Form 3911 Instructions Where to Mail

What is the Form 3911 Instructions Where To Mail

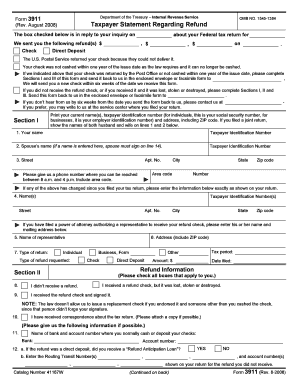

The Form 3911 is an important document used by individuals to request a trace of their Economic Impact Payment, commonly known as the stimulus check. This form is essential for those who believe they are eligible for a payment but have not received it. Understanding where to mail the completed Form 3911 is crucial for ensuring timely processing by the IRS. The mailing address varies based on the state of residence, so it is important to refer to the specific instructions provided by the IRS for accurate submission.

Steps to complete the Form 3911 Instructions Where To Mail

Completing the Form 3911 requires careful attention to detail. Here are the steps to ensure the form is filled out correctly:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate the tax year for which you are requesting the payment trace.

- Provide details about your Economic Impact Payment, including the amount you expected to receive.

- Sign and date the form to validate your request.

- Review all information for accuracy before submission.

Once completed, ensure the form is mailed to the correct address based on your state, which can be found in the IRS instructions.

How to use the Form 3911 Instructions Where To Mail

Using the Form 3911 involves understanding its purpose and the correct procedures for submission. After filling out the form, you must mail it to the appropriate IRS address. This address varies depending on whether you are sending the form from within the United States or from abroad. For domestic submissions, the address typically includes a specific IRS processing center. It is advisable to check the latest IRS guidelines for the most accurate mailing information.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 3911. These guidelines include detailed instructions on how to fill out each section of the form, what information is required, and how to ensure that your submission is processed efficiently. Adhering to these guidelines is essential for avoiding delays in processing your request. The IRS also emphasizes the importance of providing accurate information to prevent complications during the tracing process.

Required Documents

When submitting the Form 3911, it is important to include any supporting documents that may be required. This could include proof of identity, such as a copy of a government-issued ID, and any documentation that verifies your eligibility for the Economic Impact Payment. Including these documents can help expedite the processing of your request and ensure that the IRS has all the necessary information to assist you effectively.

Form Submission Methods (Online / Mail / In-Person)

The Form 3911 can be submitted through various methods, although mailing is the most common approach. Currently, the IRS does not offer an online submission option for this form. However, you may be able to visit a local IRS office for assistance if you prefer in-person support. It is important to ensure that you send the form via a secure method, such as certified mail, to confirm its delivery to the IRS.

Quick guide on how to complete form 3911 instructions where to mail

Complete Form 3911 Instructions Where To Mail effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Form 3911 Instructions Where To Mail on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Form 3911 Instructions Where To Mail with ease

- Obtain Form 3911 Instructions Where To Mail and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow supplies specifically for this purpose.

- Create your signature utilizing the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to preserve your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 3911 Instructions Where To Mail while ensuring exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3911 instructions where to mail

The best way to make an electronic signature for a PDF online

The best way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What are the 3911 instructions for using airSlate SignNow?

The 3911 instructions for using airSlate SignNow provide users with a step-by-step guide to effectively send and eSign documents. This comprehensive guide helps streamline the document workflow and ensures that all necessary actions are completed efficiently.

-

How much does airSlate SignNow cost based on the 3911 instructions?

Pricing for airSlate SignNow varies depending on the plan you choose. The 3911 instructions detail the pricing structure, including monthly and annual subscriptions, which cater to different business needs and budgets.

-

What features are highlighted in the 3911 instructions?

The 3911 instructions highlight several key features of airSlate SignNow, including customizable templates, advanced security options, and integration capabilities with various apps. These features make it easier for businesses to manage their document signing processes efficiently.

-

How can I integrate airSlate SignNow with other tools using the 3911 instructions?

The 3911 instructions provide a comprehensive overview of how to integrate airSlate SignNow with popular tools like Google Drive, Dropbox, and Salesforce. This allows businesses to enhance their workflow by connecting various applications seamlessly.

-

What are the benefits of following the 3911 instructions for airSlate SignNow?

Following the 3911 instructions ensures that users maximize the software’s capabilities, leading to improved efficiency and time savings in document management. Users can avoid common pitfalls and leverage best practices to enhance their experience.

-

Can I access the 3911 instructions from my mobile device?

Yes, the 3911 instructions for airSlate SignNow can be accessed from any mobile device with internet connectivity. This allows users to manage and sign documents on-the-go, providing flexibility and convenience.

-

How do the 3911 instructions assist with compliance and security?

The 3911 instructions emphasize compliance with legal and industry standards when using airSlate SignNow. They highlight the security features, such as encryption and audit trails, ensuring that your documents are handled safely and in accordance with regulations.

Get more for Form 3911 Instructions Where To Mail

Find out other Form 3911 Instructions Where To Mail

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast