Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return or Claim for Refund

What is the Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund

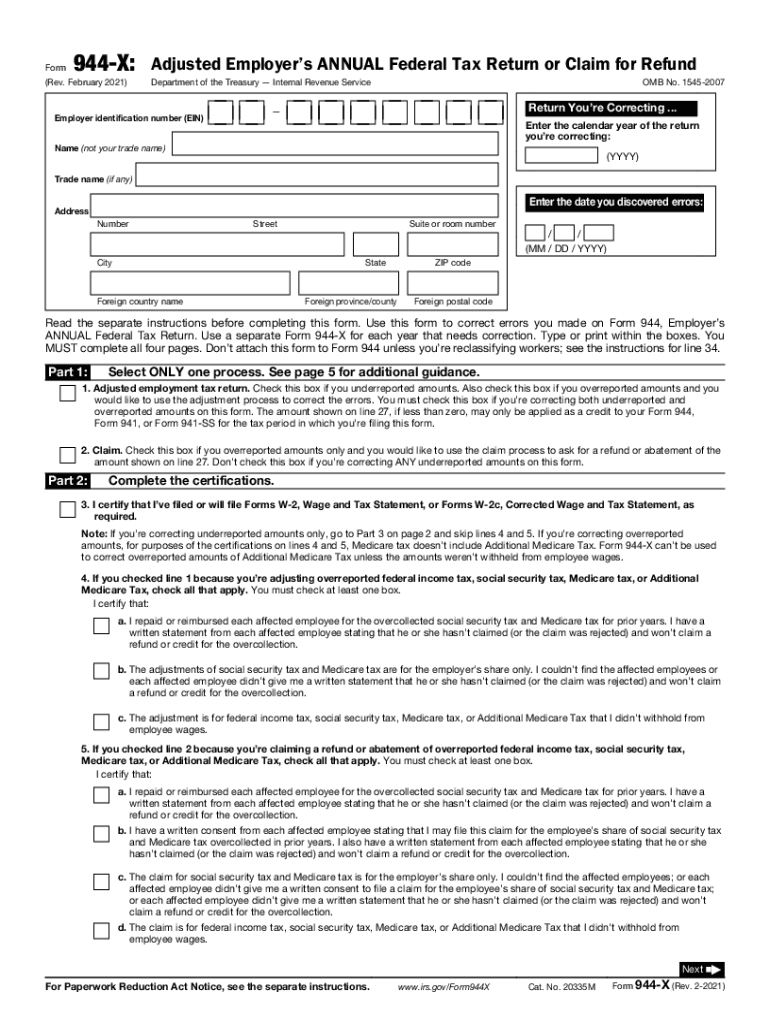

The Form 944 X Rev February is a crucial document for employers who need to amend their annual federal tax return. This form allows businesses to correct errors made on their original Form 944, which reports the employer's annual federal tax liability. It is specifically designed for those who need to claim a refund or adjust their reported tax amounts. Understanding the purpose and proper use of this form is essential for ensuring compliance with IRS regulations and for accurately managing tax obligations.

How to Obtain the Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund

Employers can easily obtain the Form 944 X Rev February from the IRS website. The form is available for download in PDF format, allowing for easy access and printing. Additionally, businesses can request a physical copy by contacting the IRS directly. It is important to ensure that the correct version of the form is used, as updates may occur over time, affecting the filing process.

Steps to Complete the Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund

Completing the Form 944 X Rev February involves several key steps to ensure accuracy and compliance:

- Begin by entering your employer identification number (EIN) at the top of the form.

- Indicate the tax year for which you are amending the return.

- Provide details of the original amounts reported on Form 944, including wages and tax withheld.

- List the corrected amounts, clearly indicating any adjustments made.

- Sign and date the form, ensuring that it is submitted to the IRS by the appropriate deadline.

Legal Use of the Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund

The legal use of the Form 944 X Rev February is governed by IRS guidelines, which stipulate that it must be filed to correct any inaccuracies in previously submitted tax returns. This form is legally binding when completed correctly, and it is essential for maintaining compliance with federal tax laws. Filing this form helps protect employers from potential penalties or audits related to incorrect tax reporting.

IRS Guidelines for Filing the Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund

The IRS provides specific guidelines for filing the Form 944 X Rev February. Employers should ensure they are familiar with these requirements, including:

- Filing deadlines, which are critical to avoid penalties.

- Documentation needed to support the corrections being made.

- How to submit the form, whether online or via mail.

Adhering to these guidelines ensures a smoother filing process and helps mitigate issues with the IRS.

Filing Deadlines for the Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund

Filing deadlines for the Form 944 X Rev February are essential to avoid late fees and penalties. Generally, the form must be filed within three years from the date the original return was filed or within two years from the date the tax was paid, whichever is later. It is advisable to keep track of these deadlines to ensure timely submissions and compliance with IRS regulations.

Quick guide on how to complete form 944 x rev february 2021 adjusted employers annual federal tax return or claim for refund

Complete Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund seamlessly

- Locate Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize essential sections of your documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Modify and eSign Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund and maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 944 x rev february 2021 adjusted employers annual federal tax return or claim for refund

The best way to make an eSignature for your PDF in the online mode

The best way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the process to eSign documents related to my tax refund 2021?

To eSign documents related to your tax refund 2021, simply upload your documents to airSlate SignNow. You can then add your signature and any required initials directly on the document. This process ensures that your tax documents are securely signed and stored for easy access.

-

What pricing plans does airSlate SignNow offer for handling tax documents?

airSlate SignNow offers several pricing plans tailored to meet different business needs, starting with a free trial. Each plan provides features that enhance the management of documents such as those for tax refund 2021. You can choose a plan that suits your volume of document signing needs and budget.

-

How can airSlate SignNow help speed up my tax refund 2021?

By using airSlate SignNow, you can streamline the signing process for documents related to your tax refund 2021. This means quicker turnaround times and reduced waiting on signatures, which can lead to a faster filing and thus expedite your refund. Our platform makes it easy to send and track your documents.

-

What integrations does airSlate SignNow support for tax-related documents?

airSlate SignNow seamlessly integrates with popular accounting and tax software, enhancing your workflow for tax refund 2021. Integrations with platforms like QuickBooks and Xero allow for easy sharing and management of financial documents. This ensures all your tax-related information is well coordinated.

-

Is it secure to use airSlate SignNow for my tax refund 2021 documents?

Yes, airSlate SignNow utilizes industry-leading security measures to protect your documents, including those related to tax refund 2021. We comply with regulations and employ encryption, ensuring your sensitive information is safe throughout the signing process. Your peace of mind is our priority.

-

Can I customize my documents for tax refund 2021 using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your documents for tax refund 2021, including adding logos, text, and fields for signatures or initials. Our user-friendly interface makes it easy to create personalized documents that fit your specific needs.

-

What support options are available if I have questions about tax refund 2021?

If you have questions regarding tax refund 2021 and using airSlate SignNow, we offer extensive support options. This includes a detailed knowledge base, live chat support, and email assistance. Our team is here to help you navigate any issues you may encounter.

Get more for Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund

- Utsa certification request form

- Rogers monitor form

- Printable mileage log form

- Respirator inspection checklist form

- Mike ferry listing presentation form

- Elizabethtown net profits license fee return form

- Golf cart liability waiver lake linganore association form

- Loan signing prep sheets pdf 401713020 form

Find out other Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer