Ga 500 Es Tax Form

What is the 2021 500 ES Tax?

The 2021 500 ES tax form is a Georgia state estimated tax form used by individuals and businesses to report and pay estimated income taxes. This form is particularly relevant for those who expect to owe tax of $500 or more when filing their annual return. It allows taxpayers to make quarterly payments to avoid penalties and interest on underpayment. The 500 ES form is essential for self-employed individuals, retirees, and anyone with income not subject to withholding.

Steps to Complete the 2021 500 ES Tax

Completing the 2021 500 ES tax form involves several straightforward steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your expected taxable income for the year to estimate your tax liability.

- Determine the amount to pay for each quarter, typically based on your estimated annual tax divided by four.

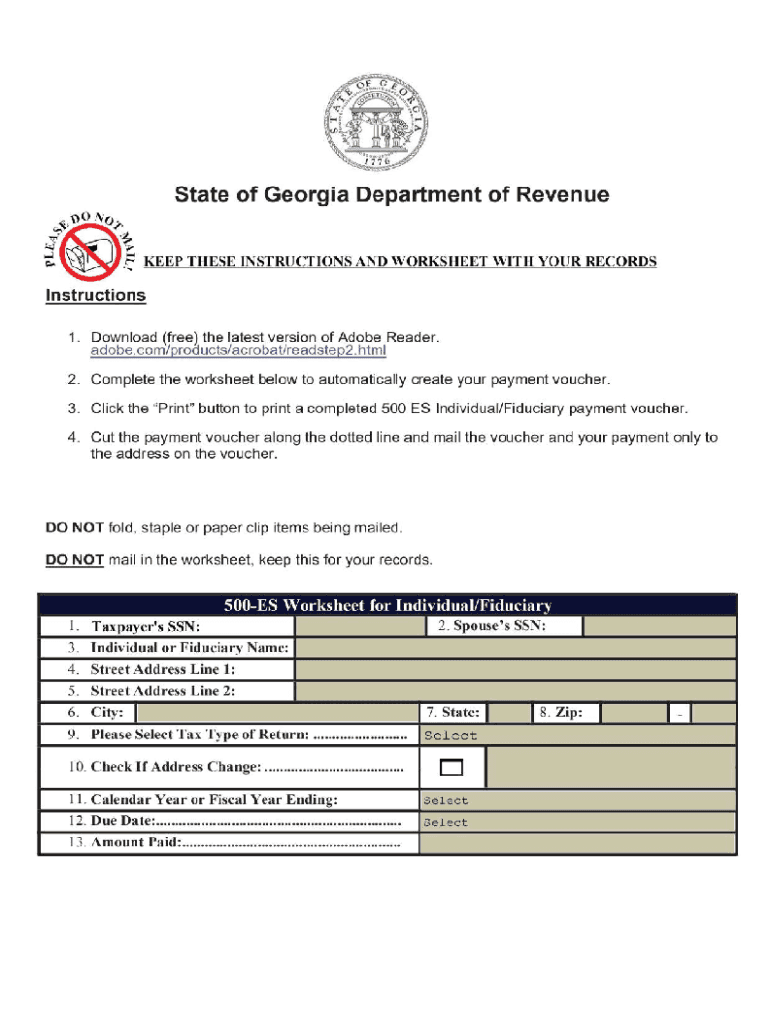

- Fill out the 500 ES form with your personal information and estimated payment amounts.

- Submit the completed form along with your payment to the Georgia Department of Revenue.

Legal Use of the 2021 500 ES Tax

The 2021 500 ES tax form is legally recognized as a valid method for reporting and paying estimated taxes in Georgia. To ensure compliance, taxpayers must adhere to the guidelines set forth by the Georgia Department of Revenue. This includes submitting the form on time and paying the correct estimated amounts. Using digital tools like e-signatures can enhance the security and legality of the submission process.

Filing Deadlines / Important Dates

Filing deadlines for the 2021 500 ES tax form are crucial to avoid penalties. Typically, estimated tax payments are due on the following dates:

- First quarter: April 15, 2021

- Second quarter: June 15, 2021

- Third quarter: September 15, 2021

- Fourth quarter: January 15, 2022

It is important to mark these dates on your calendar to ensure timely submissions.

Required Documents

To complete the 2021 500 ES tax form, you will need several documents, including:

- Previous year’s tax return for reference.

- Income statements such as W-2s or 1099s.

- Records of any other income sources, including rental or investment income.

- Documentation of any deductions or credits you plan to claim.

Form Submission Methods

The 2021 500 ES tax form can be submitted through various methods:

- Online via the Georgia Department of Revenue website, which offers a secure portal for electronic submissions.

- By mail, sending the completed form and payment to the appropriate address provided by the state.

- In-person at designated Georgia Department of Revenue offices, where you can receive assistance if needed.

Quick guide on how to complete ga 500 es tax

Complete Ga 500 Es Tax effortlessly on any device

Web-based document management has become widely embraced by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without holdups. Manage Ga 500 Es Tax on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The simplest way to modify and electronically sign Ga 500 Es Tax seamlessly

- Locate Ga 500 Es Tax and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Formulate your signature using the Sign feature, taking only seconds and carrying the same legal authority as a traditional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Choose your preferred method of sending your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Ga 500 Es Tax to ensure effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ga 500 es tax

The way to generate an electronic signature for a PDF online

The way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What is the 2021 500 ES tax form, and who needs to file it?

The 2021 500 ES tax form is an estimated tax payment voucher for individuals and businesses who expect to owe more than $500 in taxes. It's essential for taxpayers to file this form to avoid penalties for underpayment. If you are self-employed or receive income from investments, ensure that you understand your obligations regarding the 2021 500 ES tax.

-

How can airSlate SignNow assist with the 2021 500 ES tax form?

AirSlate SignNow streamlines the process of completing and sending documents like the 2021 500 ES tax form. With its easy-to-use interface, you can fill out forms quickly and securely eSign them. This ensures you meet tax deadlines without hassle.

-

Is there a cost associated with using airSlate SignNow for 2021 500 ES tax submissions?

AirSlate SignNow offers cost-effective pricing plans that cater to various business needs. By subscribing, you gain access to features that simplify the submission of documents, including the 2021 500 ES tax form. Investing in our solution can save you time and enhance your productivity.

-

What features does airSlate SignNow offer to help with tax documentation?

AirSlate SignNow provides features such as template management, document workflows, and electronic signatures, all designed to facilitate the preparation and submission of tax documents like the 2021 500 ES tax form. These tools help ensure your documents are completed correctly and delivered on time, reducing the risk of errors.

-

Can airSlate SignNow integrate with my existing accounting software for managing the 2021 500 ES tax?

Yes, airSlate SignNow offers integrations with popular accounting software that can help manage your tax documentation, including the 2021 500 ES tax form. This integration simplifies the flow of information between your systems, enhancing efficiency and accuracy in tax preparation.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents provides numerous benefits, including the ability to eSign documents securely, improved collaboration among team members, and automated workflows for managing submissions. With its user-friendly interface, you can track the status of your 2021 500 ES tax form submissions easily.

-

How does airSlate SignNow ensure the security of sensitive tax documents?

AirSlate SignNow prioritizes the security of your sensitive tax documents through advanced encryption and data protection measures. The platform complies with industry-standard regulations to ensure that information related to forms like the 2021 500 ES tax is securely handled, giving you peace of mind.

Get more for Ga 500 Es Tax

- Foyer global health reviews form

- Infectious disease worksheet answers form

- Rental property information sheet template

- Counterfeit note report example form

- Statement of non ownership of vehicle florida form

- Affidavit for efiling application form

- Empire life claim form pdf

- Examscouncil org sz apply form

Find out other Ga 500 Es Tax

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free