SBA Disaster Business Loan Application Business Loan Application Form

Understanding the SBA Disaster Business Loan Application

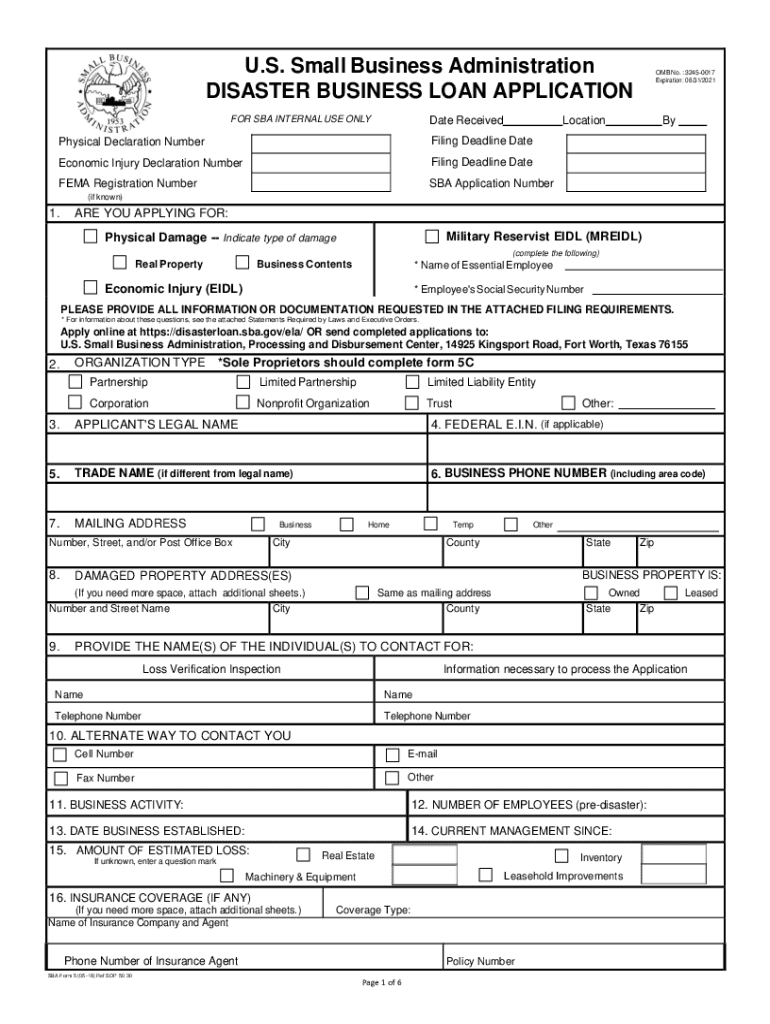

The SBA disaster business loan application is designed to assist small businesses affected by declared disasters. This loan program provides vital financial support to help businesses recover and rebuild. The application process requires specific information about your business, including financial statements, tax returns, and details about the disaster's impact on your operations. Understanding the purpose and requirements of this application is essential for a successful submission.

Eligibility Criteria for the SBA Disaster Loan

To qualify for the SBA disaster business loan, applicants must meet certain eligibility criteria. These include being a small business as defined by the SBA, demonstrating that the business has been adversely affected by a declared disaster, and being located in a designated disaster area. Additionally, the business must have a sound credit history and the ability to repay the loan. Ensuring that you meet these criteria before applying can streamline the process.

Steps to Complete the SBA Disaster Business Loan Application

Completing the SBA disaster business loan application involves several key steps. First, gather all necessary documentation, including financial records and proof of the disaster's impact. Next, fill out the application form accurately, ensuring that all information is complete and truthful. After submitting the application, be prepared to respond to any requests for additional information from the SBA. Following these steps carefully can enhance your chances of approval.

Required Documents for the SBA Disaster Loan

When applying for the SBA disaster business loan, you will need to provide various documents to support your application. Commonly required documents include:

- Business tax returns for the past three years

- Financial statements, including profit and loss statements

- Personal financial statements for business owners

- Evidence of the disaster's impact, such as insurance claims or photographs

Having these documents ready will help facilitate a smoother application process.

Application Process and Approval Time

The application process for the SBA disaster business loan typically involves submitting your completed application along with the required documents. Once submitted, the SBA will review your application and may request additional information. The approval time can vary based on the volume of applications and the complexity of your case, but it generally takes several weeks. Staying informed about your application's status can help you plan accordingly.

Legal Use of the SBA Disaster Business Loan Application

The SBA disaster business loan application is legally binding, meaning that all information provided must be accurate and truthful. Misrepresentation or failure to disclose relevant information can lead to penalties, including denial of the loan or legal repercussions. It is crucial to understand the legal implications of your application and ensure compliance with all SBA guidelines throughout the process.

Quick guide on how to complete sba disaster business loan application business loan application

Effortlessly Prepare SBA Disaster Business Loan Application Business Loan Application on Any Device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the appropriate form and safely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without hold-ups. Handle SBA Disaster Business Loan Application Business Loan Application on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

The Simplest Method to Modify and eSign SBA Disaster Business Loan Application Business Loan Application Without Stress

- Locate SBA Disaster Business Loan Application Business Loan Application and click on Get Form to begin.

- Employ the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive data with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to missing or lost files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in a few clicks from whichever device you prefer. Modify and electronically sign SBA Disaster Business Loan Application Business Loan Application to guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sba disaster business loan application business loan application

The way to create an eSignature for a PDF file in the online mode

The way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is the sba disaster loan login process?

The SBA disaster loan login process is straightforward and user-friendly. To access your account, visit the official SBA website, navigate to the login section, and enter your credentials. Once logged in, you can manage your loan applications, check statuses, and perform other necessary actions.

-

What features does airSlate SignNow offer to assist with SBA disaster loan applications?

airSlate SignNow provides an easy-to-use platform for eSigning and sending documents relevant to the SBA disaster loan application. Users can quickly fill out, sign, and send necessary forms electronically, ensuring a smooth and efficient application process. Automation features also help streamline document management and signing workflows.

-

How does pricing work for airSlate SignNow when applying for an SBA disaster loan?

airSlate SignNow offers various pricing plans that cater to different business needs, ensuring that you can find a suitable option when managing your SBA disaster loan documents. Pricing is transparent, and users can select from monthly or annual subscriptions based on their requirements. Moreover, the platform often provides discounts for long-term commitments.

-

Are there any benefits to using airSlate SignNow for the SBA disaster loan process?

Using airSlate SignNow for your SBA disaster loan process offers several benefits, including enhanced efficiency and reduced processing time. The platform allows for easy collaboration between parties, enabling you to gather signatures quickly and securely. Additionally, it helps ensure compliance with legal guidelines associated with electronic signatures.

-

Can airSlate SignNow integrate with other applications when handling SBA disaster loan documentation?

Yes, airSlate SignNow supports various integrations with popular applications, making it easier to manage documentation related to your SBA disaster loan. You can connect tools like Google Drive, Dropbox, and many others to store and access your documents seamlessly. This integration enhances your workflow, making the entire process more efficient.

-

What security measures does airSlate SignNow implement for SBA disaster loan logins?

airSlate SignNow takes security seriously, implementing robust measures to protect your data during the SBA disaster loan login process. Features like data encryption, secure access protocols, and authentication mechanisms ensure that your information remains safe. You can trust that your sensitive documents are handled with the utmost care.

-

Is there customer support available for airSlate SignNow users during the SBA disaster loan process?

Absolutely! airSlate SignNow offers dedicated customer support to assist users during the SBA disaster loan process. Whether you have questions regarding the login system or need help with document signing, their support team is ready to provide assistance through various channels, including email and live chat.

Get more for SBA Disaster Business Loan Application Business Loan Application

Find out other SBA Disaster Business Loan Application Business Loan Application

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free