211 22 Form 2016-2026

What is the 211 22 Form

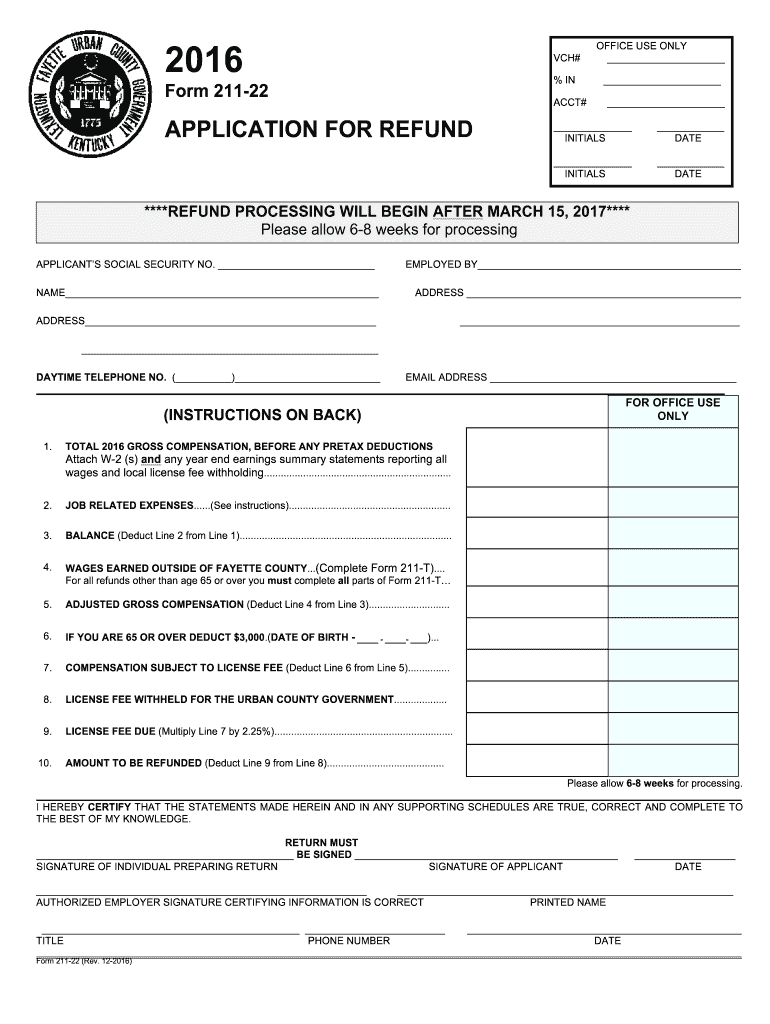

The 211 22 Form is a crucial document used for tax purposes in the United States, specifically designed to assist taxpayers in reporting their tax home. This form helps individuals and businesses determine their eligibility for various tax deductions and credits, particularly those related to travel and work-related expenses. Understanding the 211 22 Form is essential for ensuring compliance with IRS regulations and maximizing potential tax benefits.

How to use the 211 22 Form

Using the 211 22 Form involves several key steps to ensure accurate completion and submission. First, gather all necessary information, including your personal details, income sources, and any relevant expenses related to your tax home. Next, carefully fill out the form, ensuring that all sections are completed accurately. Once the form is filled out, review it for any errors or omissions before submitting it to the appropriate tax authority. Utilizing digital tools can streamline this process, allowing for easy corrections and secure submission.

Steps to complete the 211 22 Form

Completing the 211 22 Form requires a systematic approach. Start by downloading the form from a reliable source or accessing it through tax software. Follow these steps:

- Enter your personal information, including name, address, and Social Security number.

- Detail your income sources, including wages, self-employment income, and any other earnings.

- Document your expenses related to your tax home, ensuring to categorize them accurately.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the 211 22 Form

The legal use of the 211 22 Form is governed by IRS regulations, which stipulate that taxpayers must provide accurate information regarding their tax home. Misrepresentation or failure to comply with the form's requirements can lead to penalties, including fines and interest on unpaid taxes. It is essential to understand the legal implications of the information provided on this form, as it directly affects tax liabilities and eligibility for deductions.

Required Documents

When completing the 211 22 Form, certain documents are necessary to support the information provided. These may include:

- Proof of identity, such as a driver's license or Social Security card.

- Income statements, including W-2s or 1099s.

- Receipts or documentation for expenses related to your tax home.

- Any previous tax returns that may provide context for your current filing.

Filing Deadlines / Important Dates

Filing deadlines for the 211 22 Form align with standard tax deadlines in the United States. Typically, individual taxpayers must submit their forms by April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to stay informed about any changes to these dates and plan accordingly to avoid late filing penalties.

Quick guide on how to complete 211 22 form

Complete 211 22 Form effortlessly on any device

Managing documents online has gained popularity among both companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle 211 22 Form on any device using airSlate SignNow's Android or iOS applications and enhance your document-centered processes today.

The simplest way to modify and electronically sign 211 22 Form without effort

- Obtain 211 22 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you prefer. Modify and electronically sign 211 22 Form to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 211 22 form

Create this form in 5 minutes!

How to create an eSignature for the 211 22 form

The way to make an eSignature for your PDF online

The way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is fayette 211 22 and how can it benefit my business?

Fayette 211 22 is an essential tool within airSlate SignNow that streamlines the document signing process. By leveraging fayette 211 22, businesses can enhance productivity, reduce paperwork, and ensure secure, compliant transactions. This solution is designed to save time and resources while improving the overall customer experience.

-

How does pricing work for fayette 211 22?

Fayette 211 22 offers flexible pricing plans tailored to meet the needs of various businesses. Depending on your usage and specific requirements, you can choose from our affordable subscription options. By investing in fayette 211 22, you gain access to advanced features that enhance your document handling capabilities.

-

What features does fayette 211 22 provide?

Fayette 211 22 includes a variety of features designed to simplify the eSigning process. Key functionalities include customizable templates, advanced security measures, and real-time tracking of document statuses. These features help businesses manage their documents more effectively and ensure timely completion of transactions.

-

Can fayette 211 22 integrate with other software tools?

Yes, fayette 211 22 seamlessly integrates with various software tools to maximize efficiency. Whether you're using CRM systems, project management tools, or cloud storage options, fayette 211 22 enhances your existing workflows. This integration capability helps in centralizing document management for your business.

-

Is fayette 211 22 secure for sensitive documents?

Absolutely, fayette 211 22 prioritizes the security of your sensitive documents. With advanced encryption protocols and compliance with industry standards, your data remains protected throughout the signing process. Trusting fayette 211 22 means your business can operate safely and confidently.

-

How easy is it to use fayette 211 22?

Fayette 211 22 boasts an intuitive interface that makes it easy for anyone to use. Whether you're tech-savvy or a novice, you can navigate and send documents for eSigning with just a few clicks. Our user-friendly design ensures a smooth experience for all users.

-

What support options are available for fayette 211 22 users?

Fayette 211 22 offers comprehensive support to ensure users can fully benefit from the platform. Our support team is available via chat, email, and phone to assist with any queries. Additionally, we provide extensive documentation and tutorials to help users get the most out of fayette 211 22.

Get more for 211 22 Form

Find out other 211 22 Form

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter