Td1ab Fillable Form 2012

What is the Td1ab Fillable Form

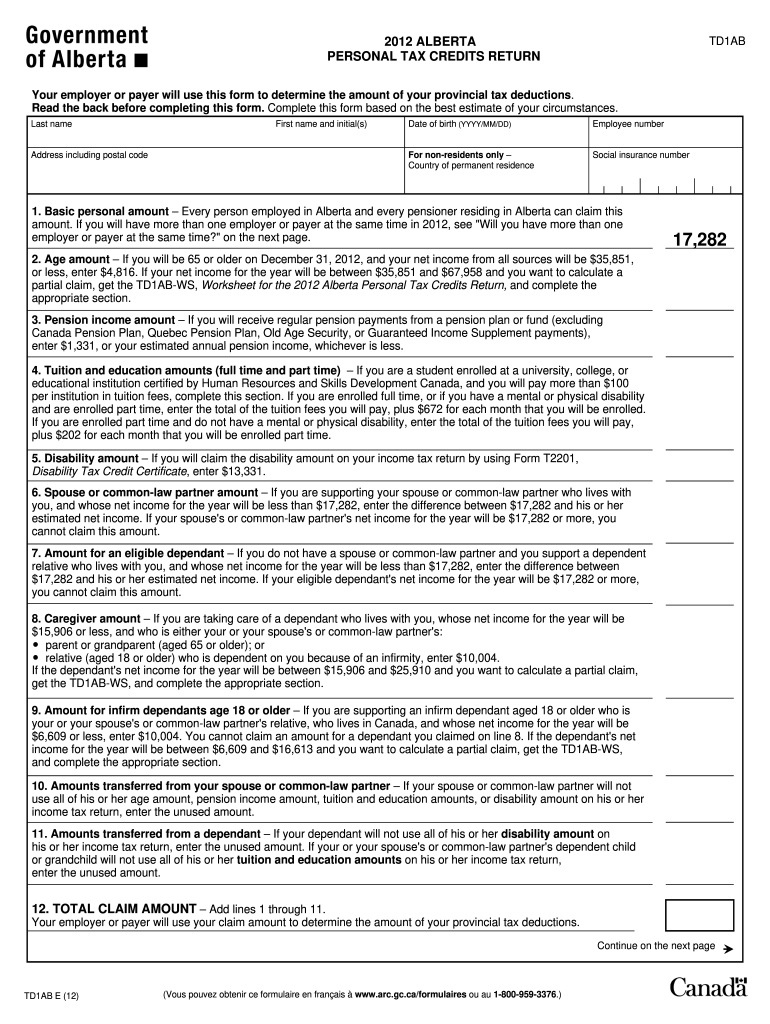

The Td1ab fillable form is a crucial document used in the United States for tax purposes. It is primarily designed for employees to indicate their personal tax credits and deductions to their employer. This form helps employers calculate the correct amount of tax to withhold from an employee's paycheck. By accurately completing the Td1ab fillable form, employees can ensure that they are not over- or under-withheld on their taxes, which can significantly impact their financial situation at the end of the tax year.

How to use the Td1ab Fillable Form

Using the Td1ab fillable form is straightforward. First, download the form from a reliable source. Once you have the form, fill in the required fields, including your personal information, such as your name, address, and Social Security number. Next, indicate your eligibility for various tax credits by checking the appropriate boxes. After completing the form, review it for accuracy to avoid any errors that could affect your tax withholding. Finally, submit the completed form to your employer, ensuring that they have the necessary information to adjust your tax withholdings accordingly.

Steps to complete the Td1ab Fillable Form

Completing the Td1ab fillable form involves several key steps:

- Download the Td1ab fillable form from a trusted website.

- Open the form using a compatible PDF reader or editor.

- Fill in your personal details accurately, including your name, address, and Social Security number.

- Review the list of tax credits and deductions, marking those that apply to your situation.

- Double-check all entries for accuracy and completeness.

- Save the completed form and print a copy for your records.

- Submit the form to your employer before the deadline for tax withholding adjustments.

Legal use of the Td1ab Fillable Form

The Td1ab fillable form is legally binding when completed and submitted correctly. It serves as an official declaration of your tax situation, which employers rely on to determine the appropriate withholding amounts. To ensure that the form is legally recognized, it is essential to provide accurate information and submit it in a timely manner. Additionally, maintaining a copy of the completed form is advisable for your records, as it may be required for future reference or in case of audits.

Form Submission Methods

The Td1ab fillable form can be submitted through various methods, depending on your employer's preferences. Common submission methods include:

- Online Submission: If your employer offers an online portal, you may be able to upload the completed form directly through their system.

- Mail: Print the completed form and send it via postal mail to your employer's HR or payroll department.

- In-Person: Deliver the completed form in person to your employer's HR department for immediate processing.

Key elements of the Td1ab Fillable Form

The Td1ab fillable form contains several key elements that are essential for accurate tax withholding. These include:

- Personal Information: Your name, address, and Social Security number.

- Tax Credits: Sections where you can indicate eligibility for various tax credits, which can reduce your overall tax liability.

- Signature: A space for your signature, confirming that the information provided is accurate and complete.

- Employer Information: Details about your employer, which may include their name and address.

Quick guide on how to complete td1ab fillable form

Effortlessly Prepare Td1ab Fillable Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and eSign your documents without any delays. Manage Td1ab Fillable Form on any platform with airSlate SignNow’s applications for Android or iOS, and simplify any document-related tasks today.

Easily Edit and eSign Td1ab Fillable Form without Hassle

- Obtain Td1ab Fillable Form and select Get Form to begin.

- Utilize the tools available to complete your document.

- Mark essential parts of the documents or conceal sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Td1ab Fillable Form to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct td1ab fillable form

Create this form in 5 minutes!

How to create an eSignature for the td1ab fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Td1ab Fillable Form and how does it work?

The Td1ab Fillable Form is a customizable document template designed for efficient data collection and electronic signatures. Users can easily fill out the form online, ensuring a seamless experience from submission to approval. This functionality streamlines the paperwork process, reducing time and increasing productivity.

-

How much does the Td1ab Fillable Form cost?

Pricing for the Td1ab Fillable Form varies based on the plan you choose with airSlate SignNow. We offer several tiers to accommodate different business sizes and needs, ensuring you find a cost-effective solution. You can review our pricing page for specific details and features associated with each plan.

-

Can I integrate the Td1ab Fillable Form with other applications?

Yes, the Td1ab Fillable Form can easily integrate with various third-party applications, enhancing its functionality. Popular integrations include cloud storage services and CRM platforms, allowing you to streamline your workflow. This connectivity ensures that your data flows seamlessly across tools you already use.

-

What are the benefits of using the Td1ab Fillable Form?

Using the Td1ab Fillable Form offers numerous benefits, including increased efficiency and reduced paper waste. It helps streamline verification processes and can speed up transaction times signNowly. Additionally, the form is designed to be user-friendly, making it accessible to individuals of all tech backgrounds.

-

Is the Td1ab Fillable Form legally binding?

Yes, the Td1ab Fillable Form is legally binding when electronically signed using airSlate SignNow’s secure eSignature technology. Our platform complies with eSignature laws, ensuring that your agreements hold up in court. This provides peace of mind knowing your documents have legal standing.

-

How can I customize the Td1ab Fillable Form?

You can easily customize the Td1ab Fillable Form using our intuitive drag-and-drop editor. This feature allows you to add fields, logos, and compliance statements according to your specific needs. Customization ensures that the form aligns with your brand and operational requirements.

-

What security measures are in place for the Td1ab Fillable Form?

The Td1ab Fillable Form is protected by advanced security measures, including encryption and secure cloud storage. airSlate SignNow prioritizes your data's safety, ensuring that all submissions are safely transmitted and stored. This level of security helps protect sensitive information from unauthorized access.

Get more for Td1ab Fillable Form

- Insulation contractor package washington form

- Paving contractor package washington form

- Site work contractor package washington form

- Siding contractor package washington form

- Refrigeration contractor package washington form

- Drainage contractor package washington form

- Tax free exchange package washington form

- Landlord tenant sublease package washington form

Find out other Td1ab Fillable Form

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe