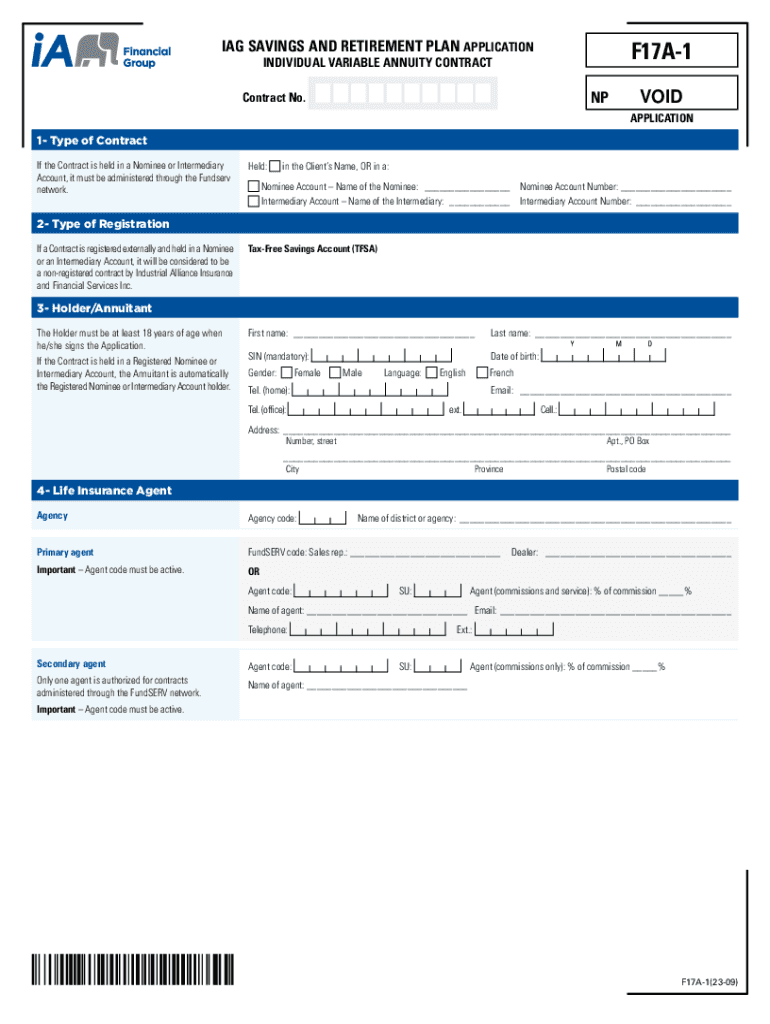

F17A 1 Application TFSA Tax Savings Account Form

What is the F17A 1 Application TFSA Tax Savings Account

The F17A 1 Application TFSA Tax Savings Account is a specific form used to establish a Tax-Free Savings Account (TFSA) in the United States. This account allows individuals to save and invest money without incurring taxes on the income earned within the account. The form is essential for anyone looking to benefit from the tax advantages provided by a TFSA, making it a valuable tool for financial planning and savings growth.

Steps to complete the F17A 1 Application TFSA Tax Savings Account

Completing the F17A 1 Application involves several key steps:

- Gather necessary information: Collect personal details, including your Social Security number, contact information, and financial information.

- Fill out the application: Provide accurate information in the designated fields on the form, ensuring all details are correct to avoid delays.

- Review the application: Double-check all entries for accuracy and completeness before submission.

- Submit the application: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent to the appropriate authority.

Eligibility Criteria

To qualify for a TFSA, applicants must meet specific eligibility criteria, including:

- Being a legal resident of the United States.

- Being at least eighteen years old at the time of application.

- Having a valid Social Security number.

Meeting these criteria is essential for successfully opening a TFSA and enjoying its tax benefits.

Required Documents

When completing the F17A 1 Application, certain documents are typically required to verify your identity and eligibility. These may include:

- Proof of identity, such as a government-issued ID.

- Social Security card or documentation showing your Social Security number.

- Proof of residency, which may include utility bills or bank statements.

Having these documents ready can streamline the application process and ensure compliance with regulatory requirements.

Form Submission Methods

The F17A 1 Application can be submitted through various methods, depending on your preference:

- Online: Many applicants prefer to submit their forms electronically for convenience.

- By mail: You can print the completed form and send it to the designated address.

- In person: Some individuals may choose to deliver the form directly to the relevant office.

Each method has its advantages, so consider your circumstances when choosing how to submit your application.

IRS Guidelines

It is important to adhere to IRS guidelines when filling out the F17A 1 Application. These guidelines outline the rules and regulations governing the use of TFSAs, including contribution limits and withdrawal rules. Familiarizing yourself with these guidelines can help you maximize the benefits of your TFSA while ensuring compliance with tax laws.

Quick guide on how to complete f17a 1 application tfsa tax savings account

Effortlessly Prepare F17A 1 Application TFSA Tax Savings Account on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed papers, as you can easily locate the correct form and securely save it online. airSlate SignNow provides all the tools you require to compose, modify, and electronically sign your documents rapidly without interruptions. Manage F17A 1 Application TFSA Tax Savings Account across any platform using the airSlate SignNow applications for Android or iOS, and enhance any document-related task today.

The simplest way to alter and electronically sign F17A 1 Application TFSA Tax Savings Account with ease

- Find F17A 1 Application TFSA Tax Savings Account and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with specific tools that airSlate SignNow offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or a sharing link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your preference. Modify and electronically sign F17A 1 Application TFSA Tax Savings Account and guarantee seamless communication at any stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f17a 1 application tfsa tax savings account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the F17A 1 Application TFSA Tax Savings Account?

The F17A 1 Application TFSA Tax Savings Account is a form used to apply for a Tax-Free Savings Account in Canada. This account allows individuals to earn tax-free investment income, making it a valuable tool for saving and investing. Understanding this application is crucial for maximizing your tax savings.

-

How can airSlate SignNow help with the F17A 1 Application TFSA Tax Savings Account?

airSlate SignNow simplifies the process of completing and submitting the F17A 1 Application TFSA Tax Savings Account. With our eSigning features, you can easily fill out, sign, and send your application securely. This streamlines the process, ensuring you can focus on your savings goals.

-

What are the benefits of using airSlate SignNow for my TFSA application?

Using airSlate SignNow for your F17A 1 Application TFSA Tax Savings Account offers numerous benefits, including enhanced security and ease of use. Our platform allows you to track your document's status and ensures compliance with legal standards. This means you can submit your application confidently and efficiently.

-

Is there a cost associated with using airSlate SignNow for the F17A 1 Application?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. The cost is competitive and reflects the value of our secure eSigning and document management features. Investing in our service can save you time and enhance your application process for the F17A 1 Application TFSA Tax Savings Account.

-

Can I integrate airSlate SignNow with other applications for my TFSA account?

Absolutely! airSlate SignNow supports integrations with various applications, making it easy to manage your F17A 1 Application TFSA Tax Savings Account alongside your other financial tools. This seamless integration enhances your workflow and ensures all your documents are in one place.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features for document management, including customizable templates, secure storage, and real-time tracking. These features are particularly useful for managing your F17A 1 Application TFSA Tax Savings Account, ensuring you have everything you need at your fingertips. Our platform is designed to simplify your document processes.

-

How secure is my information when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We use advanced encryption and security protocols to protect your information while you complete your F17A 1 Application TFSA Tax Savings Account. You can trust that your sensitive data is safe with us throughout the entire process.

Get more for F17A 1 Application TFSA Tax Savings Account

- Form 5dc55

- City hawaii or a form

- Each month during the term hereof commencing 20 form

- I the defendant acknowledge receipt of a filed copy of the complaint and summons in the above entitled action form

- This packet assumes both parties can agree on everything write form

- Defendants full name form

- Regular claims hawaii state judiciary form

- Answering a complaint in probate ampamp family court form

Find out other F17A 1 Application TFSA Tax Savings Account

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free