35 Department of Public Works and Highways Form

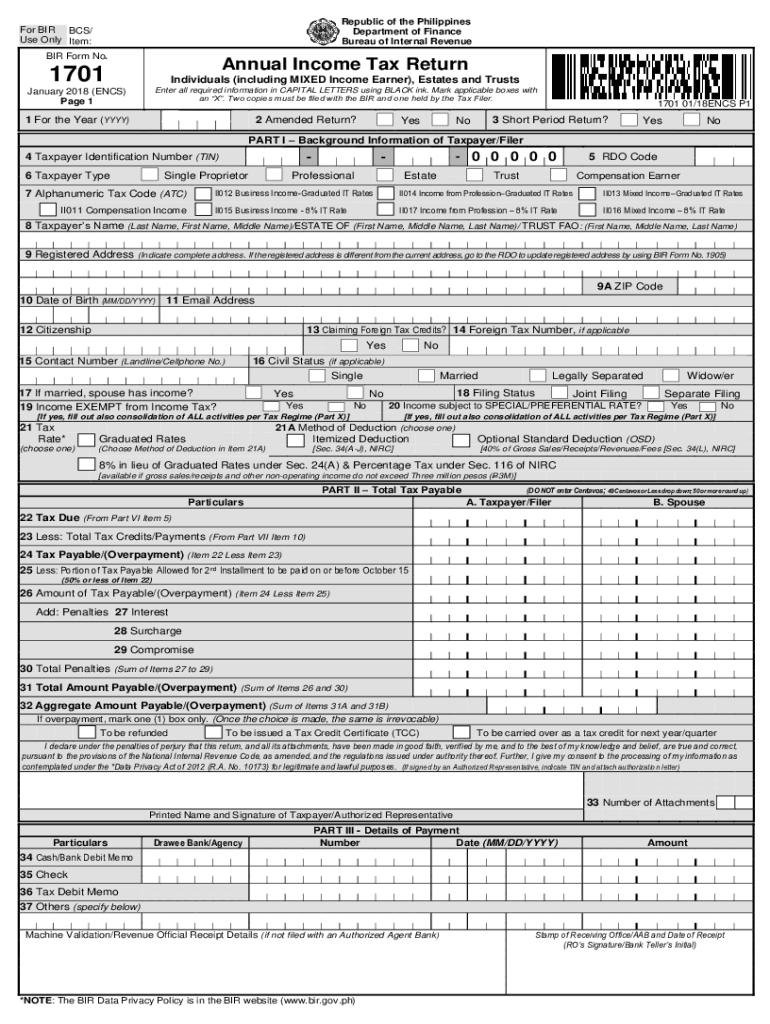

What is the bir 1701 form?

The bir 1701 form is an essential document used for filing income tax returns in the Philippines. Specifically designed for individual taxpayers, it serves to report income earned during the tax year and calculate the corresponding tax liability. This form is crucial for ensuring compliance with tax regulations and is typically required for self-employed individuals, professionals, and those with mixed income sources.

Steps to complete the bir 1701 form

Completing the bir 1701 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and receipts for deductions. Next, fill out the personal information section, including your name, Tax Identification Number (TIN), and address. Then, report your income sources in the designated sections, ensuring to include all relevant details. Calculate your total tax liability based on the income reported, applying any deductions or credits you are eligible for. Finally, review the form for completeness and accuracy before submitting it.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the bir 1701 form to avoid penalties. Typically, individual taxpayers must submit their income tax returns by April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be adjusted. Keeping track of these dates is essential for timely compliance and to avoid incurring late fees or interest on unpaid taxes.

Required Documents

To successfully complete the bir 1701 form, several documents are required. These include proof of income, such as payslips, invoices, or bank statements, which provide evidence of earnings. Additionally, any supporting documents for deductions, such as receipts for business expenses or medical expenses, should be collected. Having these documents ready will facilitate a smoother filing process and help ensure that all income and deductions are accurately reported.

Penalties for Non-Compliance

Failing to file the bir 1701 form on time or inaccurately reporting income can result in significant penalties. Taxpayers may face fines, interest on unpaid taxes, and potential legal consequences. It is crucial to adhere to tax regulations and ensure that all information submitted is accurate to avoid these repercussions. Understanding the implications of non-compliance can motivate timely and correct submissions.

Digital vs. Paper Version

Taxpayers have the option to file the bir 1701 form either digitally or using a paper version. The digital version often streamlines the process, allowing for easier calculations and quicker submissions. Additionally, electronic filing may provide immediate confirmation of submission, reducing the risk of lost documents. Conversely, some individuals may prefer the traditional paper method for its tangible nature. Understanding the benefits of each option can help taxpayers choose the best method for their needs.

Quick guide on how to complete 35 department of public works and highways

Streamline 35 Department Of Public Works And Highways effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documentation, allowing you to obtain the correct format and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage 35 Department Of Public Works And Highways on any platform via airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The easiest method to alter and eSign 35 Department Of Public Works And Highways seamlessly

- Locate 35 Department Of Public Works And Highways and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign 35 Department Of Public Works And Highways and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 35 department of public works and highways

The way to make an eSignature for a PDF in the online mode

The way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What is bir 1701 and how does it relate to airSlate SignNow?

Bir 1701 is a specific document template used in digital transactions and agreements. With airSlate SignNow, you can easily create, sign, and manage your bir 1701 documents online, ensuring compliance and efficiency in your business operations.

-

What features does airSlate SignNow offer for managing bir 1701 documents?

airSlate SignNow offers a range of features for bir 1701 documents, including customizable templates, automatic reminders, and secure e-signature options. These tools streamline your workflow, making it simpler to manage and execute bir 1701 documents effectively.

-

How much does it cost to use airSlate SignNow for bir 1701 documents?

airSlate SignNow provides flexible pricing plans tailored to your needs, making it a cost-effective solution for managing bir 1701 documents. Plans are designed to accommodate businesses of all sizes, with options for monthly or annual subscriptions.

-

Can I integrate other tools with airSlate SignNow for bir 1701 documents?

Yes, airSlate SignNow integrates seamlessly with various applications and tools to enhance the management of bir 1701 documents. Whether it's CRM software or cloud storage solutions, these integrations help automate tasks and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for bir 1701 e-signatures?

Using airSlate SignNow for bir 1701 e-signatures ensures quick turnaround times and enhanced security. The platform not only simplifies the signing process but also provides a robust audit trail, giving you confidence in the integrity of your documents.

-

Is airSlate SignNow compliant with regulations regarding bir 1701 documents?

Absolutely! airSlate SignNow is designed to comply with various regulations, ensuring that your bir 1701 documents are legally binding and secure. This compliance helps protect your business and fosters trust with your clients and partners.

-

How can businesses automate the workflow for bir 1701 documents with airSlate SignNow?

airSlate SignNow allows businesses to automate their workflow for bir 1701 documents through features such as conditional routing and automatic notifications. This helps reduce manual processes, speed up transactions, and enhance productivity across teams.

Get more for 35 Department Of Public Works And Highways

- Formal hazard assessment template

- Birth certificate correction application form kerala

- Boardreach form

- Hinds feet on high places study guide pdf form

- Comsec briefing form

- Generic immunization permission form

- Medstar doctors note 203979844 form

- Boats ampamp atvsmotor vehicle division nm mvd new mexico form

Find out other 35 Department Of Public Works And Highways

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online