Instructions for Form 1098 Instructions for Form 1098, Mortgage Interest Statement,

Understanding the 1098 Mortgage Interest Statement

The 1098 mortgage interest statement is a crucial document for homeowners in the United States. It is issued by lenders to report the amount of mortgage interest paid during the tax year. This statement is essential for taxpayers who wish to claim mortgage interest deductions on their federal income tax returns. The form includes vital information such as the borrower's name, the lender's name, and the total interest paid, which can significantly impact tax liabilities.

Steps to Complete the 1098 Mortgage Interest Statement

Completing the 1098 mortgage interest statement involves several key steps. First, gather all relevant information, including your mortgage account number and details about the lender. Next, accurately fill in the borrower and lender information, ensuring that names and addresses match official records. Report the total interest paid, which can be found on your monthly mortgage statements. Finally, review the completed form for accuracy before submitting it with your tax return.

Key Elements of the 1098 Mortgage Interest Statement

The 1098 mortgage interest statement contains several key elements that are important for tax reporting. These include:

- Borrower Information: Name, address, and social security number of the borrower.

- Lender Information: Name and address of the financial institution.

- Mortgage Interest Paid: Total amount of interest paid during the tax year.

- Points Paid: Any points paid on the mortgage, which may also be deductible.

Understanding these elements can help ensure that homeowners accurately report their mortgage interest on their tax returns.

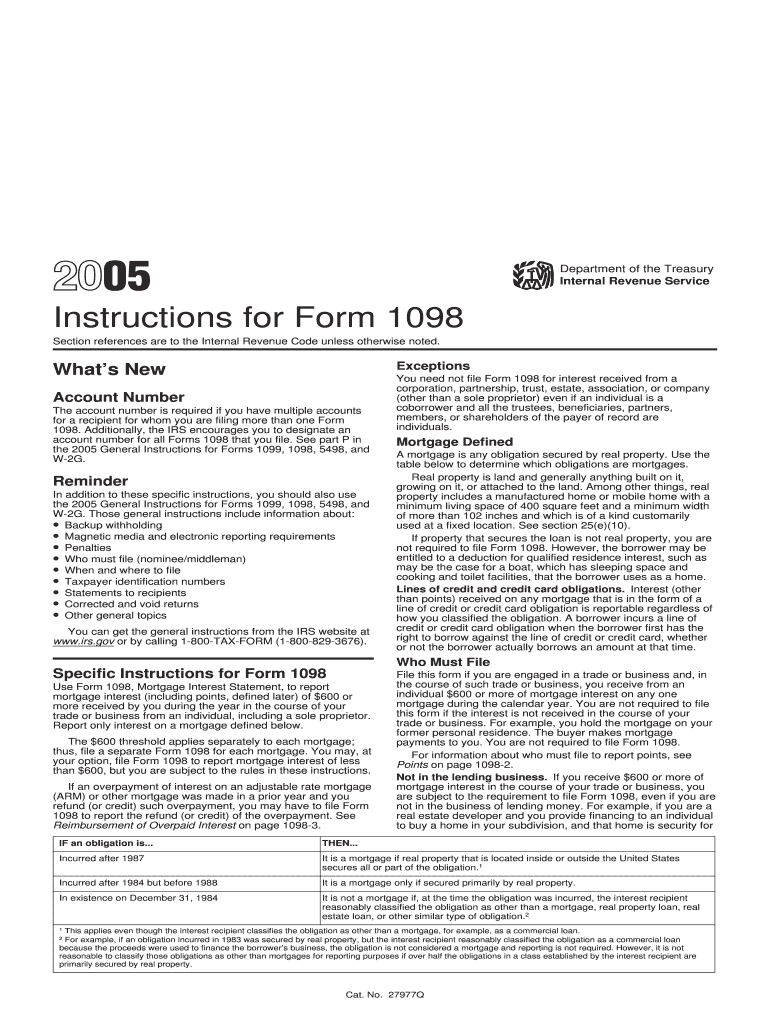

IRS Guidelines for the 1098 Mortgage Interest Statement

The Internal Revenue Service (IRS) has specific guidelines regarding the 1098 mortgage interest statement. Lenders are required to issue this form to borrowers if they have paid $600 or more in mortgage interest during the year. The IRS also mandates that borrowers retain this document for their records, as it serves as proof of interest payments for tax purposes. Familiarizing oneself with these guidelines can help ensure compliance and maximize potential tax benefits.

Obtaining the 1098 Mortgage Interest Statement

Homeowners can obtain their 1098 mortgage interest statement directly from their mortgage lender. Most lenders provide this form automatically at the beginning of each year, either through physical mail or electronically via secure online portals. If a borrower does not receive their statement, they should contact their lender to request a copy. It is essential to have this document on hand when preparing tax returns to ensure accurate reporting of mortgage interest deductions.

Legal Use of the 1098 Mortgage Interest Statement

The 1098 mortgage interest statement is legally binding and must be accurate to avoid potential penalties from the IRS. Homeowners are responsible for ensuring that the information reported on their tax returns matches the data provided on the 1098 form. Any discrepancies can lead to audits or additional taxes owed. Therefore, understanding the legal implications of this document is crucial for homeowners seeking to claim mortgage interest deductions.

Quick guide on how to complete 2005 instructions for form 1098 instructions for form 1098 mortgage interest statement

Complete Instructions For Form 1098 Instructions For Form 1098, Mortgage Interest Statement, effortlessly on any device

Digital document management has become increasingly popular with businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Instructions For Form 1098 Instructions For Form 1098, Mortgage Interest Statement, on any device using airSlate SignNow's Android or iOS apps and enhance any document-driven process today.

How to modify and eSign Instructions For Form 1098 Instructions For Form 1098, Mortgage Interest Statement, with ease

- Find Instructions For Form 1098 Instructions For Form 1098, Mortgage Interest Statement, and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Instructions For Form 1098 Instructions For Form 1098, Mortgage Interest Statement, and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I get a form 1098 for a mortgage I have in France to prepare my tax returns?

You will have to order the form from Internal Revenue Service. You can order it here, Online Ordering for Information Returns and Employer Returns. Scroll down to find the form you are looking for. It will probably take awhile to receive it, but while you are waiting you can look over this online form to know what you need to fill it out, Page on irs.gov. You may have to file an extension to include it with your taxes. Be sure to send in an estimated payment (if you think you owe taxes) to the IRS by April 15, 2015 to avoid penalties.The official form is red and scannable, the pdf is not.

-

I am an international student who will need to file a tax return; would it be convenient for me to also fill a 1098-t form?

You do not complete a 1098T. If you paid qualifying tuition, then your school will send you a 1098-T. That will support your educational tax credits or deduction if you qualify to take them on a US tax return. You might check Am I Eligible to Claim an Education Credit?

-

What's the best way to get users to read a set of instructions for filling out a form?

Your question confuses me a bit. What's missing is "WHY are the instructions displayed?" What makes them so important? More to the point, what makes them so important to the user?You say it's a simple form, but also say they must read the instructions before filling it out. If it's simple, what are all the instructions for? I haven't seen the form and already I'm confused.People will do things if they understand (and agree with) the purpose for doing them. If they don't understand the need for the instructions (e.g. because the form appears to be simple), you'll have a hard time getting users to read them (they won't see the need).My suggestion would be to take a step back from the design a bit and look at the form's purpose. If the instructions are to minimize data entry errors, look for ways in your design to do that and eliminate an instruction or two. For example, do real-time validation of things like zip codes, phone numbers, usernames, and anything else your web page can do.If the instructions are to educate the user on some specific process, look at the process to see if it can be made simpler or more obvious such that it doesn't need any explanation.Finally, don't forget user testing--ask some potential (or representative) users what they think works for them.

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

How do you figure out if you owe the IRS on form 1040 when the instructions are the same for figuring out your refund?

You compare the amount of tax you owe (line 15) with the amount of tax you've paid (line 18).If the amount you've paid is less than the amount you owe, the difference between the two numbers is the additional tax you owe the IRS.If it is the other way around, then the difference between the two numbers is the refund you are due.

-

I need instructions on how to complete the form to create a blog. What can I type for an URL?

Are you creating a blog on a blogging platform, like WordPress.com: Create a free website or blog, or is it your own website on the domain you manage? The url for the blog can be anything, for example, the free subdomain on wordpress(.)com may be http://yourname.wordpress.com

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

How can I find the instructions for the California tax form 541 (fiduciary filing)? The form is on the FTB web site but the instructions (and hence the actual tax table) is nowhere to be found.

I’ve just Google it type in 541 form and select the appropriatelink to your question.

Create this form in 5 minutes!

How to create an eSignature for the 2005 instructions for form 1098 instructions for form 1098 mortgage interest statement

How to generate an electronic signature for the 2005 Instructions For Form 1098 Instructions For Form 1098 Mortgage Interest Statement in the online mode

How to generate an electronic signature for the 2005 Instructions For Form 1098 Instructions For Form 1098 Mortgage Interest Statement in Google Chrome

How to create an eSignature for putting it on the 2005 Instructions For Form 1098 Instructions For Form 1098 Mortgage Interest Statement in Gmail

How to make an eSignature for the 2005 Instructions For Form 1098 Instructions For Form 1098 Mortgage Interest Statement from your mobile device

How to create an eSignature for the 2005 Instructions For Form 1098 Instructions For Form 1098 Mortgage Interest Statement on iOS devices

How to generate an electronic signature for the 2005 Instructions For Form 1098 Instructions For Form 1098 Mortgage Interest Statement on Android

People also ask

-

What are the form 1098 instructions provided by airSlate SignNow?

The form 1098 instructions from airSlate SignNow guide you through the process of preparing and submitting Form 1098, which reports mortgage interest paid. With our user-friendly platform, you can easily fill out and eSign documents while ensuring compliance with IRS requirements.

-

How can airSlate SignNow help with form 1098 instructions?

airSlate SignNow provides detailed support on form 1098 instructions, allowing you to complete your form accurately. Our platform includes templates that streamline the completion process, making it simpler to gather the necessary information and sign electronically.

-

Are there any costs associated with using airSlate SignNow for form 1098 instructions?

Yes, airSlate SignNow offers a range of pricing plans tailored to fit your business needs. Each plan includes access to comprehensive form 1098 instructions and additional features to optimize document management and electronic signing.

-

What features does airSlate SignNow offer for form 1098 instructions?

airSlate SignNow features include customizable templates, collaboration tools, and a secure platform for eSigning documents related to form 1098 instructions. These tools streamline the documentation process, ensuring that you can easily create and manage orders for mortgage interest reporting.

-

Can I integrate airSlate SignNow with other software when handling form 1098 instructions?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your workflows when dealing with form 1098 instructions. This ensures that all your financial and accounting software can work together smoothly to manage your documentation.

-

What are the benefits of using airSlate SignNow for form 1098 instructions?

Using airSlate SignNow for form 1098 instructions offers increased efficiency and reduced errors in document handling. Our platform helps you quickly prepare and submit forms, allowing you to focus on other important aspects of your business.

-

Is customer support available for help with form 1098 instructions?

Absolutely, airSlate SignNow provides dedicated customer support for any questions related to form 1098 instructions. Our team is ready to assist you with navigating the platform and ensuring accuracy in your document submissions.

Get more for Instructions For Form 1098 Instructions For Form 1098, Mortgage Interest Statement,

Find out other Instructions For Form 1098 Instructions For Form 1098, Mortgage Interest Statement,

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors