Publication 6292 a Rev 9 Fiscal Year Return Projections for the United States 2023

Understanding Publication 6292 A Rev 9 Fiscal Year Return Projections

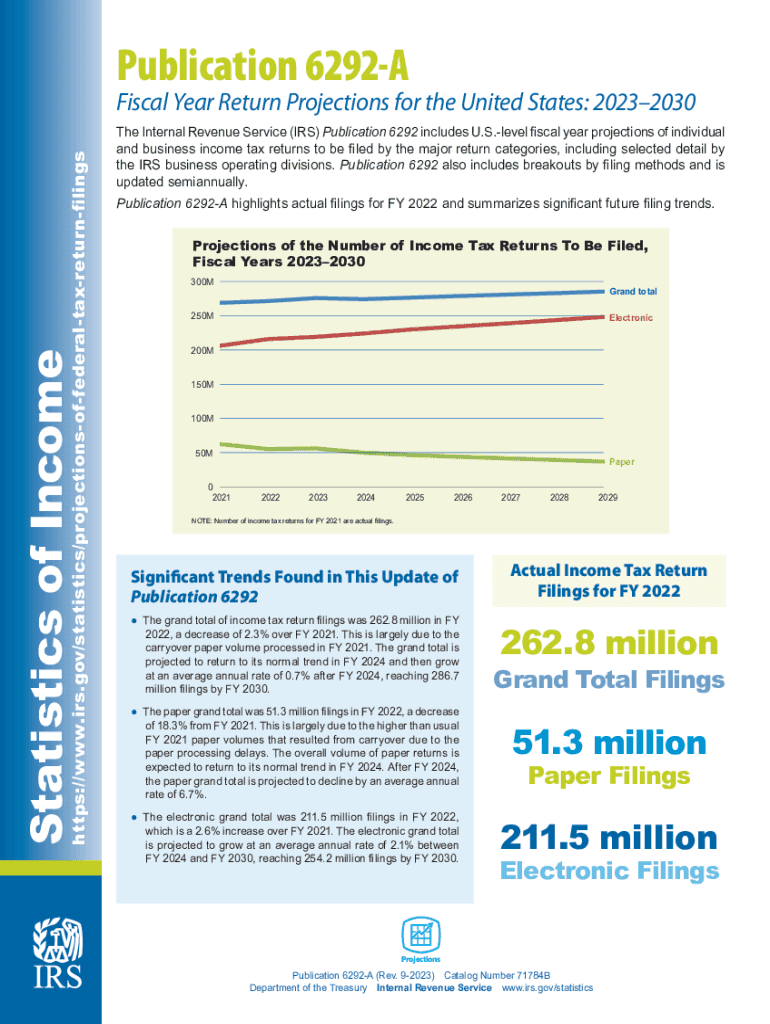

Publication 6292 A Rev 9 provides essential guidance for individuals and businesses in the United States regarding fiscal year return projections. This document outlines how to estimate tax liabilities and plan for upcoming financial obligations based on projected income and expenses. It serves as a valuable resource for taxpayers seeking clarity on their financial responsibilities within a specific fiscal year.

How to Utilize Publication 6292 A Rev 9 Effectively

To effectively use Publication 6292 A Rev 9, taxpayers should first familiarize themselves with the key components of the document. This includes understanding the specific calculations required to project taxes accurately. Users are encouraged to gather all relevant financial data, including income statements and expense reports, to ensure precise projections. By applying the guidelines provided in the publication, individuals can create a comprehensive financial plan that aligns with their tax obligations.

Obtaining Publication 6292 A Rev 9

Publication 6292 A Rev 9 can be obtained directly from the Internal Revenue Service (IRS) website or through authorized tax preparation services. It is important to ensure that you are accessing the most current version of the publication to receive accurate information. Additionally, local libraries and community centers may provide printed copies for public use, making it accessible to a wider audience.

Steps to Complete the Publication 6292 A Rev 9 Projections

Completing the projections outlined in Publication 6292 A Rev 9 involves several key steps:

- Gather relevant financial documents, including previous tax returns, income statements, and any anticipated changes in financial status.

- Review the guidelines in the publication to understand the necessary calculations for estimating tax liabilities.

- Utilize worksheets or templates provided in the publication to organize your financial data systematically.

- Double-check calculations for accuracy to ensure reliable projections.

- Consult with a tax professional if needed for clarification on complex scenarios.

Key Elements of Publication 6292 A Rev 9

Key elements of Publication 6292 A Rev 9 include:

- Detailed instructions on calculating projected income and expenses.

- Examples illustrating common scenarios faced by taxpayers.

- Important deadlines and filing requirements associated with tax projections.

- Information on potential penalties for non-compliance with tax obligations.

IRS Guidelines Related to Publication 6292 A Rev 9

The IRS provides specific guidelines regarding the use of Publication 6292 A Rev 9. Taxpayers are advised to follow the outlined procedures closely to avoid errors in their projections. The IRS emphasizes the importance of accuracy and completeness in financial reporting to ensure compliance with federal tax laws. Regular updates to the publication may reflect changes in tax laws, so staying informed is crucial for effective tax planning.

Quick guide on how to complete publication 6292 a rev 9 fiscal year return projections for the united states

Facilitate Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly option to conventional printed and signed documents, as you can locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without holdups. Manage Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States across any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to modify and eSign Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States seamlessly

- Locate Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States and click Get Form to commence.

- Make use of the tools we offer to complete your document.

- Emphasize key sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose your method of sharing the form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Edit and eSign Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct publication 6292 a rev 9 fiscal year return projections for the united states

Create this form in 5 minutes!

How to create an eSignature for the publication 6292 a rev 9 fiscal year return projections for the united states

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States?

Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States is a guide provided by the IRS that assists businesses in projecting their fiscal year taxes. It outlines key information and considerations necessary for accurate financial planning. Understanding this publication helps businesses prepare more effectively for tax season.

-

How can airSlate SignNow help me with my tax preparations related to Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States?

airSlate SignNow streamlines the document signing process, making it easier to manage the necessary paperwork when preparing for Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States. Our platform allows users to electronically sign and send documents, reducing the time spent on administrative tasks and improving compliance.

-

What features does airSlate SignNow offer for handling documents related to Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States?

AirSlate SignNow offers a range of features including customizable templates, secure eSigning, and integrated workflows, all crucial for managing documents related to Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States. These features ensure that you can prepare and file necessary documentation efficiently and in compliance with the IRS requirements.

-

Is airSlate SignNow cost-effective for small businesses looking at Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small enterprises. By reducing the need for paper-based processes and saving time with eSignatures, it aligns perfectly with the financial considerations outlined in Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States.

-

Can I integrate airSlate SignNow with other financial software to simplify processes related to Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States?

Absolutely! airSlate SignNow offers integrations with various financial and accounting software platforms, which can simplify your processes related to Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States. This compatibility enhances workflow efficiency and ensures that all your financial documents are easily accessible.

-

What benefits do businesses gain from using airSlate SignNow for Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States?

Using airSlate SignNow provides businesses with quick access to necessary documents, legal security for eSignatures, and enhanced collaboration among teams. These benefits are essential when addressing the requirements outlined in Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States, positioning your business for successful tax planning.

-

Is it easy to train my team to use airSlate SignNow for handling Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States?

Yes, airSlate SignNow is designed to be user-friendly, which means your team can quickly learn to navigate it efficiently. The platform provides resources and support to help users understand how to manage documents effectively, particularly those pertaining to Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States.

Get more for Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States

- Lockout tagout template word form

- Copy request form 225777203

- Midland central appraisal district southwest data solutions form

- Omb control number 1506 0043 the information bb fincen commerzbank

- English student mentor program parent permission form doc healthiersf

- Ca1 form 25302143

- Virtual office lease agreement template form

- Void lease agreement template form

Find out other Publication 6292 A Rev 9 Fiscal Year Return Projections For The United States

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online