Form 211 22 Employee Refund Application Lexingtonky Gov 2015

What is the Form 211 22 Employee Refund Application?

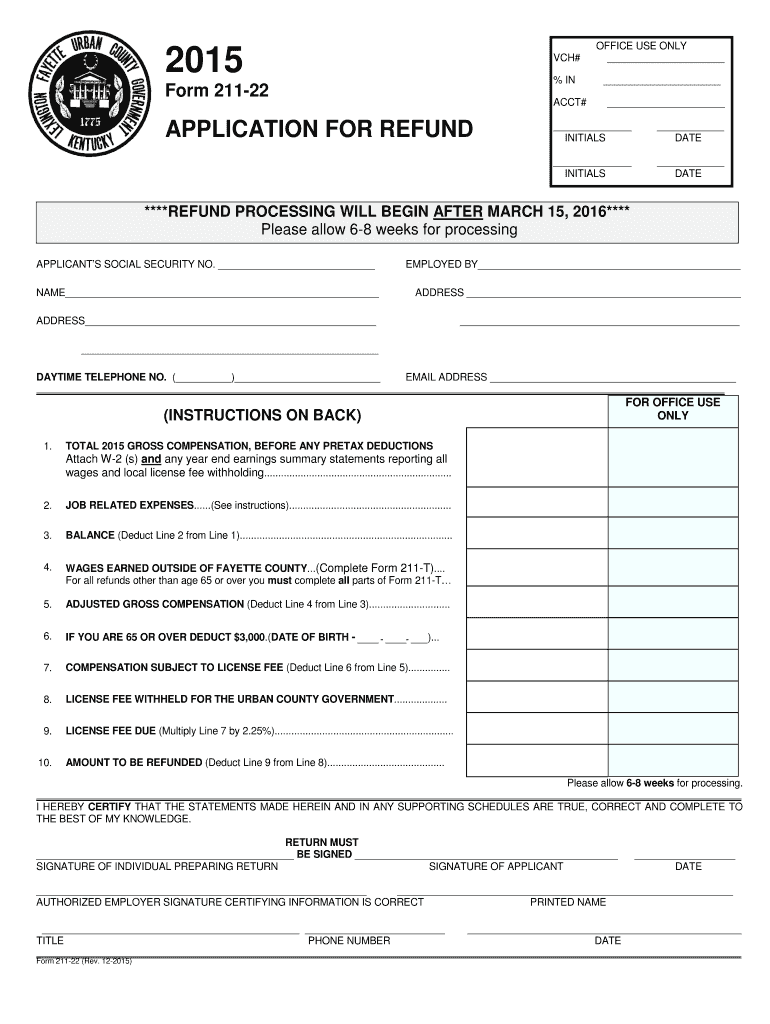

The Form 211 22 Employee Refund Application is a document used by employees in Lexington, Kentucky, to request a refund of overpaid taxes. This form is crucial for individuals who believe they have paid more tax than necessary and wish to reclaim those funds. By submitting this application, employees can initiate the process of receiving their refund, ensuring compliance with state tax regulations.

How to use the Form 211 22 Employee Refund Application

Using the Form 211 22 Employee Refund Application involves several steps to ensure accuracy and compliance. First, you need to obtain the form from the official Lexington government website. After downloading the form, fill it out with the required personal information, including your name, address, and tax identification number. Ensure that you provide accurate details regarding the overpayment. Once completed, you can submit the form through the designated channels, which may include online submission, mailing, or in-person delivery.

Steps to complete the Form 211 22 Employee Refund Application

Completing the Form 211 22 Employee Refund Application requires careful attention to detail. Follow these steps:

- Download the form from the Lexington government website.

- Fill in your personal information accurately.

- Provide details of the tax overpayment, including the amount and tax year.

- Review the form for any errors or omissions.

- Submit the completed form via the preferred submission method.

Legal use of the Form 211 22 Employee Refund Application

The legal use of the Form 211 22 Employee Refund Application is governed by state tax laws. This form must be completed and submitted in accordance with these regulations to ensure that the refund request is valid. It is important to retain copies of all submitted documents for your records, as they may be needed for future reference or in case of disputes regarding the refund.

Eligibility Criteria

To be eligible to use the Form 211 22 Employee Refund Application, individuals must meet specific criteria. Primarily, applicants must have overpaid their taxes for the relevant tax year. Additionally, they should be current employees or have been employed during the tax period in question. It is essential to check the specific eligibility requirements outlined by the Lexington government to ensure compliance.

Form Submission Methods

The Form 211 22 Employee Refund Application can be submitted through various methods, depending on the preferences of the applicant. These methods typically include:

- Online submission through the Lexington government website.

- Mailing the completed form to the specified tax office.

- In-person submission at designated government offices.

Filing Deadlines / Important Dates

Filing deadlines for the Form 211 22 Employee Refund Application are crucial to ensure that your request is processed timely. Typically, applications must be submitted within a specific period following the tax year in which the overpayment occurred. It is advisable to check the Lexington government website for the most current deadlines and important dates related to tax refunds.

Quick guide on how to complete form 211 22 2015 employee refund application lexingtonkygov

Complete Form 211 22 Employee Refund Application Lexingtonky gov effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and eSign your documents promptly without interruptions. Manage Form 211 22 Employee Refund Application Lexingtonky gov on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven activity today.

How to modify and eSign Form 211 22 Employee Refund Application Lexingtonky gov with ease

- Locate Form 211 22 Employee Refund Application Lexingtonky gov and click Get Form to begin.

- Employ the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, laborious form hunting, or errors that necessitate creating new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Adjust and eSign Form 211 22 Employee Refund Application Lexingtonky gov and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 211 22 2015 employee refund application lexingtonkygov

Create this form in 5 minutes!

How to create an eSignature for the form 211 22 2015 employee refund application lexingtonkygov

The way to make an eSignature for a PDF document in the online mode

The way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the Form 211 22 Employee Refund Application Lexingtonky gov?

The Form 211 22 Employee Refund Application Lexingtonky gov is a document used by employees in Lexington, Kentucky, to apply for tax refunds. This form ensures that employees can efficiently navigate the refund process and reclaim any overpaid taxes.

-

How can I easily complete the Form 211 22 Employee Refund Application Lexingtonky gov?

You can easily complete the Form 211 22 Employee Refund Application Lexingtonky gov using the airSlate SignNow platform, which provides intuitive editing tools. Simply upload your document, fill in the required fields, and leverage our platform to comply with Lexington-KY government standards.

-

Is there a cost associated with using airSlate SignNow for the Form 211 22 Employee Refund Application Lexingtonky gov?

Yes, airSlate SignNow offers competitive pricing for its services, including the completion and eSigning of the Form 211 22 Employee Refund Application Lexingtonky gov. We provide different subscription plans to meet the needs of businesses of all sizes, ensuring cost-effectiveness.

-

What features does airSlate SignNow offer for the Form 211 22 Employee Refund Application Lexingtonky gov?

airSlate SignNow offers features such as easy document uploads, customizable templates, eSignature capabilities, and automated workflows for the Form 211 22 Employee Refund Application Lexingtonky gov. These features streamline the refund application process and enhance efficiency.

-

Are there benefits to using airSlate SignNow for my Form 211 22 Employee Refund Application Lexingtonky gov?

Using airSlate SignNow for the Form 211 22 Employee Refund Application Lexingtonky gov brings many benefits, including quicker turnaround times and reduced paperwork. Our platform enhances collaboration and document security, providing you with peace of mind throughout the application process.

-

Can I integrate airSlate SignNow with other tools for the Form 211 22 Employee Refund Application Lexingtonky gov?

Yes, airSlate SignNow offers integrations with various popular applications and software to enhance your workflow. This flexibility allows for seamless processing of the Form 211 22 Employee Refund Application Lexingtonky gov while connecting with tools your business already uses.

-

How does airSlate SignNow ensure the security of my Form 211 22 Employee Refund Application Lexingtonky gov?

airSlate SignNow prioritizes the security of your data, employing advanced encryption protocols to protect documents, including the Form 211 22 Employee Refund Application Lexingtonky gov. Our strict compliance with data protection regulations ensures that your information remains confidential and secure.

Get more for Form 211 22 Employee Refund Application Lexingtonky gov

Find out other Form 211 22 Employee Refund Application Lexingtonky gov

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF