1040 Schedule C Instructions Line 2 Form

What is the 1040 Schedule C Instructions Line 2 Form

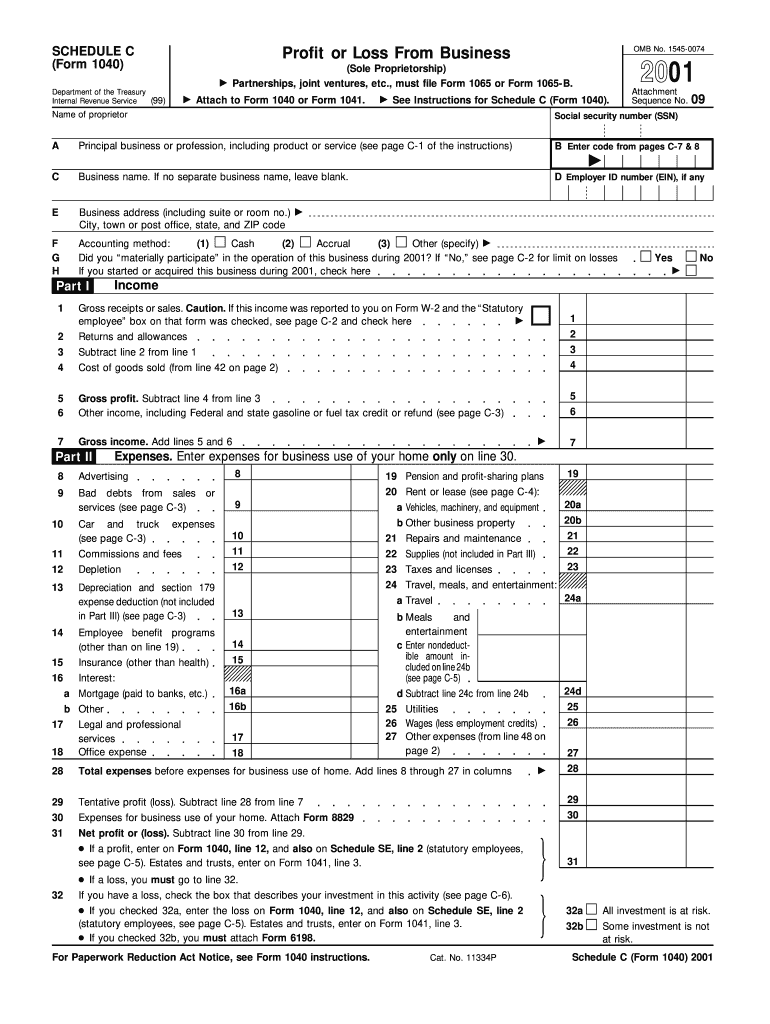

The 1040 Schedule C Instructions Line 2 Form is a critical document for self-employed individuals and small business owners in the United States. This form is used to report income or loss from a business operated as a sole proprietorship. Line 2 specifically focuses on detailing gross receipts or sales, which is essential for calculating net profit or loss. Accurately completing this line is vital for ensuring compliance with IRS regulations and for determining tax obligations.

Steps to complete the 1040 Schedule C Instructions Line 2 Form

Completing Line 2 of the 1040 Schedule C involves several steps:

- Gather all relevant financial documents, including sales records, invoices, and receipts.

- Calculate total gross receipts or sales for the tax year. This includes all income received from business activities.

- Enter the total amount on Line 2 of the Schedule C form.

- Review the entry to ensure accuracy, as this figure will impact overall tax calculations.

IRS Guidelines

The IRS provides specific guidelines for completing the 1040 Schedule C, particularly regarding Line 2. It is important to refer to the most current IRS publications and instructions to ensure compliance. The IRS expects taxpayers to report all income received, including cash, checks, and electronic payments. Any adjustments, such as returns or allowances, should be subtracted from the total gross receipts reported.

Filing Deadlines / Important Dates

For individuals filing the 1040 Schedule C, the deadline typically aligns with the federal tax return deadline, which is April 15 each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is essential to be aware of any changes to these dates, as penalties for late filing can be significant.

Required Documents

To complete the 1040 Schedule C, several documents are necessary:

- Sales records and invoices that detail income received.

- Receipts for business expenses that may be deducted.

- Bank statements that reflect business transactions.

- Any relevant financial statements that summarize business performance.

Penalties for Non-Compliance

Failure to accurately complete and file the 1040 Schedule C can result in various penalties from the IRS. These may include fines for late filing, interest on unpaid taxes, and potential audits. Ensuring that all information is correct and submitted on time is crucial to avoid these repercussions.

Quick guide on how to complete 2001 1040 schedule c instructions line 2 form

Prepare 1040 Schedule C Instructions Line 2 Form seamlessly on any gadget

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without any hold-ups. Handle 1040 Schedule C Instructions Line 2 Form on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to alter and eSign 1040 Schedule C Instructions Line 2 Form effortlessly

- Obtain 1040 Schedule C Instructions Line 2 Form and click Obtain Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click the Finish button to save your modifications.

- Select how you wish to share your form, whether via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow simplifies your document management needs in just a few clicks from any device you choose. Modify and eSign 1040 Schedule C Instructions Line 2 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

-

When filing a 1040 Schedule C-EZ form does it matter what my job description is (Part 1, Line A)? How accurate or descriptive should it be?

The job description on the tax return is apparently not very important. A word or two is sufficient - like manager, physician, route sales, clerical services or whatever is appropriate is all that is needed on that form. Include enough that the IRS can see the relationship to any signNow expenses you have, like a lot of mileage. But if you have such signNow expenses you would be filing Schedule C. We do not always include the business code and have had no issues with that from the IRS.If you have an EIN for your business you should include that so the IRS knows the business return has been filed.

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

If an undocumented resident wants to pay taxes and she is paid in cash by her employer, how can she file taxes when she applies for an ITIN? Does she use a Schedule C Form 1040 or a Form 4852?

Schedule C is used if the person is self-employed. Form 4852 is used for employment. There is a difference.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

Create this form in 5 minutes!

How to create an eSignature for the 2001 1040 schedule c instructions line 2 form

How to make an electronic signature for the 2001 1040 Schedule C Instructions Line 2 Form online

How to create an eSignature for your 2001 1040 Schedule C Instructions Line 2 Form in Chrome

How to generate an electronic signature for signing the 2001 1040 Schedule C Instructions Line 2 Form in Gmail

How to create an electronic signature for the 2001 1040 Schedule C Instructions Line 2 Form from your smartphone

How to generate an electronic signature for the 2001 1040 Schedule C Instructions Line 2 Form on iOS devices

How to make an electronic signature for the 2001 1040 Schedule C Instructions Line 2 Form on Android

People also ask

-

What is the 1040 Schedule C Instructions Line 2 Form used for?

The 1040 Schedule C Instructions Line 2 Form is crucial for sole proprietors and self-employed individuals to report their income. This line specifically helps you document your gross receipts or sales, providing clarity on your business's financial performance. Understanding this form ensures accurate tax reporting and compliance.

-

How can airSlate SignNow assist with completing the 1040 Schedule C Instructions Line 2 Form?

airSlate SignNow offers an intuitive platform that allows you to easily fill out and eSign the 1040 Schedule C Instructions Line 2 Form. With its user-friendly interface, you can efficiently manage your tax documentation and ensure that all required information is accurately captured and securely stored.

-

What are the benefits of using airSlate SignNow for tax forms like the 1040 Schedule C Instructions Line 2 Form?

Using airSlate SignNow for the 1040 Schedule C Instructions Line 2 Form streamlines your tax filing process. The platform provides a secure, easy-to-use environment for managing documents while ensuring compliance with IRS regulations. Additionally, you can save time and reduce errors with its comprehensive eSigning features.

-

Is there a cost associated with using airSlate SignNow for the 1040 Schedule C Instructions Line 2 Form?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs. You can choose a plan that suits your budget while gaining access to features that simplify the completion of the 1040 Schedule C Instructions Line 2 Form and other essential documents.

-

Can I integrate airSlate SignNow with other accounting software for the 1040 Schedule C Instructions Line 2 Form?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, allowing you to streamline your workflow. This integration ensures that your data for the 1040 Schedule C Instructions Line 2 Form is synchronized, reducing the risk of manual errors and enhancing efficiency.

-

How does airSlate SignNow ensure the security of my 1040 Schedule C Instructions Line 2 Form?

airSlate SignNow prioritizes your document security with advanced encryption protocols and secure storage solutions. When you eSign the 1040 Schedule C Instructions Line 2 Form, you can rest assured that your sensitive tax information is protected from unauthorized access.

-

What types of documents can I manage besides the 1040 Schedule C Instructions Line 2 Form with airSlate SignNow?

In addition to the 1040 Schedule C Instructions Line 2 Form, airSlate SignNow allows you to manage a variety of documents such as contracts, agreements, and consent forms. This versatility makes it an ideal solution for businesses looking to streamline their entire document management process.

Get more for 1040 Schedule C Instructions Line 2 Form

- Official homeschool transcript university of uis form

- Lab 2 2 overcoming barriers to being active pdf form

- Broward college form

- Site assessment checklist fsu facilities form

- Middle school score sheet form

- Lesson plan feedback form

- Computer check out form

- High school and community activities record form

Find out other 1040 Schedule C Instructions Line 2 Form

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile