franchise Tax Board. Using a reliable eSigning solution, like signNow, can enhance the legal validity of your submission by providing a digital certificate and ensuring compliance with eSignature laws. This adds an extra layer of security and legitimacy to your tax filing process.

Filing Deadlines / Important Dates

Filing deadlines for the 540nr are critical to avoid penalties. For the 2020 tax year, the deadline to file the 540nr is typically April 15 of the following year. If you require additional time, you may file for an extension, but it is essential to understand that any tax owed must still be paid by the original deadline to avoid interest and penalties. Keeping track of these important dates can help ensure timely compliance with California tax regulations.

Required Documents

To complete the 540nr, several documents are necessary:

- W-2 forms from employers reporting California income.

- 1099 forms for other sources of income, such as freelance work or interest.

- Any additional documentation that supports deductions or credits claimed.

- Identification documents, such as a driver’s license or Social Security number.

Having these documents ready will streamline the process of completing the 540nr and ensure accuracy in reporting.

Quick guide on how to complete 2020 540nr

Effortlessly Prepare 540nr on Any Device

Managing documents online has become increasingly prevalent among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage 540nr on any device using the airSlate SignNow apps for Android or iOS, and simplify any document-related process today.

Edit and eSign 540nr with Ease

- Locate 540nr and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal authority as a conventional handwritten signature.

- Review all information and click the Done button to save your updates.

- Select your preferred method to send your form via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign 540nr to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 540nr

The way to create an eSignature for your PDF online

The way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

How to create an eSignature for a PDF on Android

People also ask

-

What is the 2020 540nr schedule ca, and who needs to file it?

The 2020 540nr schedule ca is a form used by non-residents of California to report income earned in the state. Individuals who have income sourced from California while residing outside the state must complete this form to comply with tax requirements. It's essential for accurate tax reporting and to ensure that you're meeting all necessary regulations.

-

How does airSlate SignNow help with the 2020 540nr schedule ca?

airSlate SignNow provides a seamless electronic signature solution that allows you to complete and send your 2020 540nr schedule ca forms quickly and securely. With its user-friendly interface, you can easily add signatures, initials, and dates to your tax documents. This streamlines the filing process and helps you avoid delays.

-

What features does airSlate SignNow offer for document management related to the 2020 540nr schedule ca?

airSlate SignNow includes features such as document templates, customizable fields, and real-time tracking to enhance your document management experience with the 2020 540nr schedule ca. These tools ensure that you can efficiently prepare and organize your tax documents while keeping them secure. You can also access your documents from anywhere, at any time.

-

Is there a cost associated with using airSlate SignNow for my 2020 540nr schedule ca?

Yes, airSlate SignNow offers cost-effective pricing plans to suit your business needs, making it accessible for individuals preparing the 2020 540nr schedule ca. The platform provides a variety of subscription options, allowing you to choose a plan that fits your budget without compromising on features. You can also take advantage of free trials to explore its functionalities.

-

Can airSlate SignNow integrate with other accounting software for filing the 2020 540nr schedule ca?

Absolutely! airSlate SignNow integrates seamlessly with several popular accounting software solutions, which can assist in preparing and filing the 2020 540nr schedule ca. This ensures that your data is synchronized and minimizes the chances of errors during the filing process. You can easily transfer information and documents between platforms.

-

What benefits do I gain from using airSlate SignNow for my tax documents?

Using airSlate SignNow for your tax documents, including the 2020 540nr schedule ca, brings numerous benefits such as enhanced security, time efficiency, and ease of use. It allows you to electronically sign documents, reducing paperwork and expediting the filing process. Additionally, you can store all your documents securely in the cloud for easy access.

-

How does airSlate SignNow ensure the security of my 2020 540nr schedule ca documents?

airSlate SignNow prioritizes the security of your documents, implementing advanced encryption technologies to safeguard your 2020 540nr schedule ca files. The platform complies with regulatory standards and offers features such as secure sharing options and audit trails to keep track of document access and modifications. You can trust that your sensitive tax information is well-protected.

Get more for 540nr

Find out other 540nr

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe