Florida Apply Refund Form

What is the Florida Apply Refund Form

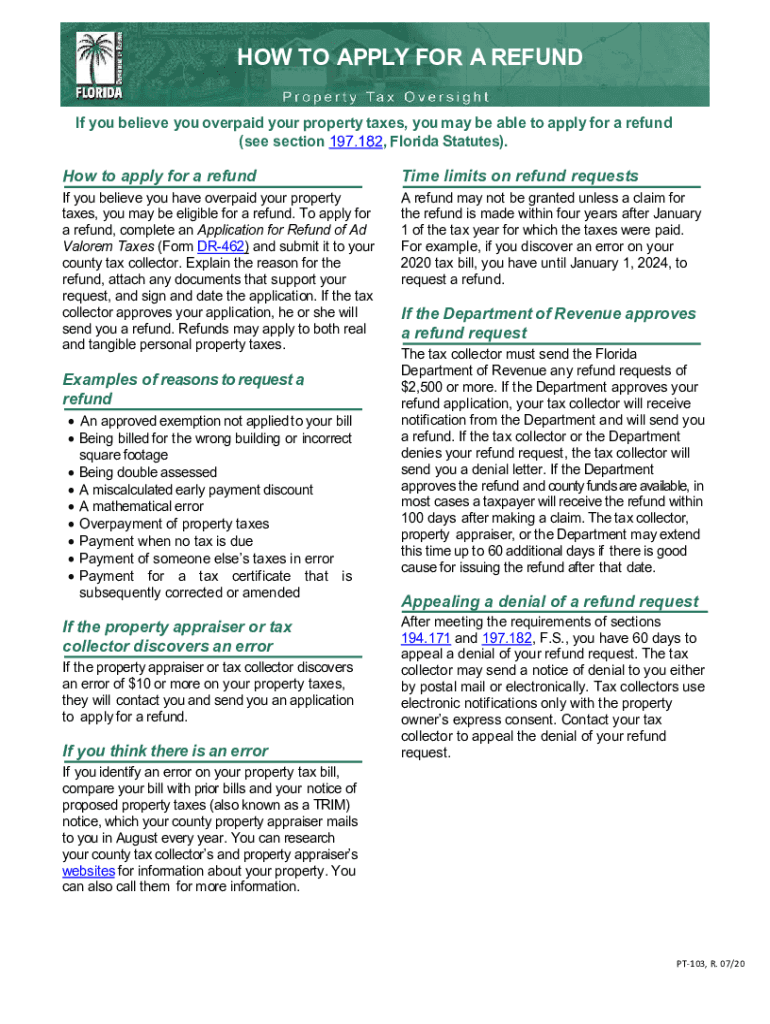

The Florida Apply Refund Form is a document used by residents to request a refund for overpaid property taxes or other applicable fees. This form is essential for individuals seeking to reclaim amounts that they believe were incorrectly assessed or paid. Understanding the purpose and function of this form is crucial for ensuring that taxpayers can navigate the refund process effectively.

Steps to Complete the Florida Apply Refund Form

Completing the Florida Apply Refund Form involves several key steps to ensure accuracy and compliance with state regulations. Here are the essential steps:

- Gather necessary documentation, such as proof of payment and property tax statements.

- Fill out the form with accurate personal information, including your name, address, and tax identification number.

- Clearly state the reason for the refund request, providing any supporting details or documentation.

- Review the completed form for errors or omissions before submission.

How to Obtain the Florida Apply Refund Form

The Florida Apply Refund Form can be obtained through several channels. Residents can access the form online via the official Florida Department of Revenue website or request a physical copy from their local tax collector's office. Ensuring that you have the most current version of the form is important for a successful application.

Legal Use of the Florida Apply Refund Form

The Florida Apply Refund Form is legally binding when completed and submitted according to state regulations. It is important to adhere to the specific guidelines outlined by the Florida Department of Revenue to ensure that your request is processed without delays. Compliance with legal requirements enhances the validity of your refund request.

Required Documents

To successfully complete the Florida Apply Refund Form, certain documents are required. These typically include:

- Proof of payment, such as receipts or bank statements.

- Property tax statements for the relevant tax year.

- Any additional documentation that supports your claim for a refund.

Having these documents ready will facilitate a smoother application process.

Form Submission Methods

The Florida Apply Refund Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via the Florida Department of Revenue's website.

- Mailing the completed form to the appropriate tax collector's office.

- In-person submission at designated local offices.

Choosing the most convenient method for submission can help expedite the refund process.

Eligibility Criteria

To qualify for a refund using the Florida Apply Refund Form, taxpayers must meet specific eligibility criteria. Generally, these include:

- Being the property owner or having a legal interest in the property.

- Demonstrating that an overpayment occurred due to an error in assessment or payment.

- Submitting the form within the designated timeframe set by the state.

Understanding these criteria is essential for ensuring that your refund request is valid and can be processed efficiently.

Quick guide on how to complete florida apply refund form

Complete Florida Apply Refund Form smoothly on any gadget

Digital document administration has become increasingly favored among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can easily locate the correct template and securely save it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Florida Apply Refund Form on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Florida Apply Refund Form effortlessly

- Find Florida Apply Refund Form and click on Get Form to begin.

- Utilize the tools we provide to finish your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from a device of your preference. Edit and eSign Florida Apply Refund Form and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the florida apply refund form

The way to create an eSignature for a PDF online

The way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is the florida apply refund form and how can I access it?

The florida apply refund form is a necessary document for requesting a refund in Florida. You can easily access it through the official website of the Florida Department of Revenue or use airSlate SignNow to eSign and submit it electronically for convenience.

-

What features does airSlate SignNow offer for filling out the florida apply refund form?

airSlate SignNow provides an intuitive platform that allows users to easily fill out the florida apply refund form online. Features like document templates, eSignature capability, and secure storage ensure a seamless experience for your refund request.

-

How does airSlate SignNow ensure the security of my florida apply refund form data?

The security of your florida apply refund form data is a top priority at airSlate SignNow. The platform uses industry-standard encryption and compliance measures, ensuring that your sensitive information is kept secure throughout the signing process.

-

Is there a cost associated with using airSlate SignNow for the florida apply refund form?

Yes, using airSlate SignNow involves a subscription cost, but it is competitive and worth the investment. The platform provides a cost-effective solution to handle your florida apply refund form efficiently, with varying pricing plans to suit different business needs.

-

Can I integrate airSlate SignNow with other applications for my florida apply refund form?

Absolutely! airSlate SignNow offers several integrations with popular applications, allowing you to streamline the process of submitting your florida apply refund form. This means you can connect your existing tools to automate workflows and enhance productivity.

-

What are the benefits of using airSlate SignNow for the florida apply refund form?

Using airSlate SignNow for your florida apply refund form offers numerous benefits, including time savings, a user-friendly interface, and the ability to track your submission. This ensures a hassle-free experience and helps you manage your refund process effectively.

-

How long does it take to process the florida apply refund form via airSlate SignNow?

The processing time for the florida apply refund form when submitted through airSlate SignNow can vary, but you can typically expect quicker responses. The platform facilitates faster document handling and allows for efficient communication with tax authorities.

Get more for Florida Apply Refund Form

- Macc gift shop consignment bapplicationb city of marquette mqtcty form

- Visionworks com contactlensrebates form

- Delaware residential lease agreement form

- 1040es me form

- Informal observation examples

- Tb 43 180 pdf form

- Form 1099 b proceeds from broker and barter exchange transactions

- Form 200 local intangibles tax return rev 11 23 form 200 local intangibles tax return county taxes

Find out other Florida Apply Refund Form

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist