Form 941

What is the Form 941

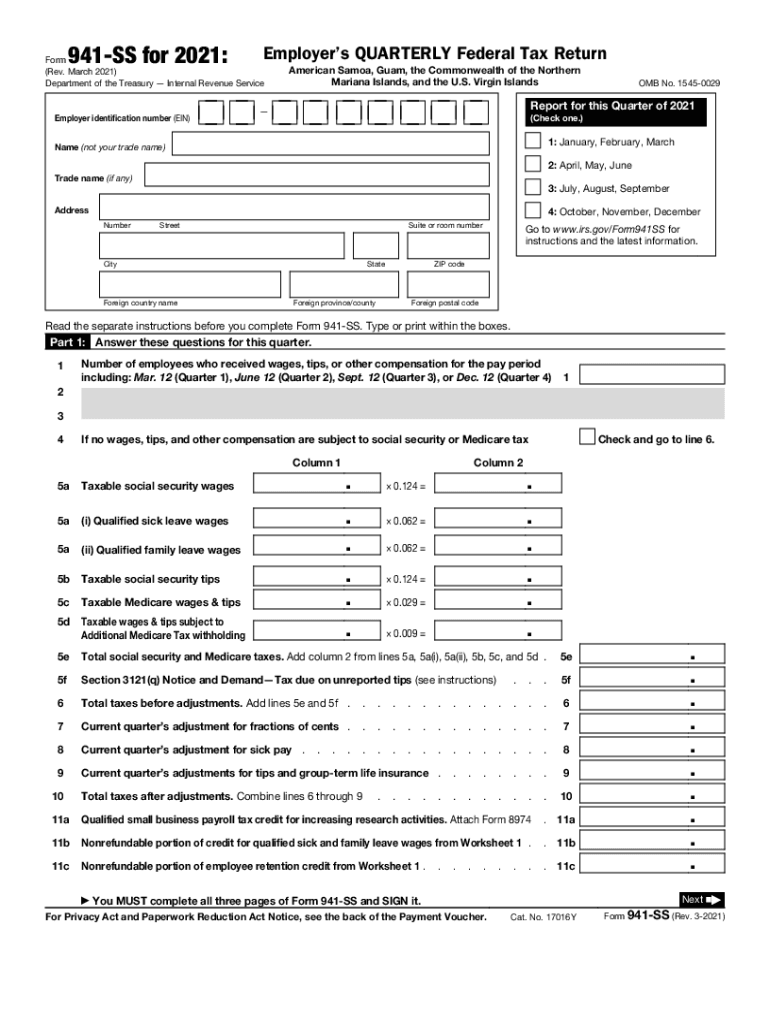

The Form 941, officially known as the Employer's Quarterly Federal Tax Return, is a crucial document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employees' wages. It is essential for businesses to accurately report these amounts to the Internal Revenue Service (IRS) on a quarterly basis. The form also provides information on the employer's portion of Social Security and Medicare taxes, ensuring compliance with federal tax obligations.

How to use the Form 941

Using the Form 941 requires careful attention to detail. Employers must fill out the form with accurate information regarding their employees' wages, the taxes withheld, and the employer's tax liability. Each quarter, the form must be completed and submitted to the IRS, reflecting the payroll activities for that specific period. It is important to retain copies of the submitted forms for record-keeping and future reference, as they may be needed for audits or other inquiries.

Steps to complete the Form 941

Completing the Form 941 involves several key steps:

- Gather necessary documentation, including payroll records and previous tax returns.

- Fill out the employer identification information at the top of the form.

- Report the total number of employees and their wages for the quarter.

- Calculate the amount of federal income tax withheld, along with Social Security and Medicare taxes.

- Complete the section detailing any adjustments for the quarter, if applicable.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

Filing deadlines for Form 941 are critical for compliance. Employers must submit the form by the last day of the month following the end of each quarter. The specific deadlines are:

- First quarter (January to March): Due by April 30

- Second quarter (April to June): Due by July 31

- Third quarter (July to September): Due by October 31

- Fourth quarter (October to December): Due by January 31 of the following year

Legal use of the Form 941

The Form 941 is legally binding when completed and submitted according to IRS guidelines. Employers must ensure that all information provided is accurate and truthful to avoid penalties. Misreporting or failure to file can lead to significant fines and legal repercussions. Adhering to the guidelines set forth by the IRS is essential for maintaining compliance and protecting the business from legal issues.

Key elements of the Form 941

Key elements of the Form 941 include:

- Employer identification information, including the Employer Identification Number (EIN).

- Total wages paid to employees during the quarter.

- Federal income tax withheld from employee wages.

- Employer and employee portions of Social Security and Medicare taxes.

- Adjustments for any overpayments or corrections from previous filings.

Quick guide on how to complete form 941 557838144

Effortlessly Prepare Form 941 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Handle Form 941 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Form 941 with Ease

- Locate Form 941 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you prefer to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, frustrating form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form 941 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 941 557838144

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the printable 941 form 2021?

The printable 941 form 2021 is a tax form used by employers to report the wages they’ve paid and taxes withheld. It is essential for keeping accurate payroll records and ensuring compliance with tax regulations. For businesses looking to accurately file their payroll taxes, utilizing the printable 941 form 2021 is crucial.

-

How can I obtain the printable 941 form 2021?

You can easily obtain the printable 941 form 2021 directly from the IRS website or through reliable eSignature platforms like airSlate SignNow. With our solution, you can upload and securely store your documents, including the printable 941 form 2021, for easy access anytime. Make sure to download the form in a printable format for your convenience.

-

What are the benefits of using airSlate SignNow for the printable 941 form 2021?

Using airSlate SignNow for the printable 941 form 2021 allows for a seamless electronic signature process, saving you time and reducing paperwork. Our platform ensures that all documents are securely stored and can be easily retrieved when needed. Additionally, you can track document status in real-time, providing transparency and efficiency to your payroll process.

-

Is airSlate SignNow affordable for small businesses needing the printable 941 form 2021?

Absolutely! airSlate SignNow offers a cost-effective solution, making it accessible for small businesses to utilize the printable 941 form 2021. With our flexible pricing plans, you can select a package that fits your budget, ensuring you have the necessary tools to manage your payroll documentation efficiently. You can sign up today and enjoy a free trial to see if it meets your needs.

-

Can I integrate airSlate SignNow with other tools for handling the printable 941 form 2021?

Yes, airSlate SignNow integrates seamlessly with several leading business tools, allowing for efficient handling of the printable 941 form 2021. Whether you use accounting software or project management tools, our integrations enhance the productivity of your workflow. This ensures that your tax forms, including the printable 941 form 2021, are easily accessible across various applications.

-

How secure is airSlate SignNow for managing the printable 941 form 2021?

Security is a top priority at airSlate SignNow, especially when handling important documents like the printable 941 form 2021. Our platform uses advanced encryption technologies to protect your data and ensure that your sensitive information remains confidential. Additionally, we comply with all necessary regulations to keep your documents secure during storage and transmission.

-

Can I digitally sign the printable 941 form 2021 with airSlate SignNow?

Yes, you can easily digitally sign the printable 941 form 2021 with airSlate SignNow. Our intuitive electronic signature tools enable you to complete and sign documents securely in just a few clicks. This digital solution streamlines your process, making it more efficient without compromising legal compliance.

Get more for Form 941

Find out other Form 941

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure