PURCHASER'S STATEMENT of TAX EXEMPTION Virginia 2021-2026

What is the purchaser's statement of tax exemption in Virginia?

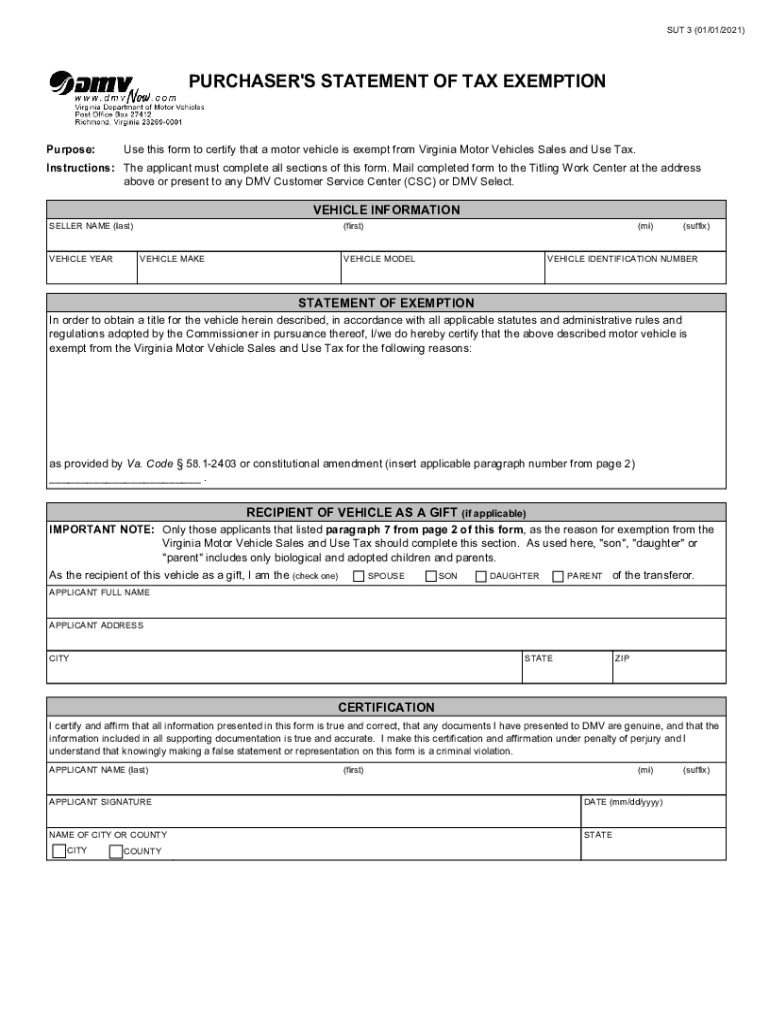

The purchaser's statement of tax exemption, commonly referred to as the SUT 3 form, is a legal document used in Virginia to certify that a buyer is exempt from sales tax on certain purchases. This form is essential for businesses and individuals who qualify for tax exemptions, such as non-profit organizations, government entities, or specific educational institutions. By submitting the SUT 3, purchasers can avoid paying sales tax on eligible items, ensuring compliance with state tax regulations while facilitating smoother transactions.

Steps to complete the purchaser's statement of tax exemption in Virginia

Completing the SUT 3 form requires careful attention to detail to ensure accuracy and compliance. Follow these steps:

- Obtain the form: Access the SUT 3 form from the Virginia Department of Taxation website or through authorized sources.

- Fill in purchaser information: Provide the name, address, and contact details of the purchaser. Ensure that the information is accurate to avoid processing delays.

- Specify the exemption reason: Clearly indicate the reason for the tax exemption, referencing the specific statutes that apply to your situation.

- List items purchased: Detail the items being purchased under the exemption, including descriptions and quantities.

- Signature: The form must be signed by an authorized representative of the purchaser to validate the exemption claim.

Legal use of the purchaser's statement of tax exemption in Virginia

The SUT 3 form serves as a legally binding document when filled out correctly. It is crucial for purchasers to understand that misuse or fraudulent claims can lead to penalties and legal repercussions. The form must be presented to the seller at the time of purchase to ensure that sales tax is not applied. Sellers are required to keep the completed forms on file for their records, as they may be subject to audits by the Virginia Department of Taxation. Proper use of the form protects both the purchaser and the seller from potential tax liabilities.

Eligibility criteria for the purchaser's statement of tax exemption in Virginia

To qualify for using the SUT 3 form, purchasers must meet specific eligibility criteria set forth by the Virginia Department of Taxation. These criteria generally include:

- Non-profit status: Organizations that are recognized as tax-exempt under IRS guidelines may qualify.

- Government entities: Federal, state, and local government agencies are typically exempt from sales tax.

- Educational institutions: Certain schools and colleges may also be eligible for tax exemptions.

It is important for purchasers to verify their eligibility before completing the SUT 3 form to ensure compliance with state regulations.

Examples of using the purchaser's statement of tax exemption in Virginia

The SUT 3 form can be utilized in various scenarios where tax exemption applies. Some common examples include:

- Non-profit organizations: A charity purchasing supplies for an event may use the SUT 3 to avoid sales tax.

- Government contracts: A local government purchasing equipment for public use can present the form to exempt the transaction from sales tax.

- Educational purchases: A university buying textbooks for its library may qualify for tax exemption using the SUT 3 form.

These examples illustrate the practical applications of the SUT 3 form, highlighting its importance in facilitating tax-exempt transactions within Virginia.

How to obtain the purchaser's statement of tax exemption in Virginia

The SUT 3 form can be obtained through several channels to ensure accessibility for all eligible purchasers. Options include:

- Virginia Department of Taxation website: The official website provides downloadable versions of the form.

- Local tax offices: Physical copies may be available at local tax offices or government buildings.

- Professional tax advisors: Tax professionals can assist in obtaining and completing the form correctly.

By utilizing these resources, purchasers can easily access the SUT 3 form to facilitate their tax-exempt transactions.

Quick guide on how to complete purchasers statement of tax exemption virginia

Prepare PURCHASER'S STATEMENT OF TAX EXEMPTION Virginia effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right forms and securely store them online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle PURCHASER'S STATEMENT OF TAX EXEMPTION Virginia on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to edit and eSign PURCHASER'S STATEMENT OF TAX EXEMPTION Virginia with ease

- Locate PURCHASER'S STATEMENT OF TAX EXEMPTION Virginia and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important portions of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, laborious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign PURCHASER'S STATEMENT OF TAX EXEMPTION Virginia and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct purchasers statement of tax exemption virginia

Create this form in 5 minutes!

How to create an eSignature for the purchasers statement of tax exemption virginia

The best way to create an eSignature for your PDF document in the online mode

The best way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is sut 3 in the context of airSlate SignNow?

Sut 3 refers to the third level of our secure electronic signature solutions within airSlate SignNow. This level offers advanced features like customizable workflows and enhanced security measures to ensure your documents are protected. With sut 3, businesses can streamline their signing process while maintaining compliance.

-

How can sut 3 benefit my business operations?

Implementing sut 3 can signNowly enhance your business operations by reducing turnaround times for document signing. With its feature-rich environment, you can automate workflows and improve overall efficiency. This results in increased productivity and allows your team to focus on more strategic tasks.

-

What features are included in the sut 3 package?

The sut 3 package includes features such as advanced document routing, customizable templates, and multi-party signing options. Additionally, you gain access to detailed analytics and reporting capabilities to monitor document status. These features work together to create a seamless signing experience for users.

-

Is sut 3 cost-effective for small businesses?

Yes, sut 3 is designed to be a cost-effective solution for businesses of all sizes, including small companies. The pricing model is competitive, allowing you to benefit from advanced features without breaking the bank. Investing in sut 3 can lead to considerable savings by reducing operational inefficiencies.

-

Can I integrate sut 3 with my existing software?

Absolutely! Sut 3 is designed to integrate seamlessly with a variety of third-party applications, such as CRM and project management tools. This ensures that your document management processes are as streamlined as possible, enhancing collaboration across your platforms.

-

What industries can benefit from sut 3?

Sut 3 can benefit a wide range of industries, including real estate, healthcare, finance, and education. The flexibility and robust features of airSlate SignNow allow it to adapt to the specific needs of different industries, enabling compliant and efficient document handling. Ultimately, any business that relies on signed documents can find value in sut 3.

-

How secure is sut 3 for electronic signatures?

Security is a top priority for sut 3, which incorporates multiple layers of protection such as encryption and secure access controls. This ensures that your sensitive documents are safeguarded against unauthorized access. Additionally, sut 3 complies with major regulations like eIDAS and ESIGN to provide peace of mind.

Get more for PURCHASER'S STATEMENT OF TAX EXEMPTION Virginia

- Dart reduced fare application form

- Security deposit claim form

- Suitability questionnaire form

- Cift 620es web louisiana department of revenue 735288027 form

- 32423 louisiana department of revenue form

- Cdocuments and settingsjmdesktopiseclawenforcementrequestform3 14 03 wpd labor alabama

- Scodrdot form

- Alaska plan for custody and visitation in support of shc 1120 form

Find out other PURCHASER'S STATEMENT OF TAX EXEMPTION Virginia

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy