Publication 6292 a Rev 9 Fiscal Year Return Projections for the United States 2020

What is the Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States

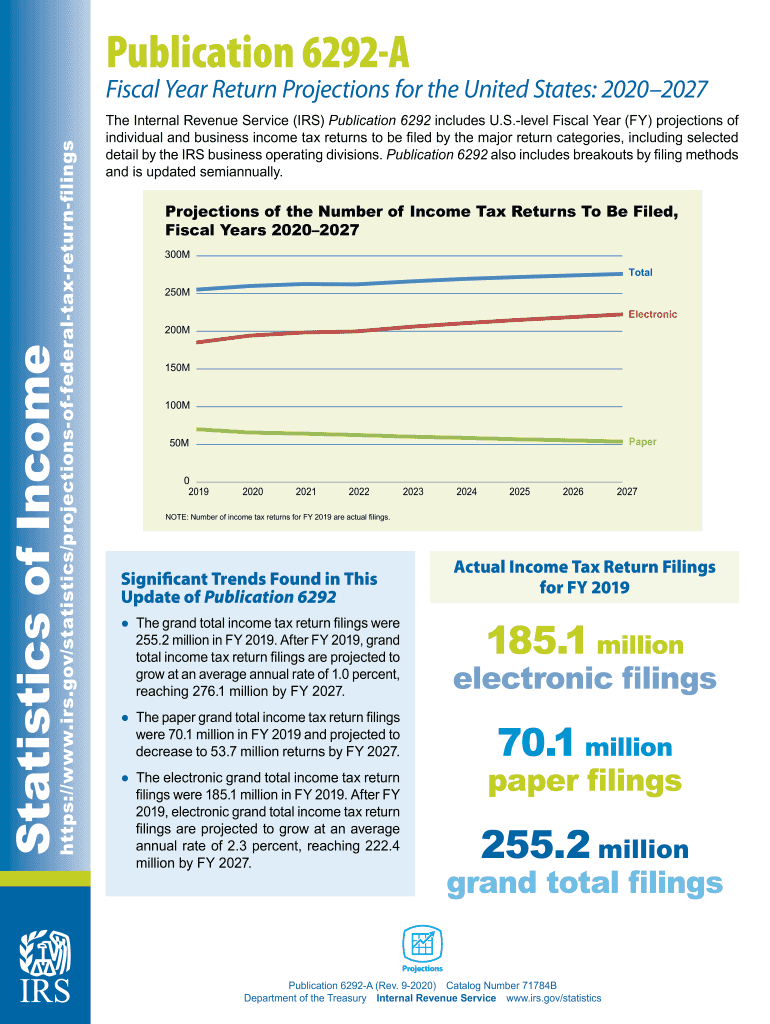

The Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States is an official document issued by the Internal Revenue Service (IRS). This publication provides essential guidelines and projections for taxpayers regarding their anticipated tax returns for the fiscal year. It serves as a resource for understanding potential tax liabilities and planning accordingly. The publication outlines various factors that can influence tax returns, including income levels, deductions, and credits available to different taxpayer categories.

How to use the Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States

To effectively use the Publication 6292 A Rev 9, taxpayers should first review the guidelines outlined within the document. It is important to identify the relevant sections that pertain to individual financial situations. Taxpayers can utilize the projections provided to estimate their tax obligations and make informed decisions regarding withholding and estimated tax payments. This proactive approach can help avoid underpayment penalties and ensure compliance with IRS regulations.

Steps to complete the Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States

Completing the Publication 6292 A Rev 9 involves several key steps:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Review the publication to understand the specific projections and guidelines that apply to your situation.

- Calculate your expected income and applicable deductions based on the information provided.

- Use the projections to estimate your tax liability for the fiscal year.

- Consider adjustments to withholding or estimated payments based on your projections.

Legal use of the Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States

The legal use of the Publication 6292 A Rev 9 is grounded in its status as an official IRS document. Taxpayers are encouraged to utilize the publication to ensure compliance with federal tax laws. The projections and guidelines provided are designed to help individuals and businesses accurately report their tax liabilities. Utilizing this publication can also aid in defending against potential audits by demonstrating adherence to IRS recommendations.

IRS Guidelines

The IRS guidelines related to the Publication 6292 A Rev 9 emphasize the importance of accurate reporting and timely submissions. Taxpayers should familiarize themselves with the specific requirements outlined in the publication, including deadlines for filing and payment. Adhering to these guidelines not only ensures compliance but also helps in effective tax planning and management.

Filing Deadlines / Important Dates

Filing deadlines associated with the Publication 6292 A Rev 9 are crucial for taxpayers to observe. Typically, the deadline for filing federal tax returns falls on April fifteenth of each year, unless it falls on a weekend or holiday. Taxpayers should also be aware of any extensions that may apply and the importance of timely estimated tax payments throughout the fiscal year to avoid penalties.

Examples of using the Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States

Examples of using the Publication 6292 A Rev 9 include scenarios such as:

- A self-employed individual estimating their quarterly tax payments based on projected income and expenses.

- A family planning for potential tax credits related to education expenses by reviewing the publication's guidelines.

- A business assessing its tax liability for the upcoming year based on projected revenue and allowable deductions.

Quick guide on how to complete publication 6292 a rev 9 2020 fiscal year return projections for the united states

Handle Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States seamlessly on any gadget

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and eSign Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States effortlessly

- Find Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the information and click on the Done button to secure your changes.

- Choose how you wish to share your form, via email, SMS, or a shared link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and eSign Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct publication 6292 a rev 9 2020 fiscal year return projections for the united states

Create this form in 5 minutes!

How to create an eSignature for the publication 6292 a rev 9 2020 fiscal year return projections for the united states

The best way to create an eSignature for your PDF document in the online mode

The best way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

The best way to make an eSignature for a PDF file on Android devices

People also ask

-

What is 'Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States'?

Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States is a guide that helps individuals and businesses understand their tax return projections. This document outlines the expected fiscal year tax obligations, providing invaluable insights for financial planning and compliance.

-

How can airSlate SignNow assist with 'Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States'?

airSlate SignNow streamlines the process of signing and managing documents related to 'Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States'. Our easy-to-use platform allows businesses to digitally sign and send documents quickly, ensuring efficiency and accuracy in tax documentation.

-

What features does airSlate SignNow offer for managing tax documents?

With airSlate SignNow, you can create, edit, and sign documents related to 'Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States'. Features include customizable templates, real-time notifications, and secure storage, making it easier for businesses to handle their tax documents effectively.

-

Is airSlate SignNow a cost-effective solution for businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses. By simplifying the document signing process related to 'Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States', companies can save on time and resources, ultimately lowering costs associated with paper-based workflows.

-

What benefits does airSlate SignNow provide for tax professionals?

airSlate SignNow offers several benefits for tax professionals, including enhanced workflow efficiency and document tracking. By utilizing our platform, tax professionals can quickly manage and sign documents related to 'Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States', improving client satisfaction and timely tax submissions.

-

Does airSlate SignNow integrate with other software commonly used for tax preparation?

Yes, airSlate SignNow integrates seamlessly with various accounting software and tax preparation tools. This integration helps professionals manage documents concerning 'Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States' within their preferred platforms, streamlining their work process.

-

How secure is the document management process with airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, employing advanced encryption methods to protect sensitive information related to 'Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States'. Our platform ensures that your documents are safe and compliant with industry standards.

Get more for Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States

- Trinity grade 4 topic form

- Umverteilungsantrag form

- Uti form for cliam relaxed procedure

- Participant medical history and examination form

- R 1201 form

- Mba project completion certificate format in word

- Instructions for form 1042 annual withholding tax return for

- Schedule lep form 1040 rev december request for change in language preference

Find out other Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament