Irs Publication Unemployment Form

What is the IRS Publication Unemployment

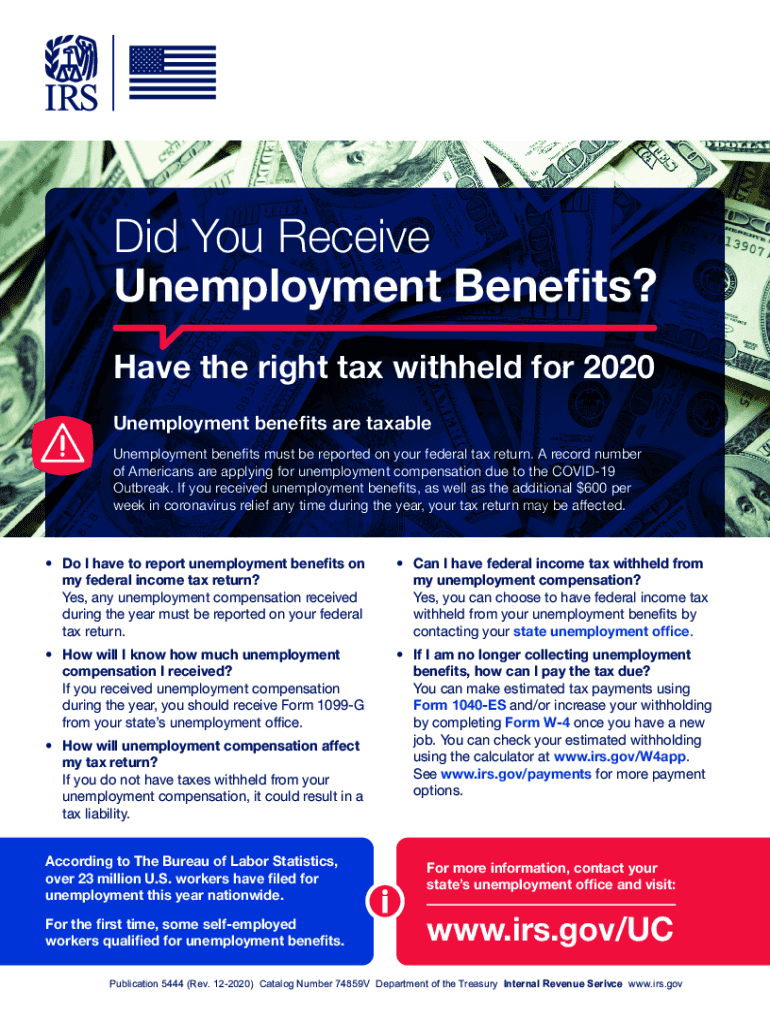

The IRS Publication 5444 provides crucial information regarding unemployment benefits and the tax implications associated with them. This publication outlines how unemployment compensation is treated for federal tax purposes, detailing what individuals must report as income. Understanding this publication is essential for those who have received unemployment benefits, as it helps clarify how these funds impact their overall tax obligations.

How to Use the IRS Publication Unemployment

To effectively use the IRS Publication 5444, individuals should first review the document to understand the specifics of unemployment benefits and their tax responsibilities. It is important to identify which portions of the publication apply to your situation, such as eligibility criteria and reporting requirements. Additionally, taxpayers can use the publication as a reference when completing their tax returns, ensuring they accurately report any unemployment income received during the tax year.

Steps to Complete the IRS Publication Unemployment

Completing the IRS Publication 5444 involves several key steps:

- Gather all relevant documents, including any forms received from the unemployment office.

- Read through the publication to understand your reporting obligations regarding unemployment income.

- Fill out your tax return accurately, including any unemployment compensation as specified in the publication.

- Double-check your completed return for accuracy before submission.

Legal Use of the IRS Publication Unemployment

The IRS Publication 5444 is legally binding in the sense that it provides guidelines for how unemployment benefits should be reported for tax purposes. By adhering to the instructions within the publication, taxpayers can ensure compliance with federal tax laws. Failure to correctly report unemployment income can lead to penalties, making it essential to follow the guidelines provided in this publication.

Eligibility Criteria

Eligibility for unemployment benefits, as outlined in the IRS Publication 5444, varies by state and individual circumstances. Generally, individuals must have lost their job through no fault of their own and meet specific work history requirements. The publication also explains how different types of unemployment benefits may affect eligibility and what documentation is necessary to support claims.

Filing Deadlines / Important Dates

Filing deadlines for reporting unemployment income are typically aligned with the general tax filing deadlines. The IRS Publication 5444 provides guidance on these important dates, ensuring taxpayers are aware of when they must report their unemployment benefits. Staying informed about these deadlines is crucial to avoid late penalties and ensure compliance with tax regulations.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit their completed forms related to unemployment benefits through various methods, as indicated in the IRS Publication 5444. Options typically include online submission through the IRS e-file system, mailing paper forms, or in-person filing at designated tax offices. Each method has its own requirements and timelines, which are detailed in the publication to assist taxpayers in choosing the best option for their needs.

Quick guide on how to complete irs publication unemployment

Manage Irs Publication Unemployment effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Handle Irs Publication Unemployment on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The easiest way to modify and eSign Irs Publication Unemployment without effort

- Obtain Irs Publication Unemployment and click on Get Form to begin.

- Use the tools at your disposal to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form hunts, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Alter and eSign Irs Publication Unemployment to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs publication unemployment

How to create an eSignature for your PDF file online

How to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF on Android devices

People also ask

-

What is IRS Publication 5444 and how can I access it?

IRS Publication 5444 provides important information on how to properly eSign documents related to tax compliance. You can access IRS Publication 5444 easily through the official IRS website or by using an eSigning platform like airSlate SignNow, which also helps you manage your documents effectively.

-

How does airSlate SignNow support IRS Publication 5444 compliance?

airSlate SignNow ensures compliance with IRS Publication 5444 by providing secure eSignature options that meet federal guidelines. Our platform is designed to maintain your document integrity, making it easier to fulfill IRS requirements while streamlining your signing processes.

-

What are the benefits of using airSlate SignNow for IRS documents?

Using airSlate SignNow for IRS documents, including those governed by IRS Publication 5444, allows users to save time and reduce errors associated with manual signing. Our user-friendly platform ensures quick access to signed documents, improving your overall workflow efficiency.

-

Is airSlate SignNow a cost-effective solution for eSigning IRS Publication 5444-related documents?

Yes, airSlate SignNow offers a cost-effective solution for eSigning documents associated with IRS Publication 5444. Our flexible pricing plans are designed for businesses of all sizes, helping you save on traditional printing and mailing costs.

-

Can I integrate airSlate SignNow with other tools for IRS Publication 5444 documentation?

Absolutely! airSlate SignNow integrates seamlessly with various platforms such as Google Drive, Dropbox, and more, allowing you to manage your IRS Publication 5444 documents alongside your existing tools. This integration streamlines your document flow and enhances productivity.

-

What features does airSlate SignNow offer that are relevant to IRS Publication 5444?

airSlate SignNow provides several features that are highly relevant to IRS Publication 5444, including customizable templates, secure cloud storage, and audit trails. These features ensure your eSigning process is efficient, compliant, and easy to track.

-

How does airSlate SignNow ensure the security of documents related to IRS Publication 5444?

The security of your documents is a top priority at airSlate SignNow. We comply with the latest security standards, ensuring that all documents related to IRS Publication 5444 are encrypted and protected from unauthorized access.

Get more for Irs Publication Unemployment

Find out other Irs Publication Unemployment

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online