Publication 1769 En Sp Rev 4 IRS Bookmark English & Spanish Form

What is the Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish

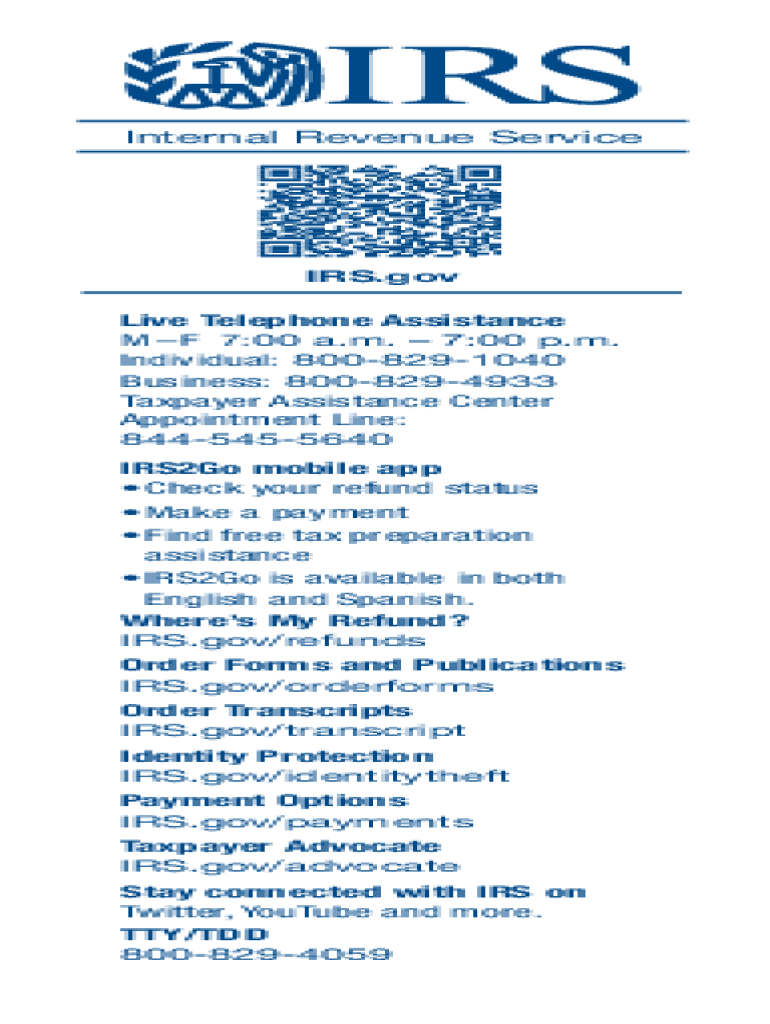

The Publication 1769 en sp Rev 4 IRS Bookmark is a bilingual resource provided by the IRS, designed to assist taxpayers in understanding their tax obligations and rights. This publication serves as a guide that outlines essential information regarding tax processes, including forms, instructions, and relevant tax law updates. It is available in both English and Spanish, making it accessible to a broader audience and ensuring that non-English speakers can navigate tax-related matters effectively.

How to use the Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish

To utilize the Publication 1769 en sp Rev 4 IRS Bookmark, taxpayers should first familiarize themselves with its contents. This publication includes crucial information about various tax forms and procedures. Users can reference specific sections that pertain to their individual tax situations, whether they are filing as individuals, businesses, or other entities. By following the guidelines provided, users can ensure they meet their tax obligations accurately and on time.

Steps to complete the Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish

Completing the Publication 1769 en sp Rev 4 IRS Bookmark involves several key steps:

- Review the publication thoroughly to identify the sections relevant to your tax situation.

- Gather necessary documentation, such as income statements, previous tax returns, and any other required forms.

- Follow the instructions outlined in the publication to fill out the appropriate forms accurately.

- Ensure that all information is complete and correct before submission.

- Keep a copy of the completed forms and any supporting documents for your records.

Legal use of the Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish

The Publication 1769 en sp Rev 4 IRS Bookmark is legally recognized as a valid resource for taxpayers. It provides essential guidance that can help ensure compliance with federal tax laws. Utilizing this publication can aid in understanding the legal implications of various tax actions, such as filing deadlines and documentation requirements. It is important for taxpayers to rely on this publication to stay informed about their rights and responsibilities under U.S. tax law.

IRS Guidelines

The IRS guidelines outlined in the Publication 1769 en sp Rev 4 IRS Bookmark offer taxpayers clear instructions on how to comply with tax regulations. These guidelines cover a range of topics, including filing procedures, eligibility criteria for various deductions and credits, and the importance of accurate record-keeping. Following these guidelines helps minimize the risk of errors and potential penalties associated with non-compliance.

Filing Deadlines / Important Dates

Publication 1769 en sp Rev 4 includes important filing deadlines that taxpayers must adhere to. These deadlines typically relate to the annual tax return submission, estimated tax payments, and other critical dates that may affect tax liability. Staying aware of these deadlines is crucial for avoiding late fees and ensuring timely compliance with tax obligations.

Quick guide on how to complete publication 1769 en sp rev 4 2021 irs bookmark english ampamp spanish

Prepare Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without any delays. Manage Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish effortlessly

- Obtain Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize essential sections of the documents or conceal sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Choose your preferred method to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the publication 1769 en sp rev 4 2021 irs bookmark english ampamp spanish

How to make an eSignature for your PDF online

How to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What is 'Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish'?

'Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish' is an important tax document provided by the IRS that offers guidelines in both English and Spanish. This publication helps individuals and businesses understand tax responsibilities and benefits in a multilingual format, which is crucial for effective communication and compliance.

-

How can airSlate SignNow help me with 'Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish'?

With airSlate SignNow, you can easily send and eSign the 'Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish' document, ensuring that it is processed quickly and securely. Our platform streamlines document management, making sure that your tax-related paperwork complies with IRS standards.

-

Is Pricing for airSlate SignNow competitive for using 'Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish'?

Yes, airSlate SignNow offers competitive pricing for its services, making it affordable for anyone needing to manage the 'Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish' document. Various plans cater to different business sizes, ensuring that you get the best value for your money.

-

What features does airSlate SignNow provide for eSigning 'Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish'?

airSlate SignNow includes robust features such as customizable eSignatures, document templates, and real-time tracking for 'Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish'. These tools enhance efficiency and provide a seamless signing experience for all users.

-

Can I integrate airSlate SignNow with other applications while working with 'Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish'?

Absolutely! airSlate SignNow offers seamless integration with popular applications such as Google Drive, Dropbox, and Microsoft Office. This allows users to manage 'Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish' documents alongside their existing workflows with ease.

-

What are the benefits of using airSlate SignNow for 'Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish'?

Using airSlate SignNow for 'Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish' provides fast document turnaround, enhanced security features, and easy access to signed documents from anywhere. This ensures that your important tax documents are managed efficiently and securely.

-

Is airSlate SignNow secure for handling 'Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish'?

Yes, airSlate SignNow prioritizes security, utilizing bank-level encryption to protect your documents, including 'Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish'. With built-in security features, you can rest assured that your sensitive information is safe while using our platform.

Get more for Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish

Find out other Publication 1769 en sp Rev 4 IRS Bookmark English & Spanish

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online