New Hampshire Non Foreign Affidavit under IRC 1445 Form

Understanding the New Hampshire Non Foreign Affidavit Under IRC 1445

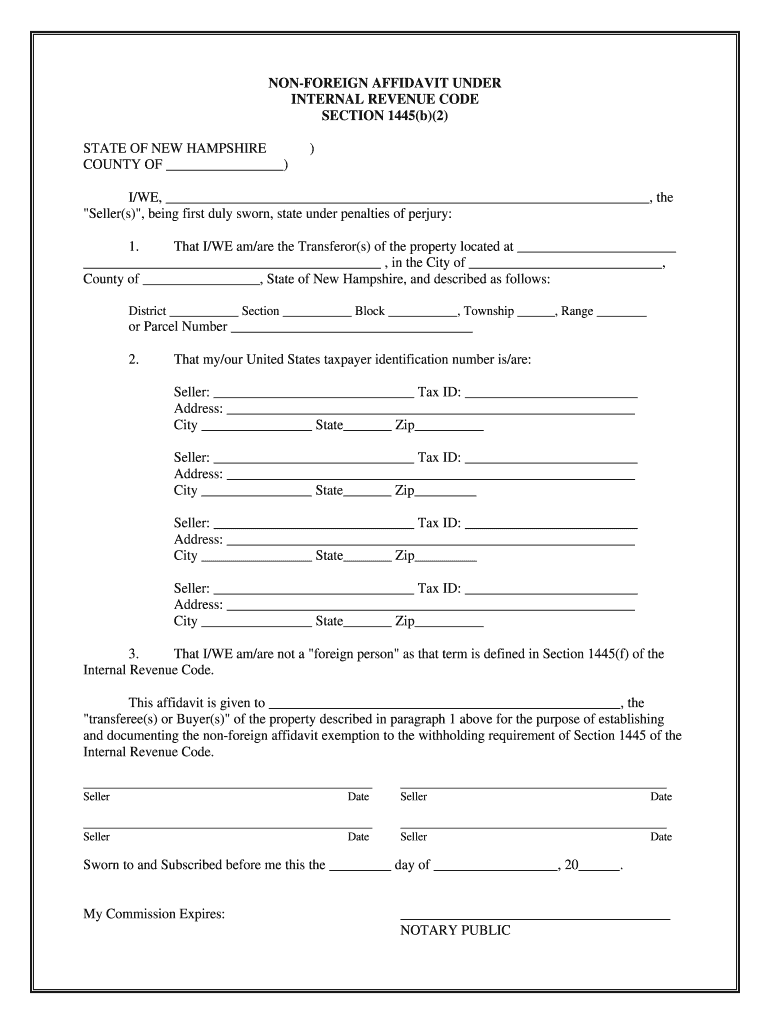

The New Hampshire Non Foreign Affidavit, governed by the Internal Revenue Code (IRC) section 1445, is a crucial document for real estate transactions involving foreign persons. This affidavit certifies that the seller is not a foreign entity, which is essential for withholding tax purposes. When a foreign person sells U.S. real property, the buyer must withhold a percentage of the sales price for tax compliance. By providing this affidavit, the seller can avoid unnecessary tax withholding, ensuring a smoother transaction.

Steps to Complete the New Hampshire Non Foreign Affidavit Under IRC 1445

Completing the New Hampshire Non Foreign Affidavit involves several important steps:

- Gather necessary personal information, including your name, address, and taxpayer identification number.

- Provide details about the property being sold, including its address and sale price.

- Complete the affidavit form accurately, ensuring all information is correct and up-to-date.

- Sign and date the affidavit, affirming that the information provided is true and correct.

- Submit the completed affidavit to the buyer or their representative as part of the closing process.

Legal Use of the New Hampshire Non Foreign Affidavit Under IRC 1445

The legal use of the New Hampshire Non Foreign Affidavit is primarily to comply with U.S. tax regulations. This affidavit serves as proof that the seller is not a foreign person, which is vital for the buyer to avoid withholding taxes on the sale. If the affidavit is not provided, the buyer may be required to withhold a percentage of the sale price and remit it to the IRS. Therefore, ensuring the affidavit is accurately completed and submitted is essential for both parties involved in the transaction.

Key Elements of the New Hampshire Non Foreign Affidavit Under IRC 1445

Several key elements must be included in the New Hampshire Non Foreign Affidavit to ensure its validity:

- Personal Identification: Full name and address of the seller.

- Tax Identification Number: The seller's Social Security Number or Employer Identification Number.

- Property Information: Address and sale price of the property being sold.

- Certification Statement: A declaration confirming the seller is not a foreign person.

- Signature: The seller's signature and date of signing.

IRS Guidelines for the New Hampshire Non Foreign Affidavit Under IRC 1445

The IRS provides specific guidelines regarding the use of the Non Foreign Affidavit under IRC 1445. These guidelines outline the requirements for sellers to certify their non-foreign status. It is important to refer to the IRS instructions for Form 8288-B, which details the withholding tax requirements and the process for submitting the affidavit. Adhering to these guidelines helps ensure compliance and avoids potential penalties associated with incorrect withholding.

Filing Deadlines and Important Dates

Filing deadlines for the New Hampshire Non Foreign Affidavit are closely tied to the real estate transaction timeline. Typically, the affidavit should be completed and submitted at the closing of the property sale. It is important to be aware of the IRS deadlines for withholding tax payments, which usually occur within twenty days after the sale. Timely submission of the affidavit helps prevent unnecessary withholding and ensures compliance with tax regulations.

Quick guide on how to complete new hampshire non foreign affidavit under irc 1445

Complete New Hampshire Non Foreign Affidavit Under IRC 1445 effortlessly on any device

Web-based document administration has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the required form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Manage New Hampshire Non Foreign Affidavit Under IRC 1445 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign New Hampshire Non Foreign Affidavit Under IRC 1445 effortlessly

- Find New Hampshire Non Foreign Affidavit Under IRC 1445 and click Get Form to begin.

- Employ the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management requirements with just a few clicks from any device you prefer. Alter and eSign New Hampshire Non Foreign Affidavit Under IRC 1445 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new hampshire non foreign affidavit under irc 1445

How to generate an electronic signature for your New Hampshire Non Foreign Affidavit Under Irc 1445 online

How to generate an eSignature for the New Hampshire Non Foreign Affidavit Under Irc 1445 in Google Chrome

How to create an eSignature for putting it on the New Hampshire Non Foreign Affidavit Under Irc 1445 in Gmail

How to generate an eSignature for the New Hampshire Non Foreign Affidavit Under Irc 1445 straight from your smart phone

How to generate an electronic signature for the New Hampshire Non Foreign Affidavit Under Irc 1445 on iOS

How to create an eSignature for the New Hampshire Non Foreign Affidavit Under Irc 1445 on Android

People also ask

-

What is form 1445 and how can airSlate SignNow help me with it?

Form 1445 is a document used for reporting certain tax information. With airSlate SignNow, you can easily upload, send, and electronically sign form 1445, streamlining the entire process. Our platform ensures that your form is securely managed and compliant with regulations, saving you time and hassle.

-

How much does it cost to use airSlate SignNow for managing form 1445?

airSlate SignNow offers various pricing plans starting from a competitive rate that caters to different business needs. The cost to manage form 1445 efficiently depends on the features you choose, ensuring value for all your document signing and management needs. Consider our plans to find the best fit for your company's budget.

-

What features does airSlate SignNow offer for form 1445?

Our platform provides a range of features specifically designed to enhance your experience with form 1445, including easy document uploads, customizable templates, and secure e-signature capabilities. You can track the status of your document in real-time and collaborate with others seamlessly for a smoother transaction process.

-

Can I integrate airSlate SignNow with other software when using form 1445?

Yes, airSlate SignNow integrates seamlessly with various business software solutions to enhance your document management capabilities. Whether it's a CRM, email system, or project management tool, our integrations ensure that managing form 1445 becomes part of your existing workflow, improving efficiency and productivity.

-

What are the benefits of using airSlate SignNow for form 1445 transactions?

Using airSlate SignNow for form 1445 transactions offers numerous benefits, including faster processing times and enhanced security features. Our user-friendly interface makes it simple to e-sign documents, while compliance measures protect sensitive information. This results in a more streamlined operation and improved customer satisfaction.

-

Is airSlate SignNow secure for handling sensitive form 1445 data?

Absolutely. airSlate SignNow prioritizes security, ensuring that all your form 1445 data is encrypted and managed according to industry standards. We implement strict access controls and regular audits to protect your information, allowing you to focus on your business while ensuring compliance and safety.

-

How can I get started with airSlate SignNow for my form 1445 needs?

Getting started with airSlate SignNow for your form 1445 needs is easy. Simply sign up for a free trial on our website, explore our features, and start uploading your documents. Our customer support team is also available to assist you throughout the onboarding process.

Get more for New Hampshire Non Foreign Affidavit Under IRC 1445

Find out other New Hampshire Non Foreign Affidavit Under IRC 1445

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now