Department of the Treasury Internal Revenue Service 14095 Irs 2017

Understanding the Department Of The Treasury Internal Revenue Service 14095 IRS Form

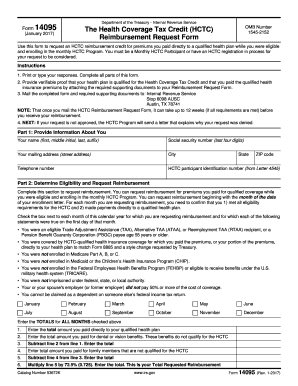

The Department Of The Treasury Internal Revenue Service 14095 IRS form is a crucial document used in various tax-related processes. It serves specific purposes, including reporting certain financial information to the IRS. Understanding this form is essential for compliance with federal tax regulations. The IRS provides guidelines on how to accurately complete and submit this form, ensuring that taxpayers meet their obligations without facing penalties.

Steps to Complete the Department Of The Treasury Internal Revenue Service 14095 IRS Form

Completing the Department Of The Treasury Internal Revenue Service 14095 IRS form involves several key steps. Begin by gathering all necessary information, including personal identification details and financial records relevant to the form. Next, carefully fill out each section of the form, ensuring accuracy to avoid delays or issues with processing. After completing the form, review it thoroughly for any errors before submission. This careful attention to detail helps ensure compliance with IRS requirements.

Legal Use of the Department Of The Treasury Internal Revenue Service 14095 IRS Form

The legal use of the Department Of The Treasury Internal Revenue Service 14095 IRS form is governed by federal tax laws. This form must be filled out accurately and submitted on time to avoid potential penalties. Electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act. Utilizing a reliable eSignature solution can enhance the form's legality and security, ensuring that it meets all necessary legal standards.

How to Use the Department Of The Treasury Internal Revenue Service 14095 IRS Form

Using the Department Of The Treasury Internal Revenue Service 14095 IRS form effectively requires understanding its purpose and requirements. Begin by accessing the form through the IRS website or authorized platforms. Follow the instructions carefully, filling out each section based on your specific tax situation. If you are uncertain about any part of the form, consider consulting IRS resources or a tax professional for guidance. This ensures that you use the form correctly and in accordance with IRS regulations.

Filing Deadlines for the Department Of The Treasury Internal Revenue Service 14095 IRS Form

Filing deadlines for the Department Of The Treasury Internal Revenue Service 14095 IRS form are critical to ensure compliance. Typically, forms must be submitted by specific dates set by the IRS, often coinciding with the annual tax filing season. It is essential to stay informed about these deadlines to avoid late fees or other penalties. Marking important dates on your calendar can help you manage your filing responsibilities effectively.

Required Documents for the Department Of The Treasury Internal Revenue Service 14095 IRS Form

To complete the Department Of The Treasury Internal Revenue Service 14095 IRS form, certain documents are required. These may include your Social Security number, income statements, and any relevant financial documentation that supports the information reported on the form. Having these documents ready beforehand can streamline the completion process and help ensure that all necessary information is accurately reported to the IRS.

Quick guide on how to complete department of the treasury internal revenue service 14095 irs

Complete Department Of The Treasury Internal Revenue Service 14095 Irs effortlessly on any device

Web-based document management has gained popularity among organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely保存 it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Department Of The Treasury Internal Revenue Service 14095 Irs on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and eSign Department Of The Treasury Internal Revenue Service 14095 Irs seamlessly

- Locate Department Of The Treasury Internal Revenue Service 14095 Irs and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select key sections of your documents or redact sensitive information using the tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to store your changes.

- Choose how you prefer to share your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Department Of The Treasury Internal Revenue Service 14095 Irs and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct department of the treasury internal revenue service 14095 irs

Create this form in 5 minutes!

How to create an eSignature for the department of the treasury internal revenue service 14095 irs

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The way to generate an eSignature for a PDF file on Android

People also ask

-

What is the role of the Department Of The Treasury Internal Revenue Service 14095 Irs?

The Department Of The Treasury Internal Revenue Service 14095 Irs plays a crucial role in the administration of federal tax laws. It is responsible for collecting taxes, issuing refunds, and enforcing tax regulations. By understanding its functions, businesses can better navigate their obligations and utilize solutions like airSlate SignNow for efficient document management.

-

How does airSlate SignNow integrate with the Department Of The Treasury Internal Revenue Service 14095 Irs?

airSlate SignNow offers seamless integration with various financial platforms, including those that interface with the Department Of The Treasury Internal Revenue Service 14095 Irs. This ensures that businesses can easily send, sign, and manage documents related to tax filings and communications with the IRS. Our solution simplifies compliance and record-keeping.

-

What are the pricing options for airSlate SignNow concerning the Department Of The Treasury Internal Revenue Service 14095 Irs?

airSlate SignNow provides flexible pricing plans that cater to businesses of all sizes, making it a cost-effective solution when dealing with documents related to the Department Of The Treasury Internal Revenue Service 14095 Irs. Our plans include features that streamline eSigning and document management, ensuring your investment leads to improved efficiency and compliance.

-

What features does airSlate SignNow offer for IRS-related documents?

airSlate SignNow offers a suite of features including customizable templates, real-time collaboration, and secure eSigning capabilities tailored for IRS-related documents. This streamlines the process of preparing and submitting necessary forms to the Department Of The Treasury Internal Revenue Service 14095 Irs. Effortlessly manage your documentation with our user-friendly platform.

-

How can airSlate SignNow benefit businesses dealing with the Department Of The Treasury Internal Revenue Service 14095 Irs?

Businesses can benefit from airSlate SignNow by saving time and reducing errors when managing their communication with the Department Of The Treasury Internal Revenue Service 14095 Irs. Our solution enhances efficiency by allowing for quick eSignatures and automated workflows that ensure compliance with IRS requirements. This leads to greater productivity and peace of mind.

-

Is airSlate SignNow secure for documents associated with the Department Of The Treasury Internal Revenue Service 14095 Irs?

Yes, airSlate SignNow prioritizes security, implementing robust measures to ensure that all documents, especially those related to the Department Of The Treasury Internal Revenue Service 14095 Irs, are protected. We use encryption and a secure environment to safeguard sensitive information. You can trust us to keep your tax-related transactions safe.

-

Can airSlate SignNow support multiple users for IRS document management?

Absolutely! airSlate SignNow supports multi-user features, enabling teams to collaborate effectively on IRS document management. Whether you're preparing forms for the Department Of The Treasury Internal Revenue Service 14095 Irs or sharing important tax documents, our platform fosters teamwork and ensures everyone stays informed throughout the process.

Get more for Department Of The Treasury Internal Revenue Service 14095 Irs

Find out other Department Of The Treasury Internal Revenue Service 14095 Irs

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile