Vermont Pt 172 S TemplatePDF Form

What is the Vermont Pt 172 S TemplatePDF Form

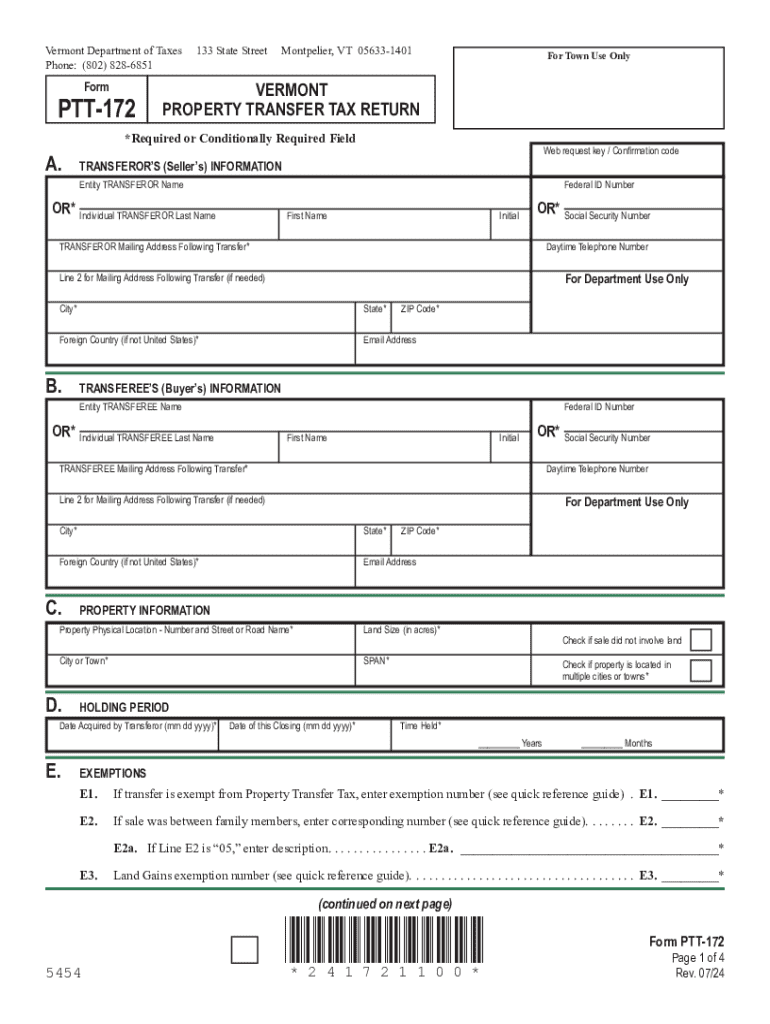

The Vermont Pt 172 S TemplatePDF Form, commonly referred to as the Vermont property transfer tax form, is a crucial document used in real estate transactions within the state of Vermont. This form is required when a property is sold or transferred, ensuring that the appropriate property transfer tax is calculated and paid. The form captures essential information about the property, including its location, sale price, and the parties involved in the transaction. It is an important part of the legal process for transferring property ownership and helps maintain accurate public records.

Steps to complete the Vermont Pt 172 S TemplatePDF Form

Completing the Vermont Pt 172 S TemplatePDF Form involves several key steps:

- Gather necessary information about the property, including the address, parcel number, and sale price.

- Identify the buyer and seller, including their names and contact information.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the property transfer tax based on the sale price and applicable rates.

- Sign and date the form, ensuring all parties involved have provided their signatures.

- Submit the completed form to the appropriate state or local authority, along with any required payment for the transfer tax.

Legal use of the Vermont Pt 172 S TemplatePDF Form

The Vermont Pt 172 S TemplatePDF Form serves a legal function in property transactions. It is mandated by state law that this form be filed whenever a property transfer occurs. Failure to submit the form can result in penalties, including fines or delays in the transfer process. The form also serves as a public record, documenting the transaction for future reference. Proper completion and submission of this form help ensure compliance with Vermont's property transfer tax regulations.

Filing Deadlines / Important Dates

When dealing with the Vermont Pt 172 S TemplatePDF Form, it is essential to be aware of critical deadlines. The form must be submitted within a specific timeframe following the completion of a property sale. Typically, this deadline is set at 15 days from the date of the property transfer. Missing this deadline can lead to penalties or additional fees. It is advisable to check for any updates or changes to these deadlines to ensure compliance.

Form Submission Methods

The Vermont Pt 172 S TemplatePDF Form can be submitted through various methods to accommodate different preferences. Options include:

- Online submission through designated state portals.

- Mailing the completed form to the appropriate local tax authority.

- In-person submission at local government offices.

Each method has its own processing times and requirements, so it is important to choose the one that best fits your situation.

Required Documents

When completing the Vermont Pt 172 S TemplatePDF Form, certain documents may be required to support the information provided. These typically include:

- A copy of the purchase and sale agreement.

- Proof of payment for the property transfer tax.

- Identification for both the buyer and seller.

Having these documents ready can facilitate a smoother completion and submission process.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vermont pt 172 s templatepdf form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the vt ptt 172 instructions for using airSlate SignNow?

The vt ptt 172 instructions provide a comprehensive guide on how to effectively utilize airSlate SignNow for document signing. These instructions cover the step-by-step process of sending, signing, and managing documents within the platform, ensuring a smooth user experience.

-

How much does airSlate SignNow cost for accessing vt ptt 172 instructions?

airSlate SignNow offers various pricing plans that cater to different business needs. The cost for accessing vt ptt 172 instructions is included in all subscription tiers, providing users with valuable resources to maximize their document management capabilities.

-

What features are included in the vt ptt 172 instructions?

The vt ptt 172 instructions include features such as document templates, eSignature capabilities, and integration options with other software. These features are designed to enhance productivity and streamline the signing process for users.

-

How can I benefit from following the vt ptt 172 instructions?

By following the vt ptt 172 instructions, users can signNowly improve their document workflow efficiency. The instructions help users understand the platform's functionalities, leading to faster turnaround times and reduced paperwork.

-

Are there any integrations available with airSlate SignNow for vt ptt 172 instructions?

Yes, airSlate SignNow offers integrations with various third-party applications, enhancing the functionality of the vt ptt 172 instructions. Users can connect with tools like Google Drive, Salesforce, and more to streamline their document processes.

-

Can I access vt ptt 172 instructions on mobile devices?

Absolutely! The vt ptt 172 instructions are accessible on mobile devices, allowing users to manage their documents on the go. This flexibility ensures that you can send and sign documents anytime, anywhere.

-

Is there customer support available for questions about vt ptt 172 instructions?

Yes, airSlate SignNow provides robust customer support for any inquiries regarding vt ptt 172 instructions. Users can signNow out via chat, email, or phone to get assistance and ensure they are using the platform effectively.

Get more for Vermont Pt 172 S TemplatePDF Form

- Satisfaction release of mortgage by mortgagee individual lender or holder new mexico form

- Partial release of property from mortgage for corporation new mexico form

- Partial release of property from mortgage by individual holder new mexico form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy new mexico form

- Warranty deed for parents to child with reservation of life estate new mexico form

- Warranty deed joint form 497320376

- Warranty deed for separate or joint property to joint tenancy new mexico form

- Warranty deed to separate property of one spouse to both spouses as joint tenants new mexico form

Find out other Vermont Pt 172 S TemplatePDF Form

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe