Form 14095 Rev 8 the Health Coverage Tax Credit HCTC Reimbursement Request 2020-2026

What is the Form 14095 Rev 8: The Health Coverage Tax Credit HCTC Reimbursement Request

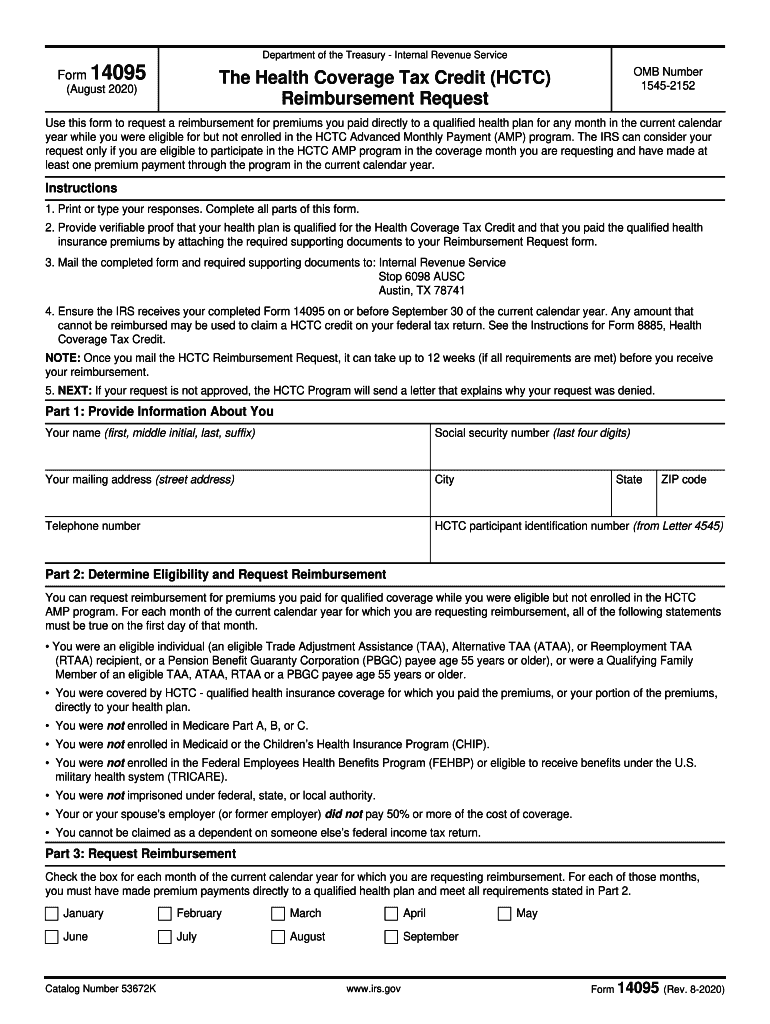

The Form 14095 Rev 8 is a crucial document for individuals eligible for the Health Coverage Tax Credit (HCTC). This tax credit assists qualified individuals in paying for health insurance premiums. The form is specifically designed for those who have lost their jobs due to trade-related issues or are receiving pension benefits from the Pension Benefit Guaranty Corporation (PBGC). By filing this form, eligible taxpayers can request reimbursement for a portion of their health insurance costs, making healthcare more affordable during challenging times.

Steps to Complete the Form 14095 Rev 8

Completing the Form 14095 Rev 8 involves several important steps to ensure accuracy and compliance. Begin by gathering necessary documents, including proof of health insurance coverage and any relevant income information. Next, fill out the form with accurate personal details, including your name, Social Security number, and the type of health coverage you have. Ensure that you provide the correct amounts for your premiums paid, as this will determine your reimbursement amount. After completing the form, review it carefully for any errors before submission.

Eligibility Criteria for the HCTC

To qualify for the Health Coverage Tax Credit, certain eligibility criteria must be met. Individuals must have been receiving trade adjustment assistance (TAA) or be eligible for PBGC pension benefits. Additionally, the health insurance plan must be a qualified plan, which includes coverage through a spouse or a former employer. It is essential to verify that all conditions are satisfied before submitting the Form 14095 to avoid delays in processing your reimbursement request.

Required Documents for Form 14095 Rev 8

When filing the Form 14095 Rev 8, specific documents are required to support your reimbursement request. These typically include proof of health insurance premiums paid, such as invoices or receipts, and documentation confirming your eligibility for the HCTC, such as TAA approval letters or PBGC benefit statements. Having these documents ready will streamline the submission process and help ensure that your request is processed efficiently.

Form Submission Methods

The Form 14095 Rev 8 can be submitted through various methods, providing flexibility for users. Individuals may choose to submit the form electronically via the IRS e-file system, which is often the fastest method. Alternatively, the form can be mailed to the appropriate IRS address, or, in some cases, submitted in person at designated IRS offices. Each method has its own processing times, so selecting the most suitable option based on your needs is important.

IRS Guidelines for Completing the Form

The IRS provides specific guidelines for completing the Form 14095 Rev 8 to ensure compliance and accuracy. These guidelines include detailed instructions on how to fill out each section of the form, what information is required, and how to calculate the reimbursement amount. It is advisable to review these guidelines thoroughly before starting the form to avoid common mistakes that could lead to delays or denials of your reimbursement request.

Filing Deadlines for the HCTC

Filing deadlines for the Form 14095 Rev 8 are critical to ensure timely reimbursement. Generally, the form must be submitted within a specific period following the payment of health insurance premiums. It is essential to stay informed about these deadlines, as late submissions may result in the loss of potential reimbursement. Keeping track of any changes in deadlines announced by the IRS can help ensure that your request is filed on time.

Quick guide on how to complete form 14095 rev 8 2020 the health coverage tax credit hctc reimbursement request

Prepare Form 14095 Rev 8 The Health Coverage Tax Credit HCTC Reimbursement Request seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the features you need to create, edit, and eSign your documents quickly without delays. Manage Form 14095 Rev 8 The Health Coverage Tax Credit HCTC Reimbursement Request on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Form 14095 Rev 8 The Health Coverage Tax Credit HCTC Reimbursement Request effortlessly

- Find Form 14095 Rev 8 The Health Coverage Tax Credit HCTC Reimbursement Request and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight relevant portions of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your delivery method for the form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 14095 Rev 8 The Health Coverage Tax Credit HCTC Reimbursement Request and maintain excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 14095 rev 8 2020 the health coverage tax credit hctc reimbursement request

Create this form in 5 minutes!

How to create an eSignature for the form 14095 rev 8 2020 the health coverage tax credit hctc reimbursement request

How to make an electronic signature for a PDF document in the online mode

How to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the IRS 14095 form and why is it important?

The IRS 14095 form is associated with specific tax-related documents which may require electronic signatures for compliance. Understanding its importance can help businesses ensure they are meeting IRS requirements efficiently. Using airSlate SignNow allows you to easily manage and eSign this form, streamlining your documentation process.

-

How can airSlate SignNow help with the IRS 14095 form?

airSlate SignNow provides a user-friendly platform that simplifies the process of signing and sending the IRS 14095 form. By utilizing our advanced eSignature technology, businesses can securely sign this form and keep track of all necessary documentation in one place, enhancing efficiency and compliance.

-

What are the pricing options for airSlate SignNow when handling IRS 14095 forms?

airSlate SignNow offers flexible pricing plans designed to fit the needs of businesses of all sizes. As you manage the IRS 14095 form through our platform, you can choose a plan that provides the right features at a cost-effective rate, ensuring you have the tools you need without overspending.

-

Can I integrate airSlate SignNow with other software for handling the IRS 14095 form?

Yes, airSlate SignNow seamlessly integrates with a variety of software tools that can assist in managing the IRS 14095 form. Whether you use CRM systems, document management tools, or other applications, our integrations enable a smooth workflow, saving you time and reducing manual errors.

-

What features does airSlate SignNow offer for managing IRS 14095 forms?

airSlate SignNow includes features such as customizable templates, bulk signing, and real-time tracking to enhance the efficiency of managing the IRS 14095 form. These tools simplify the documentation process, ensuring compliance and making it easier to handle multiple signatories.

-

Is airSlate SignNow secure for signing important documents like the IRS 14095 form?

Absolutely! airSlate SignNow takes security seriously and utilizes advanced encryption technologies to protect your documents. When signing important forms like the IRS 14095 form, you can trust that your information is secure and complied with industry standards.

-

What benefits does airSlate SignNow provide for businesses dealing with the IRS 14095 form?

Using airSlate SignNow for the IRS 14095 form offers numerous benefits, including increased efficiency, reduced turnaround time, and improved compliance. Our platform helps streamline the signing process, allowing businesses to focus more on their core activities rather than paperwork.

Get more for Form 14095 Rev 8 The Health Coverage Tax Credit HCTC Reimbursement Request

Find out other Form 14095 Rev 8 The Health Coverage Tax Credit HCTC Reimbursement Request

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now