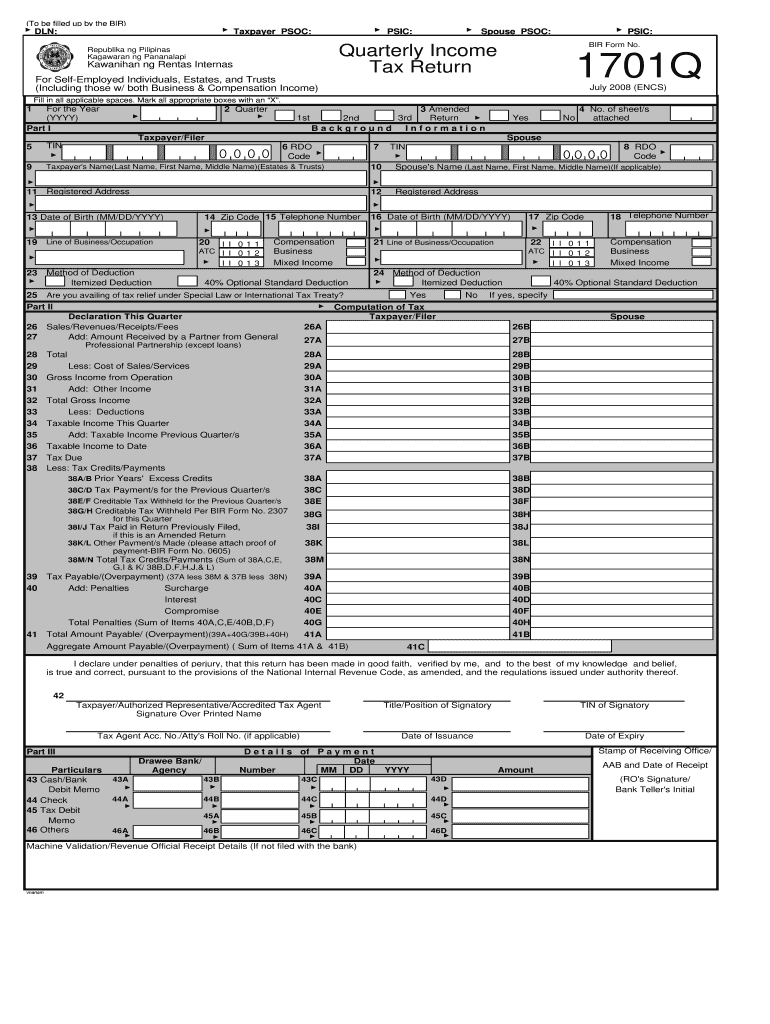

1701q Form

What is the 1701q Form

The 1701q form is a tax document used in the United States, specifically for reporting income and calculating tax liabilities for individuals and businesses. It is essential for taxpayers who need to file their quarterly income tax returns. This form helps ensure compliance with federal tax regulations and provides a structured way to report earnings and deductions. Understanding the purpose and requirements of the 1701q form is crucial for accurate tax reporting.

Steps to complete the 1701q Form

Completing the 1701q form involves several key steps to ensure accuracy and compliance. Follow these steps to fill out the form correctly:

- Gather necessary documents: Collect all relevant financial documents, including income statements, expense receipts, and previous tax returns.

- Fill in personal information: Enter your name, address, and taxpayer identification number at the top of the form.

- Report income: Accurately list all sources of income for the quarter, including wages, self-employment earnings, and any other taxable income.

- Calculate deductions: Identify and enter any allowable deductions that apply to your situation, such as business expenses or tax credits.

- Determine tax liability: Use the provided tax tables or formulas to calculate your total tax due based on your reported income and deductions.

- Review and sign: Carefully review the completed form for accuracy, then sign and date it to certify that the information is correct.

How to obtain the 1701q Form

The 1701q form can be obtained through various channels. Taxpayers can download the form directly from the official IRS website or request a physical copy from their local tax office. Additionally, many tax preparation software programs include the 1701q form, allowing users to fill it out digitally. Ensuring you have the most current version of the form is important, as tax regulations may change annually.

Legal use of the 1701q Form

The legal use of the 1701q form is governed by federal tax laws, which require accurate reporting of income and tax liabilities. When filed correctly, this form serves as a legally binding document that can be used in case of audits or disputes with tax authorities. Compliance with all applicable laws, including the timely submission of the form, is essential to avoid penalties and ensure legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the 1701q form are critical to maintaining compliance with tax regulations. Generally, the form must be submitted quarterly, with specific deadlines for each quarter. For example, the due date for the first quarter is typically April 15, the second quarter is July 15, the third quarter is October 15, and the fourth quarter is January 15 of the following year. Taxpayers should be aware of these dates to avoid late fees and penalties.

Examples of using the 1701q Form

There are various scenarios in which individuals and businesses may need to use the 1701q form. For instance, self-employed individuals must report their earnings and pay estimated taxes on a quarterly basis. Similarly, small business owners should use the form to report income from their business activities. Understanding these examples helps clarify the importance of the 1701q form in different financial situations.

Quick guide on how to complete 1701q form

Complete 1701q Form seamlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents swiftly without interruptions. Handle 1701q Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

How to edit and eSign 1701q Form with ease

- Obtain 1701q Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Select your preferred method of delivering your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced files, tedious form navigation, or mistakes that require reprinting new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your chosen device. Modify and eSign 1701q Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1701q form

How to generate an electronic signature for a PDF file in the online mode

How to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is a 1701q bir form editable pdf?

The 1701q bir form editable pdf is a digitally adaptable version of the 1701Q tax form used for income tax filing in the Philippines. This editable PDF allows users to fill out the form electronically, ensuring accuracy and ease of use. With airSlate SignNow, you can seamlessly edit and eSign this form to streamline your tax preparation process.

-

How can I create a 1701q bir form editable pdf using airSlate SignNow?

To create a 1701q bir form editable pdf with airSlate SignNow, simply upload an existing PDF of the form and use our editing tools to make the necessary changes. You can easily add text fields, checkboxes, and signature fields. This process saves time and enhances the accuracy of your filings.

-

Is there a cost associated with using the 1701q bir form editable pdf feature on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include access to the 1701q bir form editable pdf feature. Our plans are designed to be cost-effective, providing businesses with essential document management and eSigning tools. Explore our pricing options to find the best plan for your needs.

-

What are the benefits of using an editable PDF for the 1701q bir form?

Using a 1701q bir form editable pdf provides signNow benefits, such as increased accuracy, ease of editing, and the convenience of digital document management. This approach reduces the likelihood of errors associated with handwritten forms and allows for quicker submission. With airSlate SignNow, you can enjoy a comprehensive solution for your tax documents.

-

Can I integrate airSlate SignNow with other applications for handling the 1701q bir form editable pdf?

Absolutely! airSlate SignNow offers integrations with popular applications such as Google Drive and Dropbox. This allows you to easily store, share, and manage your 1701q bir form editable pdf alongside other important documents in your preferred platforms.

-

Is eSigning the 1701q bir form editable pdf legally binding?

Yes, eSigning the 1701q bir form editable pdf using airSlate SignNow is legally binding and compliant with relevant eSignature laws. This guarantees that your electronically signed documents hold the same legal weight as traditional handwritten signatures. You can confidently submit your tax forms knowing they are valid and secure.

-

What features does airSlate SignNow offer for managing the 1701q bir form editable pdf?

airSlate SignNow includes a range of features for managing the 1701q bir form editable pdf, such as document collaboration, workflow automation, and secure storage. You can also track document status and receive notifications for signed documents, making the process efficient. These tools enhance productivity and simplify your workflow.

Get more for 1701q Form

- W 8ben e example form

- Nc wdir 100 form

- Single comprehensive form word format

- Republic of the philippines brgy 24 c dvobrgy usep edu form

- Name change brochure form

- Authority to control wildlife atcw application form guide

- Tree risk assessment form 39580952

- Bsnl landline shifting form fill out and sign printable

Find out other 1701q Form

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract