and Distributions 2017

What is the And Distributions

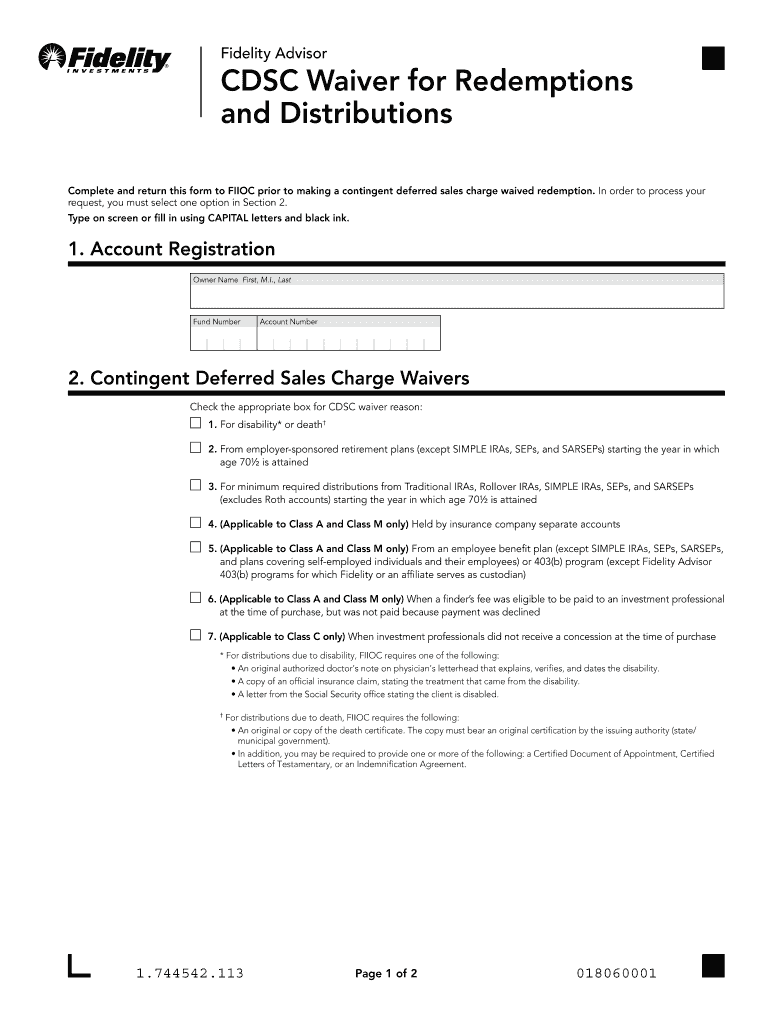

The And Distributions form is a crucial document used in various business and financial contexts, particularly for reporting distributions made to individuals or entities. This form typically serves to inform the Internal Revenue Service (IRS) about the distributions from partnerships, corporations, or other entities. It ensures compliance with tax regulations and helps maintain transparency in financial transactions.

How to use the And Distributions

Using the And Distributions form involves several steps to ensure accurate reporting. First, gather all necessary information regarding the distributions being reported, including the recipient's details and the amount distributed. Next, fill out the form with the required information, ensuring that all fields are completed accurately. Once the form is filled out, review it for any errors before submission to avoid potential penalties or delays.

Steps to complete the And Distributions

Completing the And Distributions form can be broken down into a series of straightforward steps:

- Collect necessary data, including recipient names, addresses, and Social Security numbers or Employer Identification Numbers.

- Determine the total amount of distributions made during the reporting period.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check the information for accuracy and completeness.

- Submit the form electronically or via mail, depending on your preference and compliance requirements.

Legal use of the And Distributions

The legal use of the And Distributions form is governed by IRS regulations. It is essential to ensure that the form is completed in compliance with these regulations to avoid legal repercussions. Accurate reporting of distributions not only fulfills tax obligations but also helps in maintaining good standing with the IRS. Failure to comply with these legal requirements can result in penalties, fines, or further audits.

IRS Guidelines

The IRS provides specific guidelines for completing the And Distributions form. These guidelines outline the necessary information to include, the filing deadlines, and the acceptable submission methods. It is important to follow these guidelines closely to ensure compliance and avoid any issues with the IRS. Familiarizing yourself with these guidelines can help streamline the process and ensure that all requirements are met.

Required Documents

When preparing to complete the And Distributions form, certain documents are typically required. These may include:

- Financial statements detailing the distributions made.

- Recipient information, including Social Security numbers or Employer Identification Numbers.

- Prior year tax returns, if applicable, for reference.

Having these documents on hand can facilitate the completion of the form and ensure that all necessary information is accurately reported.

Quick guide on how to complete and distributions

Effortlessly Prepare And Distributions on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can acquire the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly and without delays. Manage And Distributions on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to Edit and eSign And Distributions with Ease

- Find And Distributions, then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for such tasks.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, laborious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and eSign And Distributions while ensuring excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct and distributions

Create this form in 5 minutes!

How to create an eSignature for the and distributions

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What are the primary features of airSlate SignNow for managing And Distributions?

airSlate SignNow offers a variety of features for managing And Distributions, including customizable templates, bulk sending options, and robust eSignature capabilities. Our platform is designed to streamline the entire signing process, making it easier for teams to collaborate and finalize documents efficiently.

-

How does airSlate SignNow ensure the security of documents related to And Distributions?

Security is a top priority for airSlate SignNow, especially for sensitive documents related to And Distributions. We utilize bank-level encryption, secure access protocols, and comprehensive audit trails to ensure that your documents remain protected at all times.

-

What are the pricing plans available for airSlate SignNow focusing on And Distributions?

airSlate SignNow offers flexible pricing plans tailored for various business sizes, all focusing on eSignatures and document management for And Distributions. Plans range from a basic package suitable for small businesses to advanced options for larger enterprises, allowing you to choose the solution that fits your needs best.

-

Can airSlate SignNow integrate with other apps for managing And Distributions?

Yes, airSlate SignNow seamlessly integrates with a wide variety of applications, helping to enhance workflows involving And Distributions. Popular integrations include CRM systems, project management tools, and cloud storage services, ensuring that you can connect all your essential tools in one platform.

-

What benefits can businesses expect from using airSlate SignNow for And Distributions?

By utilizing airSlate SignNow for And Distributions, businesses can expect improved efficiency, reduced turnaround times, and higher document accuracy. Our user-friendly interface and advanced features lead to a more streamlined process, saving your team both time and resources.

-

Is mobile access available for airSlate SignNow to handle And Distributions on the go?

Absolutely! airSlate SignNow provides a mobile application that allows you to manage And Distributions from anywhere. This means you can send, sign, and track documents on your smartphone or tablet, ensuring constant accessibility and convenience.

-

How does airSlate SignNow support compliance for documents related to And Distributions?

airSlate SignNow adheres to various industry standards and complies with regulations such as eIDAS and ESIGN, which govern the legality of electronic signatures. This ensures that your documents related to And Distributions are compliant and enforceable in legal contexts.

Get more for And Distributions

Find out other And Distributions

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now